Sell in May and Go Away? Here We Go Again ...

Every year, "sell in May and go away" is dragged out for show like Punxsutawney Phil. Should you follow this advice in 2022? As always, it depends.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Fretting over whether to "sell in May and go away" is one of Wall Street's most tiresome annual rituals. And over the next few days, investors and the financial media are sure to give this dubious old saw far more attention than it deserves.

Here's our contribution.

Way Back in the Day

The "sell in May" proverb is said to have originated centuries ago in England when merchants, bankers and other interested parties in London's financial district noticed that investment returns generally did worse in the summer.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If the most profitable months of the year usually occurred when market participants weren't off in their country manors trying to escape the heat … well, apparently, that was a good enough reason to adopt "sell in May" as an investment strategy.

Incidentally, the original saying went "Sell in May and go away, and come on back on St. Leger's Day," a holiday held in mid-September. In America, it has essentially come to refer to the period between Memorial Day and Labor Day.

Getting back to the modern era: There is evidence that the stock market, on average, tends to underperform in the six-month period between May and October. However, analysts, market timers and academics who have studied the phenomenon extensively can't settle the matter conclusively one way or the other.

If they could, we wouldn't be having this discussion every year.

What strategists do tend to agree on is the answer to the question of whether investors should sell in May and go away:

It depends.

Sell in May and Go Away? Here's What the Numbers Say

Sam Stovall, chief investment strategist at CFRA Research, sums up the "Should I sell in May?" conundrum facing investors in 2022 this way:

"Some say yes, in anticipation of elevated volatility and pressure on prices from ever-rising inflation readings, interest rates and geo-political tensions. Others say no, since inflation readings likely peaked in March and the Fed’s future rate increases and quantitative tightenings have already been factored into share prices."

Stovall adds that the "strongest six months of the year," as popularized in The Stock Trader's Almanac, tells us that the price return for the S&P 500 from November through April has recorded the highest average price change of any rolling six-month period.

"Conversely, the 'sell in May' adage reminds investors that average May-through-October price returns have historically been anemic," Stovall writes.

Historical average performance can tell us only so much, of course. Past performance, as we all know too well, is not indicative of future returns.

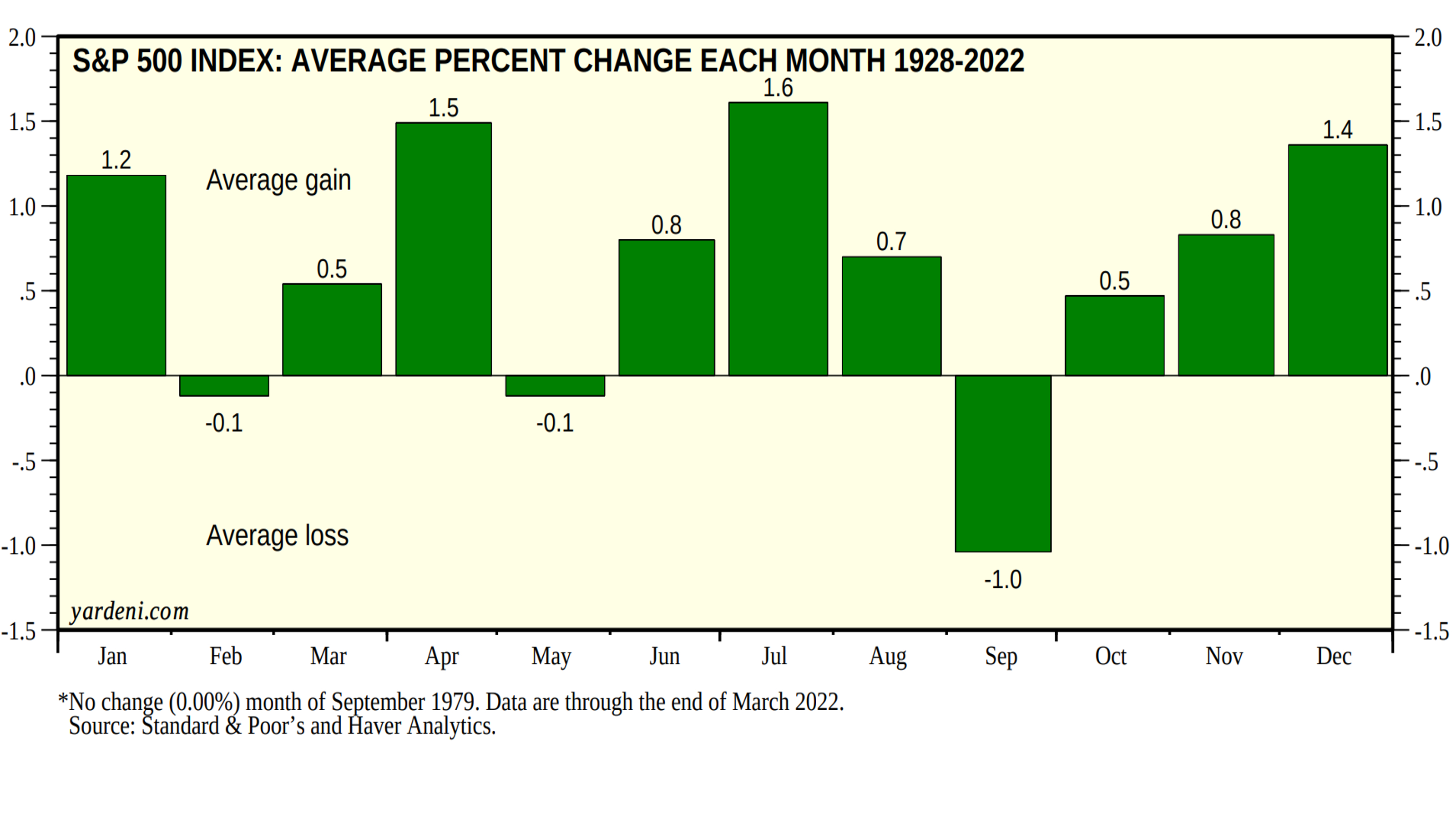

For the record, thanks to Dr. Ed Yardeni of Yardeni Research, we do know unequivocally that the worst individual months for average stock market performance are not found exclusively in the post-May period.

Indeed, per Yardeni, since 1928, average monthly price changes for the S&P 500 are quite good during the dog days of summer.

Although May is tied with February for producing the S&P 500's second-worst average price change (-0.1%), July is actually the single best month for average price change (+1.6%). Interestingly, June and August – at +0.8% and +0.7%, respectively – both offer above-average gains. Have a look at the chart below:

In fact, only one month really stands out on a historical basis as a good one to miss. Since 1928, the S&P 500 has delivered an average price change of -1.0% in September, per Yardeni Research.

Thus, based on the historical record, investors who interpret "sell in May" as the period from Memorial Day to Labor Day are coming back a month too early.

Looking at It a Different Way

Another issue to consider before pulling the trigger on the "sell in May" strategy is that, as CFRA's Stovall reminds us, sector-level returns can diverge widely over the summer months.

For example, since 1990, the consumer staples and healthcare sectors of the S&P 500 recorded average price gains of 4.7% from May to October – a period when the overall market managed an advance of just 2.4%.

In addition to the issue of individual sectors delivering relative outperformance or underperformance over different multi-month periods of the year, there's another complicating factor particular to 2022: The election calendar.

"Midterm election years are typically the most challenging for equity investors, as the S&P posted its weakest average annual return and highest level of volatility, along with recording the only two quarterly losses within the 16-quarter presidential cycle," says Stovall.

Making matters worse, Stovall notes that in the “sell in May” months of midterm election years since 1992, the S&P 500 lost an average of 3.4%, while declining nearly 40% of the time.

Most of Us Should Just Stay

The great bulk of retail investors are likely best served by simply leaving their allocations alone.

The pros get judged on every basis point of return they can squeeze out of their holdings. But for us regular folks, portfolio churning – even in the age of commission-free trades – can still take its toll, be it in the form of opportunity cost or emotional stress.

Like most Wall Street sayings that encourage clients to trade, long-term investors would do well to ignore the "sell in May" chatter. Leave the tactical moves to the tacticians and trust your plan.

Something tells us Warren Buffett isn't sweating "sell in May" right now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.