3 Major Changes Investors Must Prepare for in 2026

A possible stock market bubble. Trump accounts. Tokenized stocks. These are just three developments investors need to be aware of in the coming months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There's never a dull moment for investors, between the earnings calendar, economic data and Fed meetings. These days, the breakneck speed at which news hits the wires means we need to stay even more nimble.

Some of these developments — such as the rapid shifts in tariff policy and on-again, off-again trade wars — are especially nerve-racking for investors tracking their portfolios. Others, including new tax-free Trump Accounts for kids, are a little less stress-inducing.

Here, we take a closer look at some of the major changes coming for investors in the months ahead. Depending on your situation, one or all these issues might directly impact your financial life — and if there's anything this year has taught us, it's to be informed and prepared.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

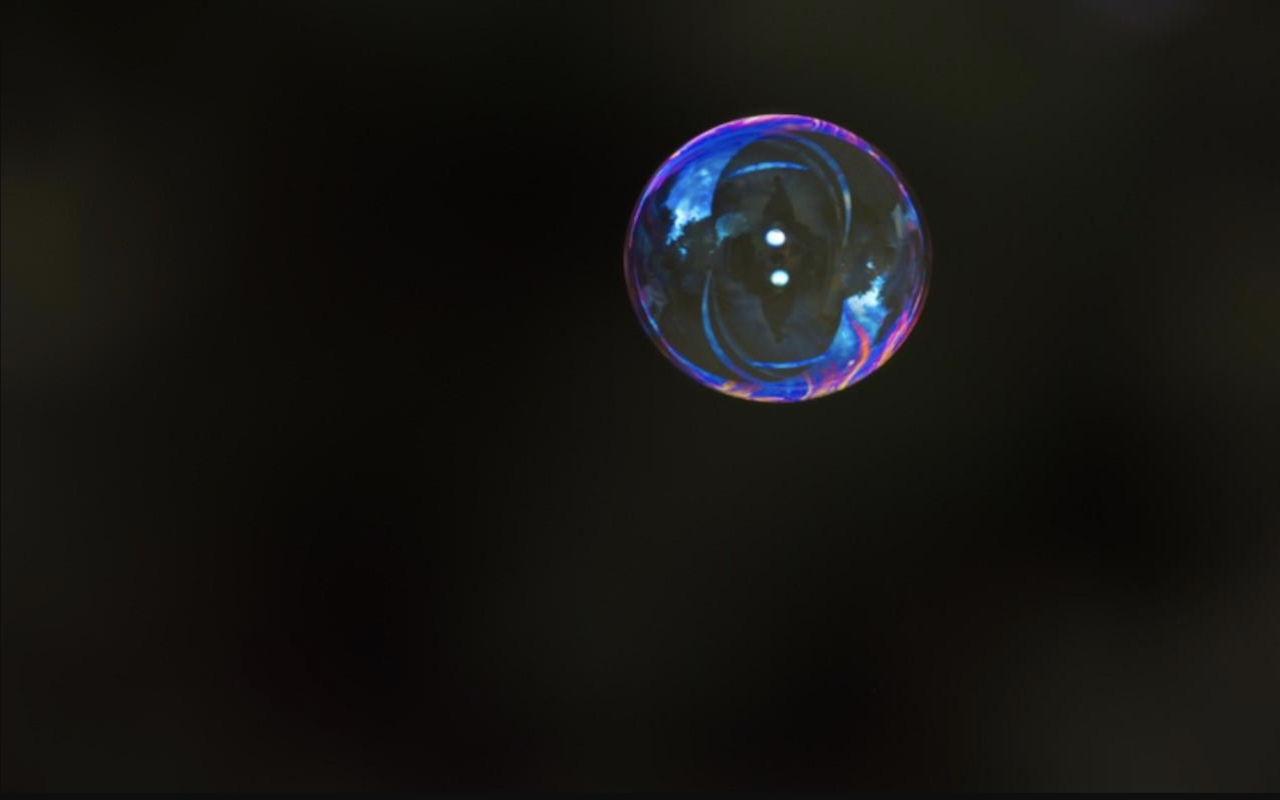

1. Beware the market bubble

This is a wildly exciting time to be an investor. The S&P 500 is up nearly 40% from its early April lows, and the growth in all things related to artificial intelligence (AI) has been off the charts.

That said, this market is starting to look a little frothy … and it's looking more like a bubble with every passing day.

The S&P 500 trades at a price-to-earnings (P/E) ratio of 31, making it one of the most expensive markets in history by that metric. The index trades at a price-to-sales (P/S) ratio of 3.4, making it literally the single most expensive market in history.

Much of this is due to the outsize influence of the technology sector in the S&P 500, as tech stocks tend to have higher valuations. Technology makes up about a third of the S&P 500 today, whereas it comprised about 15% of the index in 1999, near the end of the dot-com bubble.

Looking at individual stocks gives you even more extreme valuations. Palantir Technologies (PLTR) trades for roughly 650 times earnings, and Nvidia (NVDA) for well over 55.

Bull markets don't end simply because stocks become expensive, and bubbles have a way of inflating far beyond what most investors believe possible. There is no guarantee that the market will implode within the next 12 months.

That said, given how extreme valuations are getting, investors should keep a close eye on their portfolios and look for opportunities to rebalance to manage risk.

As Michael Taylor, investment strategy analyst, and Emily Todd, wealth and investment management analyst at Wells Fargo Investment Institute, remind us, "concentration risk is an often overlooked yet crucial aspect of asset management. Portfolios with sizable exposures — whether to an individual security or asset, sector or subsector, or geographic region — are vulnerable to significant losses."

2. Trump Accounts: Free money for your kids

In what is arguably one of the biggest changes to the financial planning landscape since the introduction of the Health Savings Account (HSA) in 2004, Congress passed legislation over the summer that paved the way for new "Trump Accounts" for American children.

The accounts have some similarities with traditional IRAs, as well as 529 college savings plans. They also have some quirks that make them unique.

The most important part first: All children born from January 1, 2025, to December 31, 2028, will be eligible for a $1,000 seed payment directly from the U.S. Treasury.

Assuming the account grows at the S&P 500's average compound annual return of around 10%, that $1,000 initial deposit would be worth more than $490,000 by the time your kid hits retirement age. If it falls short of that figure, who cares? It's free money.

If you're a new parent or expect to be, keep your eyes open for more information on Trump Accounts. They're expected to be available starting July 4, 2026; details about how to open an account should be available soon.

3. An entirely new way to trade stocks

The crypto ecosystem might be on the cusp of challenging traditional stock exchanges for the first time.

The U.S. Securities and Exchange Commission (SEC) is reportedly exploring ways to allow company shares to trade on blockchain, similar to bitcoin and other cryptocurrencies.

This could be a very big deal for the industry because it has the potential to break Wall Street's monopoly on public listings. Companies could now possibly bypass Wall Street altogether.

Some pioneers, such as crypto-centric Robinhood Markets (HOOD), are already trading a limited number of tokenized stocks. Approval by the SEC could turn this trickle into a flood.

For most investors, the benefits will be somewhat limited. Trading on blockchain won't be materially cheaper than trading on the New York Stock Exchange (NYSE) or the Nasdaq. The bigger story here is that it opens the door to large-scale tokenization of other assets that don't have a liquid market, such as real estate or hedge funds.

The SEC isn't known for moving particularly fast, but we could have real news here before the end of the year.

This isn't the only potential change being cooked up by the regulators. The SEC is reportedly close to dismantling the $25,000 minimum equity rule for pattern day trading.

Following the 2000 crash of the dot-com bubble, the SEC required that investors have a balance of at least $25,000 in a margin account to make four or more day trades within a five-business-day window. Regulators wanted to prevent excessive risk-taking by smaller rank-and-file investors.

What will the result be?

A lot more short-term trading by smaller investors.

There's nothing inherently wrong with short-term trading. If done in a disciplined manner, it's not necessarily riskier than buy-and-hold investing.

The introduction of a legion of inexperienced traders into a market already resembling a bubble should give us pause. Consider this one more reason to keep an eye on the risk you're taking as we head into the new year.

Related content

- What the Rich Know About Investing That You Don't

- The Five Safest Vanguard Funds to Own in a Volatile Market

- Best Blue Chip Dividend Stocks to Buy for 2026 and Beyond

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.