3 Energy Stocks to Buy for an Oil Breakout

Oil's fundamentals are changing for the better. And you don't need to trade futures to climb aboard.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While stock prices continue to bounce around following their tumble earlier this year, crude oil is back near new highs. In fact, despite the stock market’s super run in 2017, crude oil actually outperformed stocks starting in June. And it continues to do so here in April 2018.

That means investors have a choice during the current volatile environment for stocks. And that does not necessarily mean speculating in commodities. Energy stocks representing companies that explore, drill, produce and refine oil finally look positioned to lead the stock market to the upside.

How can this be? For years, the fundamentals of “black gold” were rather dour. It was fairly common to see headlines saying, “the world is awash in oil” or “crude oil inventories rise again.” Indeed, the U.S. became a net exporter of oil in May 2011 and the third-largest producer of crude oil in 2014, after Saudi Arabia and Russia.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

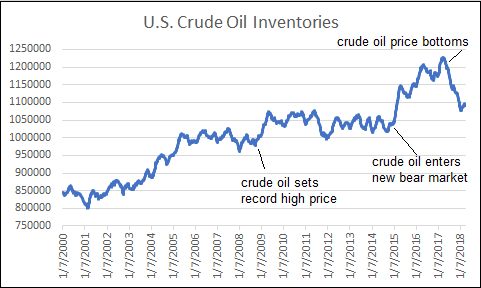

Source: U.S. Energy Information Administration

No wonder oil was a forgotten investment.

But very quietly in recent months, oil’s fundamentals changed for the better. We can credit a combination of the pickup in the global economy, firmness attributed to heightened geopolitical risk in the oil-producing Middle East and decline in those oil stockpiles.

In fact, the decline in the amount of oil in storage started in May of last year, just before crude oil prices bottomed. It is the first truly meaningful decline since 1999-2001.

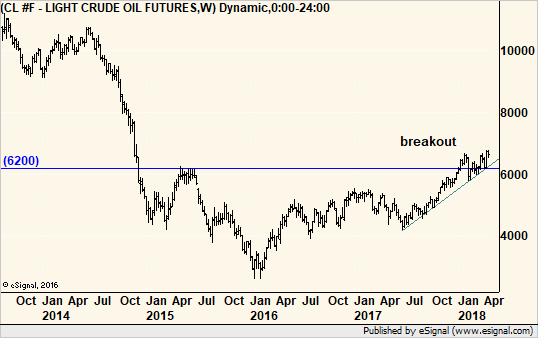

On the technical side, crude prices scored a breakout to the upside this month. It was the culmination of a three-year sideways range, called a basing pattern, in which bulls and bears test their strategies. Despite several rather sizeable short-term moves higher and lower, neither side was confident in their long-term view.

That is, until this year.

While neither the technical or fundamental side is signaling a return to $100-per-barrel oil prices any time soon, the tone of the market is bullish. The question is: What should investors buy?

Investors who do not want to speculate in the futures market can look at the United States Oil Fund (USO, $13.75) as a proxy. This is an exchange-traded product (ETP) that holds near-month crude oil futures contracts and rolls them over when each reaches maturity. It is far from a perfect match to crude oil prices, but it does follow the trends, and is itself in a bull market at this time.

Even though investors can buy and sell USO just as they do a stock, it is still an investment tied to the futures market. Not everyone is comfortable with that. For those people, many energy stocks also show rising longer-term trends and “technical” breakouts – sudden moves attached to various stock-chart patterns.

Newfield Exploration

From the oil and gas exploration and production group, Newfield Exploration Company (NFX, $27.91) was one of the worst performers over the past 17 months as it fell from a high of $50 to a low of $22.72. On Feb. 21, the company released better-than-expected Q4 earnings, yet the stock tumbled more than 10% that day.

In charting lingo, it was the culmination of a bearish trend and ended with a selling climax. This is a final washout where the last bulls finally throw in the towel. The good news is that it sets up a rather strong condition for a rally. Indeed, buyers started to test the waters and money started to flow back into the stock shortly thereafter. All that was needed to unleash this bullish sentiment was crude oil’s move to a three-year high in April.

The trailing 12-month price-to-earnings ratio on NFX is roughly 13, which is below the sector’s average P/E. Its forward P/E (based on analyst estimates for the coming year’s earnings) is 8.9, which also is historically on the low side.

That means the market has not yet priced the stock for the improvements expected by analysts.

Technically, NFX is rising off the bottom of a multiyear trading range at around $23 per share. The top of the range is near $48, so there is plenty of room for the stock to rally before running into an overwhelming amount of supply, or sellers willing to unload shares at what was historically an expensive price.

Chevron

Newfield does not pay a dividend, but there are energy stocks in rising trends that do. Of the major companies, Chevron (CVX, $122.31) has many favorable characteristics, including a 3.6% dividend yield.

Chevron’s quarterly earnings have been mostly trending higher since early 2016. Analysts expect that trend to continue with a sizeable jump in their estimates for Q1 2018, due for release later this week.

The company raised its dividend Jan. 31, which is always welcomed by investors. And Chevron’s stock price reacts to crude oil price changes, so the commodity provides additional wind in the stock’s sails.

In early February, despite reporting higher earnings than the quarter before, analysts expected more. The stock tumbled, likely exacerbated by the sudden and steep drop in the broader market when leading technology stocks finally pulled back. Technical indicators suggested that the reaction was overdone as very little money left the stock. In essence, it provided a nice buying opportunity and, with the rally in April, the bulls are back in charge.

A run at the all-time high set in 2014 is not much of a stretch from current price levels. If and when it gets there, we will have to see how it reacts. Continued short-term strength would be a good sign that CVX can rally for much of the rest of the year.

Callon Petroleum

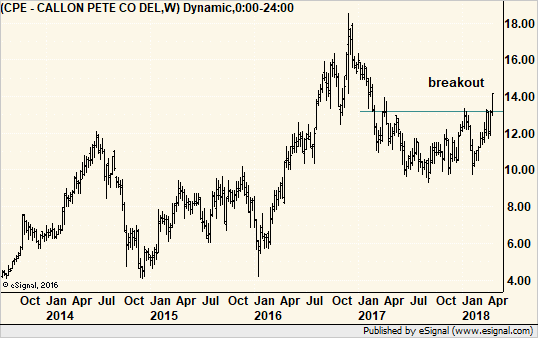

Finally, rising crude oil prices give the shale oil industry a boost, too. Depending on the source, shale oil production becomes profitable when crude oil trades between $50 and $60 per barrel or higher. With current oil price in the high $60s and looking strong, investors once again turned towards shale oil producers.

Many of these companies still do not have the strength to compete. However, Callon Petroleum (CPE, $14.17) seems poised to take advantage of the stronger energy market. Nine in 10 analysts surveyed by MarketWatch hold buy ratings on the stock and as a group they target a 38% gain over the next year. That gives the stock a forward P/E of just over 15, which is in line with other, more mainstream energy stocks.

What is most important is that the market itself already caught on to Callon’s improved condition. The stock is up sharply since February and broke out to the upside from its own basing pattern.

Oil prices are firmer, and the fundamentals finally back them up. Energy stocks also show strength and good upside potential so there is something for everyone here. Also, with commodities in general poised to perform nicely this year, energy won’t be going it alone, either.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.