Should You Invest in Commodities?

Investments in crops, metals, energy, currencies and other tangible things tend to go up when stocks and bonds go down.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The market has again reminded us that stocks can move in two directions. It's an old story but easy to forget: When inflation expectations rise, so do interest rates—and stock and bond prices fall. For the first time in five years, the consumer price index in 2017 registered an annual increase of more than 2%, and prices rose more than expected in January. The January jobs report showed a jump in wages.

Inflation has yet to reach worrisome levels, but the stock market dropped sharply after each sighting, with investors worried that the Federal Reserve would start aggressively raising short-term interest rates—something we have not seen in a long time. (Through the end of 2017, the Fed had raised rates by a total of just 1.25 points over 11 years.) Longer-term rates, not waiting for the Fed, have soared. The yield on the 10-year Treasury note rose from 2.1% to 2.9% in just five months (prices are as of February 16).

Maybe it's time to invest in a hedge, an asset that will buffer a decline in stock values. But other than selling the stock market short (essentially, betting on a market drop), which can be risky and expensive, there is no consistent way to invest in something that's guaranteed to score a profit when stocks score a loss. What about bonds? In 2008, when Standard & Poor's 500-stock index dropped 37% and nearly every other global asset got clobbered, long-term U.S. Treasury bonds returned 25.9% as investors sought safety. The next year, as stocks recovered, T-bonds lost 14.9%. But as we have seen lately, bonds often move in tandem with stocks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A zig when stocks zag. A better hedge is commodities. Research shows that investments in crops, metals, energy, currencies and other tangible things are negatively correlated with both stocks and bonds. When one group goes up, the other group tends to go down, and vice versa. This inverse relationship is not perfect. If economic growth slows sharply, stock prices typically fall, but the demand for oil, copper, corn and such slows as well, so commodity prices fall, too. If the U.S. were to slide into a serious recession, commodities would almost certainly get crushed. Over the course of the 2007-09 recession, for instance, commodities dropped 40%—even more than stocks did.

In a growing economy, however, commodities do provide protection against the ravages of inflation. Many businesses cannot pass along the extra costs when the prices of raw materials, supplies and labor rise, so their earnings and share prices suffer. But commodities, almost by definition, increase in value when inflation rises.

Now we get to the tricky part: buying those commodities. The traditional method is to purchase a futures contract, which is a promise to buy a certain amount of stuff on a specific date. For example, you can buy a contract on the New York Mercantile Exchange today to purchase 1,000 barrels of light sweet crude oil in September. The recent cost was about $60 a barrel. You are hoping that before the settlement date, the market price of crude will rise and you can sell your contract at a profit—for example, at $70 a barrel, you'd have a $10,000 gain. (Note that unless you have a big garage, you won't take delivery of the goods. The object is to sell the contract before the settlement date.)

What makes this kind of investing dangerous is that you are required to put up only a portion of the full value of the contract to open a position. Recently, the initial margin—what you'd have to put down on a crude-oil contract—was about $2,000. If you sell when oil is $70 a barrel, your $10,000 profit is roughly five times the money you put up (minus transaction fees). But that arrangement works the other way, too. If the value of your contract drops by 4%, your initial investment is wiped out unless you put up more margin money. My advice: Stay away from individual futures contracts..

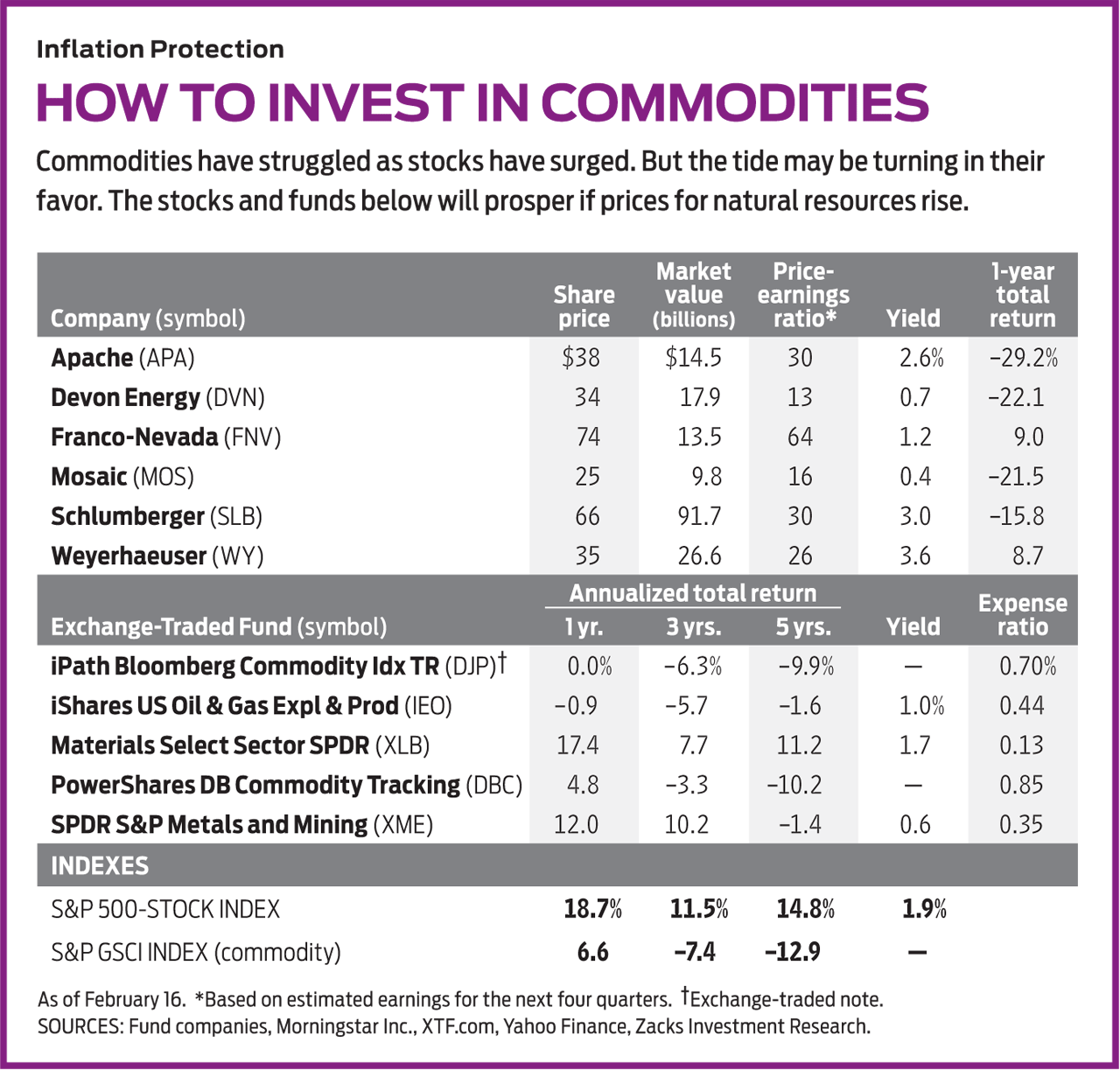

A safer bet. A less adventurous way to buy commodities is by purchasing an exchange-traded product, which is linked to an index. For example, PowerShares DB Commodity Tracking (symbol DBC, $17) mimics a Deutsche Bank index; it holds a mix of two dozen futures contracts maturing this year and next, including gold, natural gas, soybeans and wheat. The fund carries an expense ratio of 0.85%. In a vivid display of negative correlation, while the average annual return of the S&P 500 was 14.8% over the past five years, the fund returned -10.2%.

Another popular choice, iPath Bloomberg Commodity Index Total Return (DJP, $24), is structured as an exchange-traded note (ETN), or debt issued by Barclays Bank, the ETN's sponsor. Instead of paying interest, the ETN provides returns linked to the performance of the underlying index. That Bloomberg index, in turn, is composed of several subindexes. The ETN is tilted toward energy (30% of assets) and grains (21%). It returned an annual average of -9.9% over the past five years. The expense ratio is 0.70%.

As stocks have gone up and up during the bull market, the performance of these commodity funds has been rotten. In 2013, for example, when the S&P returned 32.4%, the Bloomberg ETN fell 11.1%. With the exception of a decent 2016, the commodities drought has continued for seven years. But if you believe the stock market is entering its own drought, investments in commodities could provide some fertile soil for your portfolio.

Another way to buy commodities is to purchase shares of companies whose profits depend on the value of natural resources. An obvious example is the oil and gas exploration sector. Shares of Apache (APA, $38), a 64-year-old Houston company that owns reserves throughout the world, have dropped from more than $100 per share in August 2014 to just $37 recently, as petroleum prices have declined by nearly half. Also consider Devon Energy (DVN, $34), with 15,000 oil and gas wells in the U.S. and Canada. This could also be a good opportunity to buy Schlumberger (SLB, $66), a giant company that services oil and gas firms and carries a dividend yield of 3%. Shares are down by more than 40% from their peak four years ago.

Other good companies whose fortunes rise and fall with commodities prices are Weyerhaeuser (WY, $35), which owns nearly 13 million acres of timberlands in the U.S. and has a dividend yield of 3.6%; Franco-Nevada (FNV, $74), a firm that helps mining companies develop and explore properties in return for a stream of royalties on the gold and other metals that are discovered; and Mosaic (MOS, $25), a fertilizer company that benefits from rising agricultural prices. Also consider more-specialized ETFs that own resource stocks. Examples include iShares US Oil & Gas Exploration & Production (IEO, $62), SPDR S&P Metals and Mining (XME, $38) and Materials Select Sector SPDR (XLB, $60), which owns companies that both hold and process commodities.

Commodities are not a foolproof hedge. If rising interest rates throw the economy into a tailspin, oil and corn won't help you much. But over the long term, commodities offer ballast by offsetting stock declines. That negative correlation also means that if stocks go barreling upward, your commodity holdings will limit your gains—or even turn them into losses.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients and does not own any of the securities mentioned in this column.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.