5 Tips for Getting Your Small Business Loan Approved

Rejected by the bank? Here's how to turn a "no" into a "yes."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For small business owners in need of a loan, getting an application approved can seem as mystifying as the illusions performed in a Las Vegas magic show. But the process gets a lot easier with the right preparation and an understanding of the importance of cash flow.

A survey by the 12 regional Federal Reserve banks cited "accessing necessary credit" as the No. 1 challenge facing small businesses in 2016. That was especially true for outfits with less than $1 million in revenues; while 72% of larger companies were able to secure financing, only 45% of smaller firms could get the nod from a lender.

Getting a small business loan isn't magic, but it does require meticulous preparation and an understanding of how bankers operate. Underwriting decisions are based on the 5 C's of credit -- capital, collateral, conditions, creditworthiness, and cash flow -- and borrowers must show strength in each.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here are five ways small business owners can turn a "no" into a "yes":

1. Apply for the right loan at the right bank. Loan applications are often declined because borrowers seek the wrong type of loan, or engage with the wrong institution. For example, a company that needs money to fund a new line of business would be turned down for a line of credit because a term loan would be more appropriate. Similarly, applications are often declined because the bank does not lend to certain industries, such as loans for hotels. When seeking a bank, make sure it actually lends to your industry. If they don't, find a lender that does. Applying for the right type of loan from the right type of bank is the first step to getting approved.

2. Show your cash flow. Most loans are turned down because bank underwriters can't find sufficient cash flow to support loan repayments. Documentation starts with three years of corporate and personal tax returns and three years of corporate financial statements; current year-to-date financials with prior year comparisons; a debt schedule, including real estate and equipment leases; accounts receivable and payable reports; and an inventory report. With this information in hand, the underwriter will determine how your cash flow compares to the anticipated debt payments.

Cash flow is typically calculated as net income plus interest expense, depreciation, amortization, and non-recurring expenses -- such as rent if you are buying real estate -- less distributions. But understanding your business cash flow may not end there. Providing additional information can be critical to getting loan approval. Start by creating a narrative that helps underwriters understand anything that should be taken into account to get the loan. Think back: Were there one-time expenses or unusual circumstances in any of the last three years that hurt performance? Think ahead: Are there changes on the horizon that will boost revenues or mitigate expenses?

Preparing a business plan with detailed projections is crucial in these cases -- local Small Business Development Centers and SCORE Association chapters can help. The business plan should document any contracts that will support the loan and provide a detailed explanation of how the funds will be used. A good banker will ask the right questions to help you turn your request into an approvable deal, but taking control will help you help yourself.

3. Bolster your personal credit. For small business owners, personal credit scores have a major impact on corporate credit worthiness, so improving scores in advance of seeking a loan is vital. Most people understand that paying bills late will hurt their credit score, but credit bureau models have changed in recent years. Today, high levels of credit card utilization lowers credit scores dramatically -- especially if it exceeds 50% of the available revolving credit. And, since many small business owners use their personal credit card for business travel and routine expenses to take advantage of points and other benefits, utilization is up.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

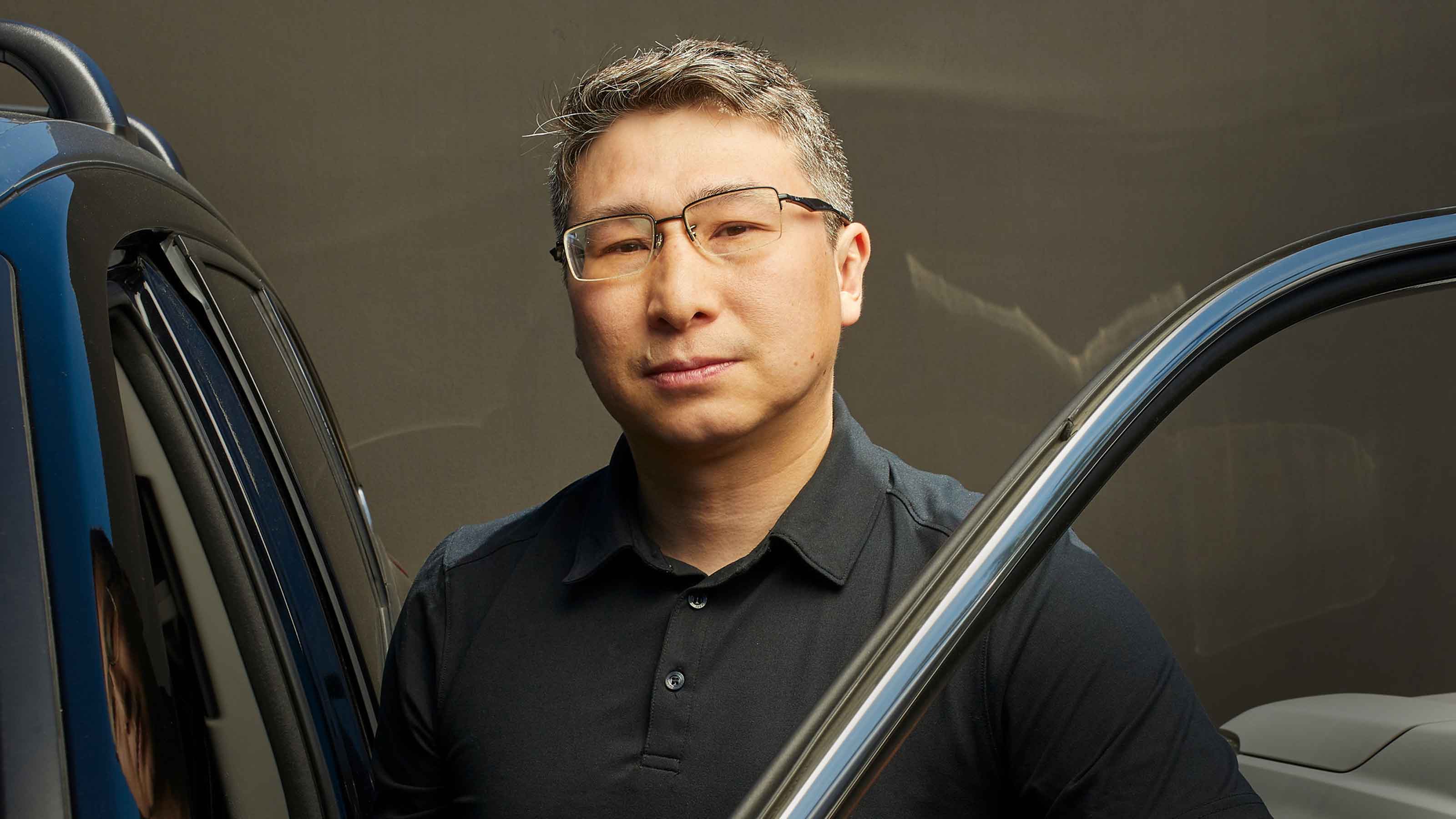

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.