New Credit-Card Options for Small-Business Owners

Chase and others help broaden out a crimped lending field.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A couple of months ago, we noted that the pickings were slim for small-business credit cards (see “Credit Cards With a Head for Business.” ) But the competition for small-business owners’ business has heated up with the recent introduction of Ink cards from Chase. Here’s a first look at what the new cards have to offer, plus a couple of other cards we like.

Chase offers four Ink rebate cards: Ink, Ink Plus, Ink Cash and Ink Bold. Ink and Ink Plus are similar rewards-points cards; with Ink Plus, you can also earn bonus rewards. The no-fee Ink Cash card is strictly cash back; the no-interest Ink Bold is meant for business owners who pay in full each month. All four cards offer online expense-management tools and higher spending limits than comparable consumer-oriented cards. Employers may request additional free cards with specified spending limits for their employees, which can help control costs.

With Ink, Ink Plus and Ink Cash, you may maintain a revolving balance. Plus, the cards offer Chase’s new Blueprint feature, which allows cardholders to specify what portion of the balance they plan to pay in full and avoid interest charges on those purchases.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

After a six-month 0% introductory rate, interest on the no-fee Ink card jumps to an annual rate of 9.24% to 15.24%, depending on your credit history. Ink Plus’s interest rate is 13.24%; the $60 annual fee is waived for the first year. When you use the Ink Cash card -- the interest rate ranges from 10.24% to 16.24% -- you earn 3% for dining, fuel, home-improvement and office-supply purchases (up to $2,000, after which you earn 1%) and 1% for all other purchases. Cardholders earn one point for each dollar spent -- and bonus points when they reach specific spending thresholds -- that they may redeem for gift cards, hotel stays, airline tickets or cash, or that they may have credited back to their account.

Ink Bold customers also earn points and bonus points that may be redeemed for perks or used to credit their account. The $95 annual fee is waived the first year.

The Ink rewards and cash-back rebates are not as generous as those of American Express’s SimplyCash Business Card, which offers unlimited rebates and an interest rate as low as 7.24% when the 0% teaser rate expires. But the Chase cards should gain acceptance because they’re Visa cards, which are more widely accepted than Amex. The fact that rewards points never expire (unlike with the Citi and Bank of America cards below) is also a plus.

Ink Bold is designed to compete with a similar Amex card, the American Express Plum Card, which offers a 1.5% credit on your next monthly statement if you pay within ten days of receiving your bill. At $185, the Plum Card’s annual fee is twice that of Ink Bold’s. You need to weigh the fee versus the value of the rewards to decide which is best for you.

To learn more about all the Chase Ink cards, go to www.chase.com/ink, or call 800-891-0259.

Other Options

We also like the no-fee Citi Professional Cash Card (www.citicards.com; 888-382-7759), which offers a 3% rebate for each dollar spent at restaurants, gas stations, car-rental agencies and participating office suppliers for a year, and 1% thereafter. All other purchases earn 1% per dollar spent. The 0% introductory rate lasts six months, then jumps to 12.24%. You can accumulate up to $500 in rebates, except for purchases made through the Citi Bonus Cash Center, which have no cap and earn an additional 5% rebate.

You also earn a 3% rebate for many purchases when you use the Bank of America Cash Rewards for Business Visa Card (www.bankofamerica.com/smallbusiness), but the categories are different; they include office supplies, gas and the costs of computer networking, such as a Web host or an ISP. All other spending earns 1%, and there is no cap on your rebate. After the nine-month introductory period, the interest rate on this no-fee card ranges from 5.99% to 15.99%, depending on your credit history. Office-based businesses with heavy computer use will benefit most from this card. Rewards for both the Citi and Bank of America cards expire after three years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

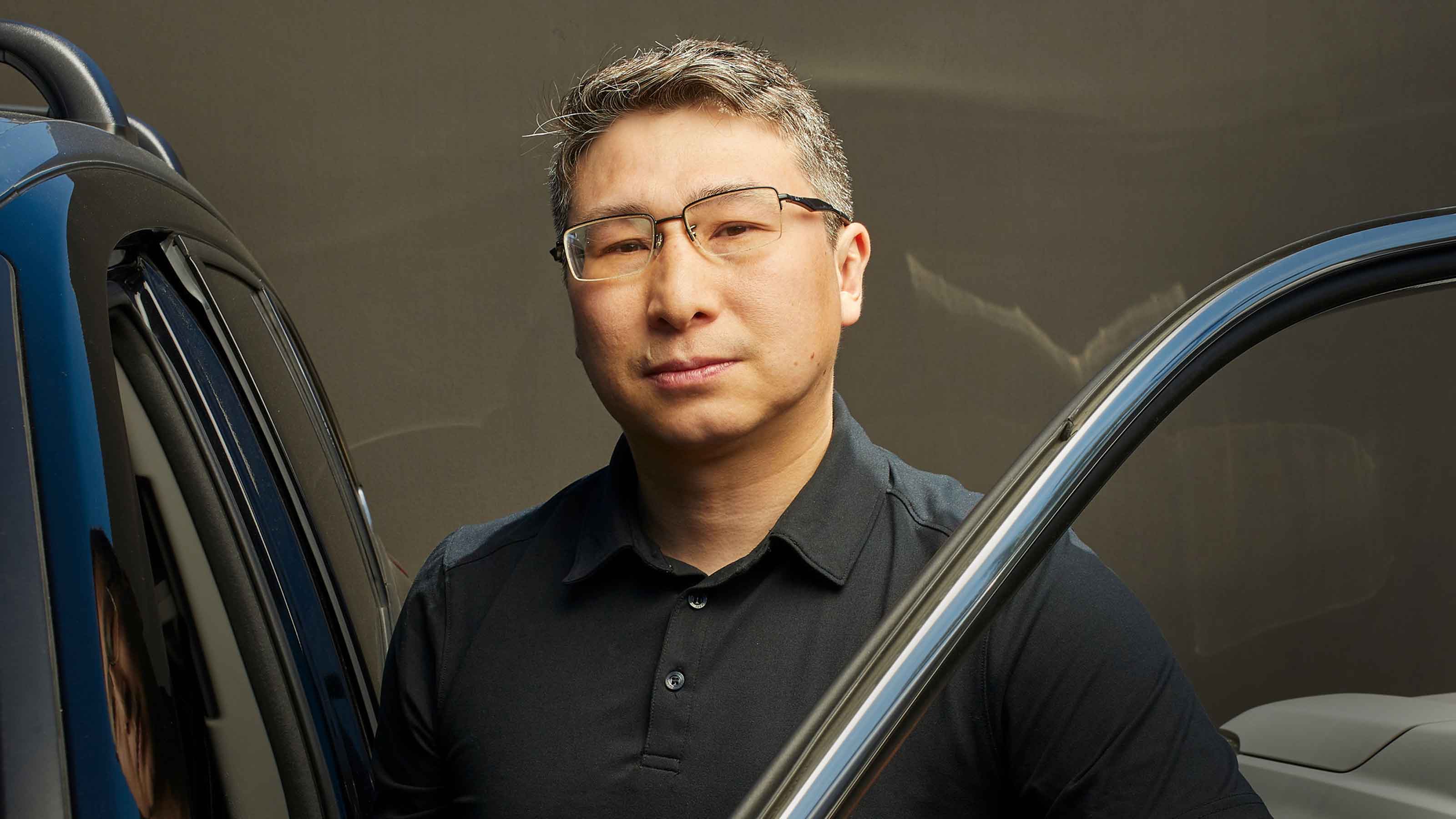

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.