7 Ways to Lose $100,000 in a Hurry

It may be, as Bob Dylan sang, when you got nothing, you got nothing to lose.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It may be, as Bob Dylan sang, when you got nothing, you got nothing to lose. But that's not the case for Americans who are trying to build college savings for their children, or for their own retirement. When you are on the road to building wealth over a lifetime, a market correction of 5% (August 2011) or a plunge of 37% (2008) can set you back quickly,

So what other events can shrink your nest egg -- and your retirement dreams along with it -- in the blink of an eye? Here are seven ways you might easily blow 100 grand in a hurry, and how to prevent that from happening.

Getting Hit With an Uninsured Home Repair

More than 60% of homes are underinsured, by an average of 18%, according to Marshall & Swift/Boeckh, a data provider serving the insurance industry. That could leave many owners vulnerable to significant out-of-pocket costs after a disaster.

Consider that in 2005, when Hurricane Katrina and subsequent storms destroyed as many as 350,000 homes across the Gulf Coast, the average paid flood claim was $97,028, according to the Insurance Information Institute (III). In 2007, when wildfires in San Diego torched more than 1,500 homes, the average paid insurance claim was $71,875, according to Verisk Analytics, a data source for insurers. Yet, one year after the wildfires, only 9% of homes had been rebuilt. "There are people lacking the $200,000 to $300,000 to rebuild," a recovery official told the San Diego Union-Tribune at the time.

How to protect yourself: Review your homeowners insurance policy annually to make sure you’re covered for the full cost to rebuild. Ask your insurer about an inflation guard that is keyed to regional supply costs and, ideally, adjusts your coverage automatically every year.

Also, examine your policy for gaps in coverage: An extra $50 a year will buy you coverage for $10,000 - $20,000 in sewer back-up damages. Flood insurance to cover potential damages caused by water that enters the home from the bottom up starts at $129 a year through the National Flood Insurance Program. And an earthquake rider will cost about $250 per year in regions that aren't prone to tremors.

Throwing a Lavish Wedding

What parents don't want a beautiful wedding for their little princess (or prince)? Small wonder that parents of the bride and groom covered 56% of wedding costs collectively last year, according to a study conducted by TheKnot.com and WeddingChannel.com, which surveyed 17,500 brides.

But wedding costs can quickly spiral out of control, with four out of every ten weddings exceeding the budgeted estimates. In 2011, there were as many as 85,000 weddings that cost $100,000 or more, according to TheKnot.com. The average wedding in New York City costs $76,687. That's a lot of money for one day of happiness.

How to protect yourself: Work with your adult child on a budget you can afford and stick with it. If that doesn't work, rather than "paying for a wedding that strikes you as excessive," advises Knight Kiplinger in his Money & Ethics column, "offer to give the couple a significant financial gift to start them off in their lives together." They'd be able to spend the money however they wish -- either on the wedding or honeymoon or for a down payment on a home -- but be clear that it's all they will receive from you in the foreseeable future.

Blindly Trusting a Financial Adviser

Never forget the 2008 collapse of Bernie Madoff's investment advisory firm -- and with it the loss of more than $17 billion of individual and institutional investors' money. Among the 1,810 individual and family account holders who lost money to Madoff's too-good-to-be-true Ponzi scheme, the average loss was $2.8 million. All those well-heeled investors trusted him blindly. Sadly, Madoff's case is simply the highest-profile among many such frauds.

How to protect yourself: Start with the National Association of Personal Financial Advisors, an association of fee-only professionals whose recommendations to you aren't swayed by potential commissions. Always conduct a background check on advisers you're considering. Search each firm's name at the SEC's Web site to review the adviser's Form ADV for any disciplinary actions. Also, ask the adviser for references from other clients with profiles similar to yours. And, most important, remember that if it seems like a too-good-to-be-true opportunity, it probably is.

Getting Injured or Sick Without Enough Insurance

If you suddenly become ill for six months or more, your nest egg could take a big hit trying to replace lost income.

The odds of you suffering an injury or illness that will keep you from working for an extended period of time are greater than you might think. At age 35, a typical male who works at an office job and lives a healthy lifestyle has a 21% chance of becoming disabled for at least three months at some point during his remaining career. The average length of disability for someone like him is nearly seven years, according to the Council for Disability Awareness.

You may benefit from disability coverage through your employer, but it probably isn't enough to cover all of your monthly expenses if you can no longer work full-time. Such policies generally max out at 60% of your pretax salary (sans bonuses) and have a monthly cap of $5,000, on which you'd have to pay taxes. An injured worker with a $75,000 salary would get only $45,000 in disability benefits.

How to protect yourself: Add an individual disability policy, which generally maxes out at 65% of your pretax income. Benefits from individual policies are tax-free. The cost of such a policy varies by age, gender and occupation. Remember that healthy 35-year-old male above, working in a white-collar profession? Assuming he makes about $75,000 a year, a disability policy paying $4,000 in monthly benefits would cost $100 a month.

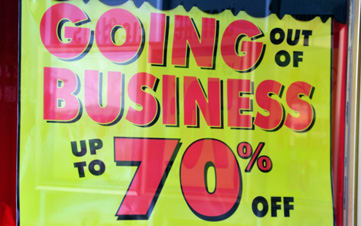

Striking Out With a New Small Business

Launching your own firm puts you in control of your career. The rewards are all yours -- and so are the risks.

The average cost of starting a small business from scratch is about $30,000, according to the Small Business Administration. However, if you're planning to open a more high-risk operation, such as a brick-and-mortar restaurant or retail store, which requires buying equipment, renting out building space and hiring employees, start-up costs can range from $150,000 up to $1 million. That's a huge financial risk to take considering that just half of all new small businesses survive their first five years.

How to protect yourself: Meet with an attorney to determine the right corporate structure to establish to limit your personal liability. Setting up your business as a limited-liability company, for instance, will shield you from any business debts, although not from lawsuits.

Consider low-cost opportunities to set out on your own. For instance, a mobile business -- see our slide show 8 Intriguing Businesses on Wheels -- avoids many of the expenses associated with brick-and-mortar operations. Start-up costs for mobile businesses range from $4,700 for a farm stand to $150,000 for a hair salon. And then there are franchises, many of which have low start-up costs and can even be operated out of your home.

Seeking an Unnecessary Grad Degree

Obtaining a graduate degree in medicine, law, or education can be a ticket to lucrative new professional opportunities.

However, if you're a few years out of college, and already in an industry that puts a greater emphasis on real-world experience, such as communications and information technology, reconsider whether you really need an advanced degree. You could be setting yourself back by tens, even hundreds of thousands of dollars with no guarantee of higher earnings power.

"Grad school is expensive. You obviously have to pay for the courses, but you also need to consider the cost of living -- especially if you're working less or not at all [to attend]," says Hallie Crawford, an Atlanta-based certified career coach. On average, the cost of completing a two-year full-time MBA program at a top university, minus living costs, is $85,306, according to Bloomberg Businessweek's 2012 Best Business School Rankings report. Once you've factored in the full cost of tuition, books, living expenses and lost wages for two consecutive years, the total average cost for grad school jumps to $230,676.

How to protect yourself: Consider getting a certification or professional degree instead, as a means of making yourself more marketable to hiring managers. Learn from others in your field about the most cost-effective programs to advance professionally, Crawford advises. Professional certification programs are a much cheaper way to ramp up your skill set. At Georgetown University, in Washington, D.C., for example, tuition for the six-course certificate of business administration program is $5,370. Their full-time MBA program, which lasts 21 months, costs $157,800.

Getting Blindsided By a Lawsuit

You never know why or when you might get hit with a civil lawsuit, from being at fault in a car accident to your dog biting a passerby to a contractual squabble with a business partner. A typical automobile tort case can range from $18,000 to $109,000 in legal fees, which includes expert witness, paralegal and attorney fees, according to the National Center for State Courts' Courts Statistics Project. The median cost for a breach-of-contract lawsuit that goes to trial is $91,000. And that's just the cost to defend yourself. The median punitive judgment in civil suits is $64,000, with 13% of judgments exceeding $1 million.

How to protect yourself: Get a personal liability umbrella policy. Insurers typically require you to have $300,000 in liability coverage on your home or vehicle before you can purchase an umbrella policy, which starts at $1 million of coverage. This type of policy protects you against lawsuits even if your net worth is less than that amount; the policy also covers legal fees. Coverage kicks in once you've used up your homeowners and auto liability limits. The first $1 million of coverage will cost about $200 to $400 annually. If you need an additional $1 million of coverage, that will run you an extra $75 to $100 a year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's Finances

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's FinancesTax Tips The Trump tax bill could help your child with future education and homebuying costs. Here’s how.

-

Key 2025 Tax Changes for Parents in Trump's Megabill

Key 2025 Tax Changes for Parents in Trump's MegabillTax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

QCD Limit, Rules and How to Lower Your 2026 Taxable Income

QCD Limit, Rules and How to Lower Your 2026 Taxable IncomeTax Breaks A QCD can reduce your tax bill in retirement while meeting charitable giving goals. Here’s how.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.