The BAITs: 4 Chinese Tech Stocks to Buy to Replace the FANGs

Wall Street loves its acronyms.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street loves its acronyms. For a long time, FANGs have reigned supreme, but now it may be time to pay attention to the BAITs.

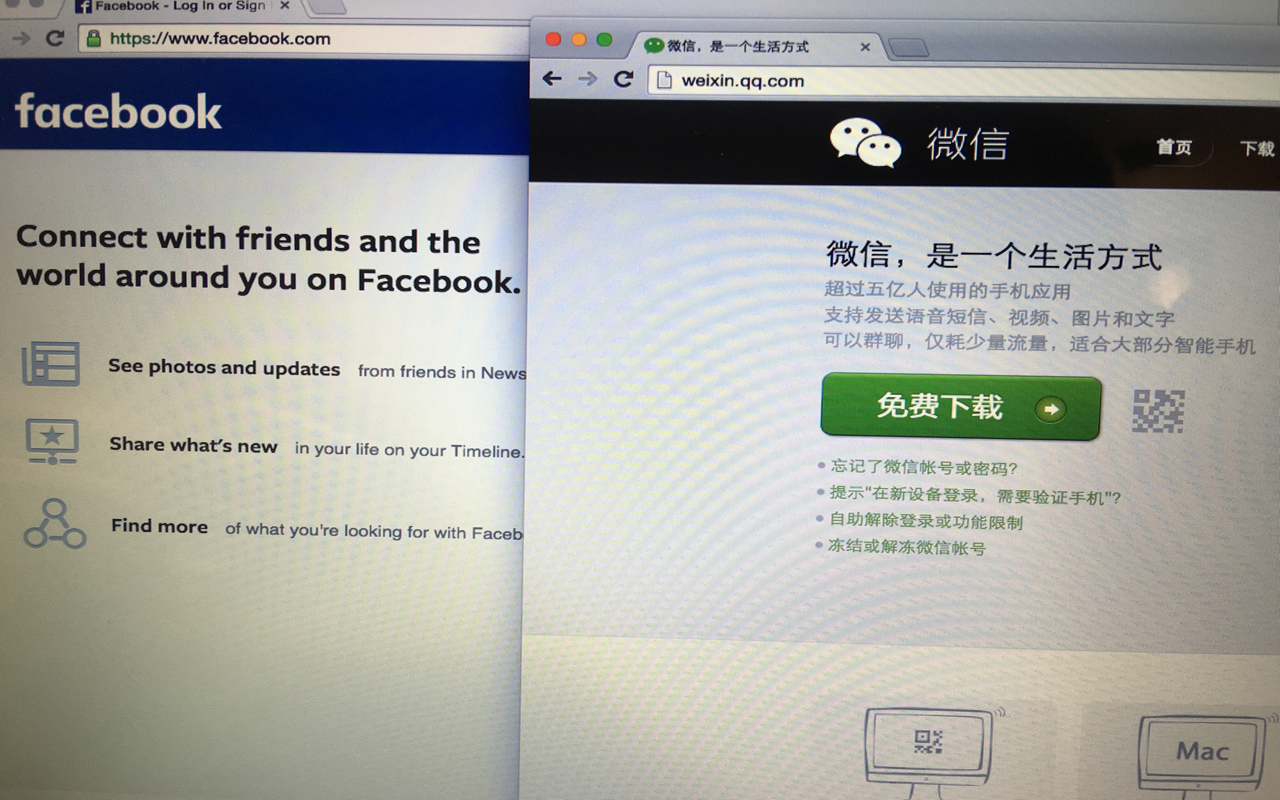

When was the last time you read a market recap that did not include mention of the FANG stocks? Depending on your definition, this group of typically (but not always) highflying tech stocks included the likes of Facebook (FB), Amazon.com (AMZN), Netflix (NFLX) and Google parent Alphabet (GOOGL), though other stocks are often mentioned in the same breath.

Why not? Acronyms catch investors’ attentions and get plenty of media play. The problem is when these vaunted stocks don’t give investors the fat returns they expect. Sure, Amazon is up 38% year-to-date, but it is now trading down 13% from its Sept. 4 peak. Alphabet’s performance lags the Standard & Poor’s 500-stock index by two percentage points for the year, and Facebook is actually negative by 22%.

But a different group of tech stocks seems poised to carry the mantle of market leadership. And they provide the game-changing technology to the world’s second largest economy. They are China’s version of the FANGs, called BAITs. they now look attractively priced thanks to China’s recent bear market.

Data is as of Nov. 11, 2018.

Baidu

- Market value: $62.7 billion

- 52-week range: $177.80-$284.22

- Trailing price-to-earnings ratio: 16.3

Comparisons between BAITs and FANGs are close, but they are not perfect. That said, Baidu (BIDU, $183.75) is the largest search engine in China and the second largest in the world behind Google. It topped analyst earnings estimates for the quarter ending in September by 13.6%. Year-over-year revenue growth was 27%.

Still, the stock trend has been down since July, and BIDU now trades near 52-week lows. As with most big Chinses stocks, low price does not necessarily mean cheap. However, BIDU is approaching areas of stock-chart support, where investors are likely to find shares attractive based on supply-and-demand characteristics over the past few years.

In other words, Baidu could fall a bit before finding its ultimate bottom. But compared to its price just a few short months ago, there is plenty of room to ride out the rest of this short-term storm for long-term gain.

Alibaba Group Holding

- Alibaba Group Holding (BABA, $144.85) has long been called the Amazon of China, but it’s arguably having even more success than its American counterpart. Its businesses go well beyond retail into e-commerce platforms, cloud computing, media, artificial intelligence, payment processing and it has many investments in startups in southeastern Asia.

If you think Amazon’s Prime Day is the sales event of the year, think again. Last year, Alibaba’s Singles Day shopping extravaganza topped $1 billion in sales within the first two minutes. It was more than $10 billion just an hour later. It ended at $25.3 billion in sales, dwarfing Prime Day’s $2.4 billion. This year, Singles Day on Nov. 11 racked up $30.8 billion in sales in early reporting, a 27% gain from last year’s record.

Chairman and Founder Jack Ma recently stepped down as executive chairman but still plans to lead the board of directors next year. Moreover, the company’s succession plan is solid and it did not skip a beat in the execution of its plans.

The company reported third quarter earnings on Nov. 2 and topped analyst estimates by over 23%. While its P/E of 42 seems high, it trades at a much more reasonable 20 times estimates of future earnings, and appears to be a victim of trade war rhetoric and an overall weak Chinese stock market. If either of these conditions change, BABA should recover nicely.

iQiyi

- Market value: $13.9 billion

- 52-week range: $15.30-$46.23

- Trailing price-to-earnings ratio: N/A

Pronounced “ee qwee yee,” iQiyi (IQ, $20.00) is a leading streaming company spun off from Baidu earlier this year. You could argue that it’s the Netflix of China.

The stock has been in decline, along with the rest of the Chinese market, since June. However, it recently moved past the lockup period following its initial public offered (IPO) that forbade insiders from selling their stock. Typically, we see these people sell their shares to “cash out” and that tends to pressure stock prices lower. With the lockup over, that potential source of supply is gone.

Subscriber count increased by 5.8 million in Q2 2018 over the previous quarter to 67.1 million. And year-over-year comparisons showed a 75% gain in the second quarter. The library of premium and original content gives the company an edge. Unfortunately, iQiyi posted a 63-cent loss, missing estimates by 25 cents.

This stock might take a while longer to get going, but it does have the elements of a long-term winner in place.

Tencent Holdings

- Market value: $320.0 billion

- 52-week range: $31.54-$61.00

- Trailing price-to-earnings ratio: 26.4

- Tencent Holdings (TCEHY, $34.82) is a bit harder to line up with a FANG counterpart because it has elements of Facebook, Netflix, payments stock PayPal (PYPL) and streaming-music stock Spotify (SPOT) – all in one place.

However, as China's largest social media and gaming company, total revenue and profits have rocketed by 201% and 143% since 2014. Whereas Facebook derives most of its revenue from advertising, Tencent’s social media revenue comes from subscriptions, a bit like iQiyi.

Tencent Music is one of the world's leading music streaming services with about 800 million users. Spotify, in comparison, has about 180 million monthly users (83 million paid). Tencent planned to spin off this business but that deal has been on hold for a while.

The company’s next earnings report is scheduled for Nov. 28. Earnings have increased steadily for at least the past 10 of 11 quarters.

Tencent is another big tech stock falling with the Chinese market. In addition to trade war fears, the stock is down on the weak Chinese currency, which could be blamed for a significant portion of the company’s fall. The upside: More attractive prices for new buyers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Dives 878 Points on Trump's China Warning: Stock Market Today

Dow Dives 878 Points on Trump's China Warning: Stock Market TodayThe main indexes erased early gains after President Trump said China is becoming "hostile" and threatened to cancel a meeting with President Xi.

-

Dow Hits New Intraday High: Stock Market Today

Dow Hits New Intraday High: Stock Market TodayValue-hunters with big stakes in a particular component kept one of the main U.S. equity indexes in positive territory.

-

Stock Market Today: Dow Dives 748 Points as UnitedHealth Sells Off

Stock Market Today: Dow Dives 748 Points as UnitedHealth Sells OffA services-sector contraction and a worse-than-anticipated consumer sentiment reading sent bulls scrambling Friday.

-

Stock Market Today: Growth Concerns Drag on Stocks

Stock Market Today: Growth Concerns Drag on StocksForward-looking commentary from a major retailer outweighed its backward-looking results as all three major equity indexes retreated on Thursday.

-

Why Alibaba Stock Is Soaring After Earnings

Why Alibaba Stock Is Soaring After EarningsAlibaba stock is higher Thursday after the China-based e-commerce platform beat expectations for its fourth quarter. Here's what you need to know.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Stock Market Today: Dow Hits New High After Upbeat Inflation Data

Stock Market Today: Dow Hits New High After Upbeat Inflation DataThe Fed's preferred inflation gauge continues to cool. Markets shift focus to next week's jobs report.

-

Alibaba Stock's Set to End September With a Bang. Here's Why

Alibaba Stock's Set to End September With a Bang. Here's WhyAlibaba stock is headed toward its best month since December 2022 and Wall Street sees even more upside ahead. Here's what you need to know.