12 Tech Stocks That Wall Street Loves the Most

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Markets have been so volatile this summer on U.S.-China trade tensions that investors might not have noticed: Tech stocks are absolutely red-hot in 2019.

Indeed, the technology sector of Standard & Poor’s 500-stock index is leading the broader market by a mile this year, with a year-to-date gain of 29% through Aug. 21. By comparison, the S&P 500 is up about 17%, while the tech-heavy Nasdaq Composite Index has risen 21%. (The second-best performing sector is real estate, up 25%.)

Stellar gains are always welcome, but they do pose a challenge for investors. After such a big run-up, is there anything left worth buying at current levels?

Analysts sure think so. Between momentum and the sector’s outsize growth prospects, plenty of tech stocks have nowhere near topped out, they say.

To see which picks analysts like best at this point, we screened the Nasdaq Composite for the top-rated small, midsize and large tech stocks. S&P Global Market Intelligence surveys analysts’ ratings on stocks and scores them on a five-point scale, where 1.0 equals Strong Buy and 5.0 means Strong Sell. Any score of 2.0 or lower means that analysts, on average, rate the stock a Buy. The closer the score gets to 1.0, the better.

Here are the 12 tech stocks the analysts love right now. This group is broken down into the four best-rated stock picks in the small-, mid- and large-cap spaces.

Data is as of Aug. 21. Companies are listed by strength of analysts’ recommendations, from lowest to highest. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Analyst ratings are provided by S&P Global Market Intelligence.

Top-Rated Small Tech Stock #4: Varonis Systems

- Market value: $2.1 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.86

Analysts think highly of Varonis Systems’ (VRNS, $70.28) strategic plan.

Like many tech stocks, the cybersecurity software company is transitioning away from selling licenses and toward a cloud-based subscription model. Although pivoting to software-as-a-service is rarely pain-free – VRNS’ revenue fell 4% in Q2 – such transitions boost margins over the long haul.

At the same time, VRNS is benefitting from new regulations on digital privacy such as the European Union’s General Data Protection Regulation (GDPR), stricter compliance requirements and the “ominous threat environment,” write Wedbush analysts, who rate shares at Outperform (equivalent to Buy).

“In the numerous software business model transitions we have seen play out over the past decade, we can never remember seeing a company so quickly ramp subscription revenues in the course of a few quarters, which speaks to a massive success story so far for the company (and its investors),” Wedbush writes.

Of the 14 analysts covering the stock tracked by S&P Global Market Intelligence, seven rate VRNS at Strong Buy, two say Buy and five call it a Hold. Their average target price of $81.46 gives Varonis implied upside of 16% over the next 12 months or so.

Top-Rated Small Tech Stock #3: Brooks Automation

- Market value: $2.3 billion

- Dividend yield: 1.3%

- Analysts’ average recommendation: 1.40

- Brooks Automation (BRKS, $32.03) has a good thing going. It’s well-established in the semiconductor, solar, and chemical industries, among others, supplying clients with specialized, high-tech equipment. But it’s the firm’s emergence in the life sciences sector that makes analysts especially bullish on the stock.

BRKS currently has a place among semiconductor and tech stocks. But analysts think it will increasingly be viewed as a life sciences play. That should help boost price-to-earnings ratios over time, and in turn, lift shares.

“We continue to view Brooks as one of the most compelling valuation stories with regards to Life Science investors,” write analysts at Janney, who rate shares at Buy. “We view the change in Brooks legacy semi/technology ownership profile will transition to primarily Life Science investors and Brooks' valuation multiple may expand.”

Stifel analysts rate shares at Buy, too, citing BRKS’ emerging life sciences business, continued outperformance in the semiconductor segment and improved free cash flow generation. “The company continues to outperform overall industry growth rates by a sizable margin, and we believe this is setting the company up for an above-average growth year in 2020,” they write.

Analysts’ average target price of $42.50 gives BRKS implied upside of about 33% over the next year or so, according to S&P Global Market Intelligence.

Top-Rated Small Tech Stock #2: Upland Software

- Market value: $1.1 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.38

Analysts are quite taken with upstart Upland Software (UPLD, $42.73). The six-year-old software company provides cloud-based work-management software for business customers – a not-uncrowded industry.

What sets UPLD apart, however, is its aggressive strategy for growth.

Upland is constantly on the prowl for mergers and acquisitions (M&A). It’s then able to bundle the software services it picks up through M&A. Most recently, the firm bought cloud-based software provider Cimpl on Aug. 22 for $23.1 million in cash and a $2.6 million cash holdback payable in 12 months. (It also announced a guidance upgrade in concert with the acquisition.)

“Our acquisition pipeline is robust, and we are actively pursuing additional opportunities to build out our solution suites,” said Jack McDonald, Upland chairman and CEO, in a press release.

William Blair analysts, who rate the tech stock at Outperform, note that enterprise customers increasingly want bundled software, and UPLD enjoyed “record expansion and major customer growth” in Q2. Of the eight analysts covering Upland that are tracked by S&P Global Market Intelligence, five rate the stock a Strong Buy, and three rate it at Buy.

Top-Rated Small Tech Stock #1: Virtusa

- Market value: $1.1 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.29

Shares in Virtusa (VRTU, $35.35) were down 17% for the year-to-date through Aug. 21 – vs. a 17% gain for the S&P 500. Analysts spot a bargain.

The company – which provides IT, business consulting and application outsourcing services – posted better-than-expected quarterly results in early August. The firm also gifted investors a share repurchase program of up to $30 million over the next 12 months.

Wedbush analysts rate shares at Outperform, citing Virtusa’s potential to take market share and improving margins at its Polaris subsidiary in India. “We continue to expect a combination of pipeline strength, expanding digital mix, and record level pipeline growth in FS vertical to generate above-sector growth this year,” they write.

VRTU also wants to make strategic, niche acquisitions, Wedbush notes.

Of the seven analysts covering Virtusa tracked by S&P Global Market Intelligence, five call the stock a Strong Buy and two call them a Buy. Their average price target of $51.50 gives VRTU implied upside of about 46% over the next year or so. Analysts also expect the company to be a profit-growth machine. They forecast average annual earnings expansion of 18% over the next three to five years, according to S&P Global Market Intelligence.

Top-Rated Mid Tech Stock #4: Dropbox

- Market value: $7.4 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.94

- Dropbox (DBX, $17.92) remains in most analysts’ good graces, despite what has been a disappointing run for the cloud-storage service ever since its March 2018 initial public offering.

Indeed, shares were off more than 12% for the year-to-date through Aug. 21 and now sit below their $21 IPO price. DBX beat Wall Street’s quarterly profit and revenue estimates in early August, but shares still tumbled as much as 14% on the report. Weaker-than-expected billings were blamed for the selloff.

Although the stock appears to have recently stabilized, it’s been a tough run for the bulls.

“It’s frustrating to face nearly ceaseless negativity and middling performance of the stock, but it is more frustrating to try to argue against arguments that the missing of some unguided number or deceleration of a favorite metric reflects anything other than the normal stochastic nature of real-life business operations,” write Canaccord Genuity analysts. “We’re willing to stick with this name with a Buy rating and push back on the negative knights who say Ni.”

The broader analyst community is mixed but lean bullish. Eight analysts tracked by S&P Global Market Intelligence rate DBX at Strong Buy, and three have it at Buy. But three say it’s a Hold and another two say to sell Dropbox. Overall, however, their $29.64 target price gives DBX whopping implied upside of 65% – among the highest on this list of tech stocks. Earnings growth is projected to grow an average of 34% annually for the next three to five years.

Top-Rated Mid Tech Stock #3: Proofpoint

- Market value: $6.6 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.54

- Proofpoint (PFPT, $117.60) easily topped the Street’s profit and revenue estimates when it posted second-quarter results in late July. The cybersecurity company, which enjoyed a 17% increase in billings, is seeing increased benefits from bundling cloud-based services for clients.

“We see Proofpoint as the leading cloud email security vendor, offering customers a best-of-breed messaging security solution,” write Stifel analysts, who rate shares at Buy. “In addition, the company has been one of the more successful acquirers within the group, leveraging M&A to drive sustained greater-than-market growth.”

Proofpoint is outperforming tech stocks as a whole, up about 40% so far in 2019 versus 29% for the sector. The pros expect more performance ahead. Their average target price of $144.50 gives PFPT stock implied upside of about 23% over the next year or so.

Analysts expect Proofpoint to grow profits at 26% annually on average over the next three to five years. Twenty-nine analysts are covering PFPT at the moment – 18 rate it a Strong Buy, seven say it’s a Buy and the remaining four call it a Hold.

Top-Rated Mid Tech Stock #2: Viavi Solutions

- Market value: $3.2 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.50

- Viavi Solutions (VIAV, $13.88) specializes in testing and monitoring various types of communications networks, such as broadband, copper, Wi-Fi and fiber optic. Analysts are bullish on its growth prospects, thanks partly to the rollout of next-generation (5G) wireless networks.

“We continue to believe the company’s wireless and fiber test businesses are in the early stages of a multi-year investment cycle as (original equipment manufacturers) and service providers begin their transition to 5G and fiber is deployed deeper into networks,” write Stifel analysts, who rate VIAV at Buy.

The company is forecast to generate average annual earnings growth of more than 12% over the next three to five years, according to S&P Global Market Intelligence. Analysts average price target of $15.35 gives VIAV implied upside of about 10% over the next year or so – that small relative upside is largely because the stock has been quickly sprinting toward that price target, up 37% year-to-date. Analysts may soon need to re-evaluate and adjust.

Seven analysts rate VIAV at Strong Buy, one says Buy and two have it at Hold, according to S&P Global Market Intelligence.

Top-Rated Mid Tech Stock #1: Lumentum Holdings

- Market value: $4.6 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.31

- Lumentum Holdings (LITE, $59.71) makes optical communications devices that help power telecom networks and data center communications equipment, among a wide range of other products. But it’s perhaps best known as the company that makes the 3D facial-recognition sensors for Apple’s (AAPL) iPhones.

The relentless growth of cloud-based services bodes well for the data-center businesses of tech stocks such as LITE, as does the build-out of 5G networks. And thanks to last year’s acquisition of optical-components maker Oclaro, Lumentum is set to make the most of its chances.

“Our Buy rating on shares of LITE is based on our expectation that the newly combined Lumentum + Oclaro is better positioned for continued growth in its core telecom optical market, should see improving economics in the datacom market with greater scale and the entry of new lower-cost high-speed products and long-term growth opportunities in 3D sensing,” Stifel analysts write.

All 16 analysts surveyed by S&P Global Market Intelligence are bullish on this tech stock – 11 call it a Strong Buy, with the other five at Buy. Their average price target of $71.39 suggests LITE will gain 20% over the next 12 months or so.

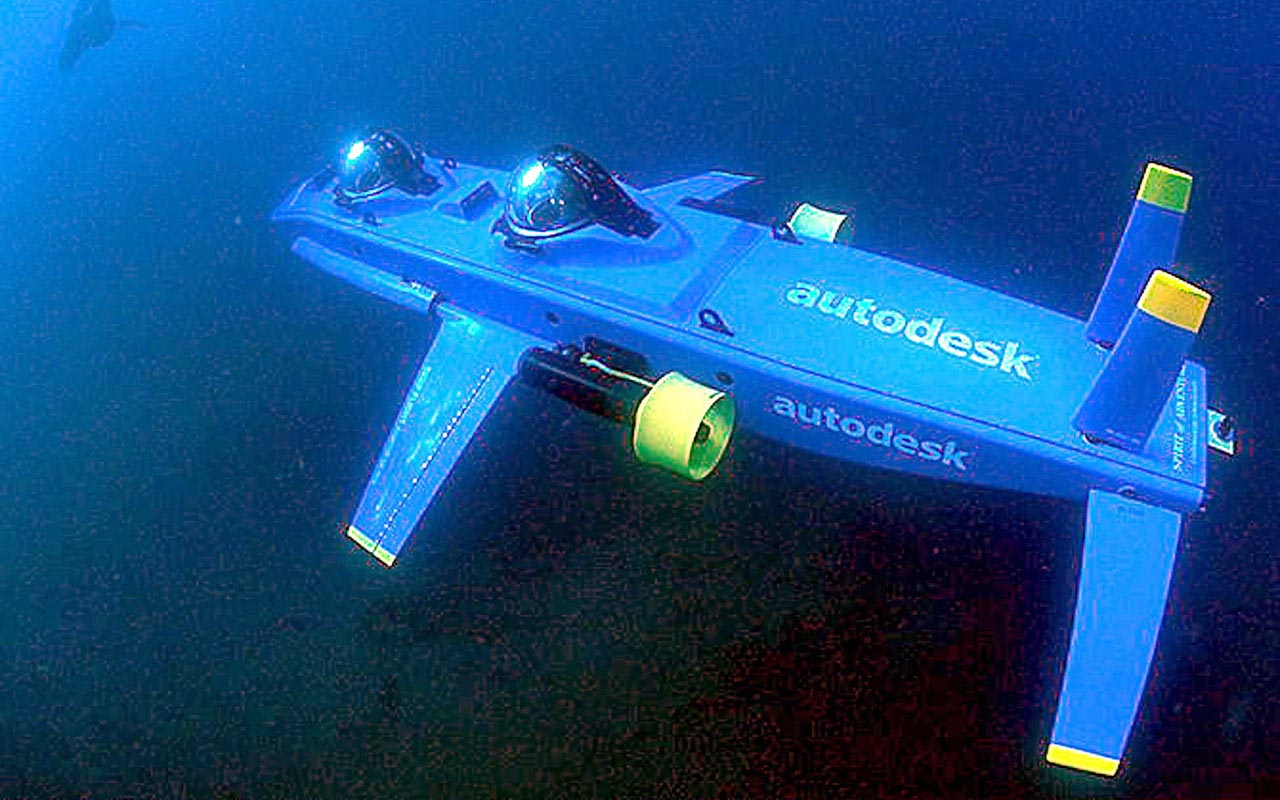

Top-Rated Big Tech Stock #4: Autodesk

- Market value: $32.1 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.76

- Autodesk (ADSK, $145.95) is by far and away the Big Kahuna when it comes to software that allows architects, engineers, manufacturers – you name it – to design complicated projects in three dimensions.

Investors are getting a bit hinky about the slowdown in the global economy, but these macro concerns haven’t put a damper on analysts’ enthusiasm for ADSK stock. At least not yet. We’ll get more clarity after the computer-assisted design company posts quarterly results, currently slated for Aug. 27. Generally, a slowdown in manufacturing is not good for Autodesk.

Keybanc analysts recently surveyed Autodesk’s North American resellers. The takeaway was that the software company should hit its quarterly numbers. Keybanc reiterated its Overweight (Buy) rating on shares. Longer-term, Stifel, which calls shares a Buy, likes ADSK’s opportunities in 3D printing and increasing use of digital design in the architecture, engineering and construction industries.

Out of 25 analysts polled by S&P Global Market Intelligence, 14 rate ADSK at Strong Buy, four say Buy, six have it a Hold and one says Sell. Their average target price of $184.29 gives shares implied upside of 26% over the next year to 18 months.

Top-Rated Big Tech Stock #3: PayPal

- Market value: $129.2 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.75

To say PayPal (PYPL, $109.82) garners a lot of interest on the part of Wall Street analysts would be an understatement. More equity research shops keep tabs on the digital payments company than Microsoft (MSFT), the world’s largest publicly traded company by a wide margin.

Fully 40 analysts cover PayPal, according to S&P Global Market Intelligence. They’re bullish: 21 rate PYPL at Strong Buy, nine say Buy, nine have it at Hold and one says Sell.

Shares in PayPal have tumbled about 9% after hitting an all-time high in late July. The culprit? The company cut its full-year revenue outlook when it posted second-quarter results. Shares had been a white-hot tear heading into the earnings release, which set them up for a significant drawdown on anything less than a perfect report. (The broader market’s tantrum didn’t help.)

Analysts aren’t fazed. If anything, the recent drop makes PayPal even more attractive. Wedbush rates the stock at Outperform based on “continued hyper growth from mobile payment transactions,” the ramping up of Venmo digital wallet and contributions from Xoom money transfer service.

With an average target price of $127.51, PYPL stock has implied upside of 16%. Analysts expect earnings to grow at an average annual pace of almost 19% over the next three to five years.

Top-Rated Big Tech Stock #2: Fiserv

- Market value: $73.4 billion

- Dividend yield: N/A

- Analysts’ average recommendation: 1.64

Digital payments, payments processors and pretty all things to do with financial tech are hot these days. Even Berkshire Hathaway (BRK.B), whose CEO and Chairman is the typically tech-averse Warren Buffett, is making multimillion-dollar investments in fintech.

- Fiserv (FISV, $107.56) is not a Berkshire holding as of this writing, but it does exemplify much of what Buffett likes about companies that facilitate financial transaction processing – ample opportunities for growth and economies of scale.

FISV, which recently acquired First Data in a $22 billion all-stock transaction, certainly has the scale part working in its favor.

“We specifically like the company’s positioning, acting as a strategic partner to large and small community banks undergoing dramatic transformation in their business model (shifting to digital-like services),” write Wedbush analysts, who rate FISV stock at Outperform.

Of the 25 analysts covering FISV tracked by S&P Global Market Intelligence, 16 rate the stock at Strong Buy, four say Buy, four call it a Hold and one holdout says it’s a Strong Sell.

Top-Rated Big Tech Stock #1: Microsoft

- Market value: $1.06 trillion

- Dividend yield: 1.3%

- Analysts’ average recommendation: 1.46

It’s no surprise that sitting atop this list of analyst-loved tech stocks is Microsoft (MSFT, $138.79). The folks in Redmond, Washington, have been killing it for some time now. The software king’s cloud-computing business has propelled a long-sleepy stock into the stratosphere.

As noted above, Microsoft is the world’s biggest publicly traded company and the only one with a market value of at least $1 trillion. No. 2 Apple, a massive stock in its own right, trails MSFT by around $100 billion in market capitalization.

Canaccord Genuity analysts, who rate shares at Buy, write the “juggernaut is set to continue” thanks to Microsoft’s arsenal of growth drivers that include Azure cloud computing, Office 365 and the Xbox gaming ecosystem.

“When we hear investors get jumpy because MSFT continues to advance in ‘beast mode,’ we suggest they relax and enjoy what looks to us to be several more years of above-average growth and price appreciation,” Canaccord Genuity writes.

Of the 35 analysts tracked by S&P Global Market Intelligence, 23 have MSFT at Strong Buy, 10 say Buy, one calls it a Hold … and one bear is hanging on to a Strong Sell call. Perhaps most impressively for a trillion-dollar company, earnings are forecast to grow an average of more than 12% a year for the next three to five years – not an easy feat for such a gigantic corporation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.