Stocks That Warren Buffett Is Buying and Selling Now

When it comes to the stock market’s so-called “smart money,” Warren Buffett is arguably still king of the hill.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to the stock market’s so-called “smart money,” Warren Buffett is arguably still king of the hill. Even at 87 years of age, the Oracle of Omaha remains involved with the stock-picking done by his iconic investment fund Berkshire Hathaway (BRK.B), and he hasn’t lost his touch. Riding his coattails, or at least studying what he’s buying (and why), can be a smart move.

That’s not a tough thing to do. Fund managers are required to report their portfolio’s position to the SEC each and every quarter. Just by cross-referencing the most recent report with the previous one, it’s not too difficult to figure out what Buffett has been buying and selling.

And Berkshire just filed its most recent report (called a 13F) on Wednesday, Feb. 14.

Here’s a look at what Warren Buffett and Berkshire Hathaway bought during the fourth quarter covered by this 13F. Yes, it’s slightly old news now, as he’s disclosing what he has already done and not what he’s going to do. But there’s still plenty of worth in this info. After all, Buffett’s preferred holding period is “forever,” so these picks have shelf life for any investor that wants to follow his lead.

Data is as of Feb. 14, 2018. Stocks are listed in alphabetical order. The number of shares held by Berkshire Hathaway are as of the fourth quarter.

American Airlines

- Action: Reduced stake

- Shares held: 46 million (-2.1% from Q3)

- Value: $2.4 billion

Berkshire shed 1 million shares of American Airlines (AAL, $51.07) last quarter. That’s not a dramatic cut, amounting to only about 2% stake of the whole position, which still makes up about 1.2% of Berkshire’s total holdings. Buffett also owns $2.8 billion worth of Delta Air Lines (DAL) and a good chunk of United Continental (UAL) to boot.

Perhaps this group of veteran stock-pickers – that also includes Ted Weschler and Todd Combs – thinks Berkshire may be a bit over-exposed to the air travel sector. However, Buffett hasn’t been afraid to overweight certain sectors in the past, if he had a strong conviction about that market’s growth prospects.

It's also possible that Berkshire’s exit from some of its AAL was ordinary profit-taking. Shares are up nearly 80% from their mid-2016 low. But that’s not a very Buffett-esque move, either.

Don’t consider this a red flag just yet. But if Berkshire Hathaway continues to cull its American Airlines position in future quarters, it could merit a much closer look at the headwinds AAL may be hitting.

Apple

- Action: Added to stake

- Shares held: 165.3 million (+23.3% from Q3)

- Value: $28.4 billion

Berkshire first added Apple (AAPL, $167.37) to its portfolio in early 2016, and has been adding steadily to it ever since. Last quarter was no exception; Buffett picked up another 31.2 million shares. Apple is now the largest holding in the portfolio, eclipsing Wells Fargo (WFC).

Granted, both stocks’ stories helped displace Wells Fargo as the now-former mainstay.

Although it looked like the big bank might have finally left its account-opening scandal in the past, the Federal Reserve effectively put the handcuffs on it, announcing earlier this month that it wouldn’t be permitted to grow its asset base until several conditions regarding its oversight measure had been met. The news tanked the stock. Meanwhile, Apple shares have made continued – even if inconsistent – progress thanks to healthy demand for its new high-priced iPhones.

Apple remains an admittedly un-Buffett-like pick, as he’s largely eschewed cyclical consumer technology stocks in the past. If there was ever a call for an exception to his own rule of thumb, though, Apple seems to be it.

Berkshire, by the way, sold a little of its Wells Fargo stake during the fourth quarter. More on that in a moment.

Bank of New York Mellon

- Action: Added to stake

- Shares held: 60.8 million (+21.1% from Q3)

- Value: $3.4 billion

Berkshire may have pared back its stake in Wells Fargo just a bit last quarter, but it’s not necessarily because Buffett has a problem with banks, per se. Given the small size of the move, one can guess that he trimmed his WFC holdings to avoid the regulatory hurdles that pop up when any one entity owns more than 10% of a banking company. Berkshire’s stake in Wells Fargo is 9.3% of outstanding shares.

The holding company clearly wasn’t shy about adding to financial companies in competition with Wells Fargo. Berkshire plumped up its Bank of New York Mellon (BK, $55.98) position to the tune of 21% during the fourth quarter.

That’s a 6% stake in Bank of New York Mellon, and it accounts for less than 2% of Berkshire’s portfolio value. But BK is a stock to watch nonetheless, just because Buffett has been consistently adding to the position.

General Motors

- Action: Reduced stake

- Shares held: 50 million (-17% from Q3)

- Value: $2.1 billion

It’s arguably Berkshire Hathaway’s least-discussed move from last quarter, but the fund dumped 10 million shares of carmaker General Motors (GM, $41.81) late last year.

That’s a bit of a turnaround from Buffett’s point of view just a couple of years ago, when he was adding to the position. Of course, much has changed in the meantime. While 2016’s record-breaking pace of automobile sales in the all-important U.S. market made for a compelling bullish argument – and GM is now the nation’s preferred carmaker – that year ended up marking the “peak auto” pivot. Last year’s car sales, despite the surge of demand created by Hurricane Harvey, fell for the first time in seven years. Warren Buffett also has to know that the 2018 auto sales outlook isn’t looking so hot, either, thanks to rising interest rates.

What’s noteworthy is that GM shares are priced at less than 7 times their forward-looking earnings, offering the kind value Buffett normally would seek out.

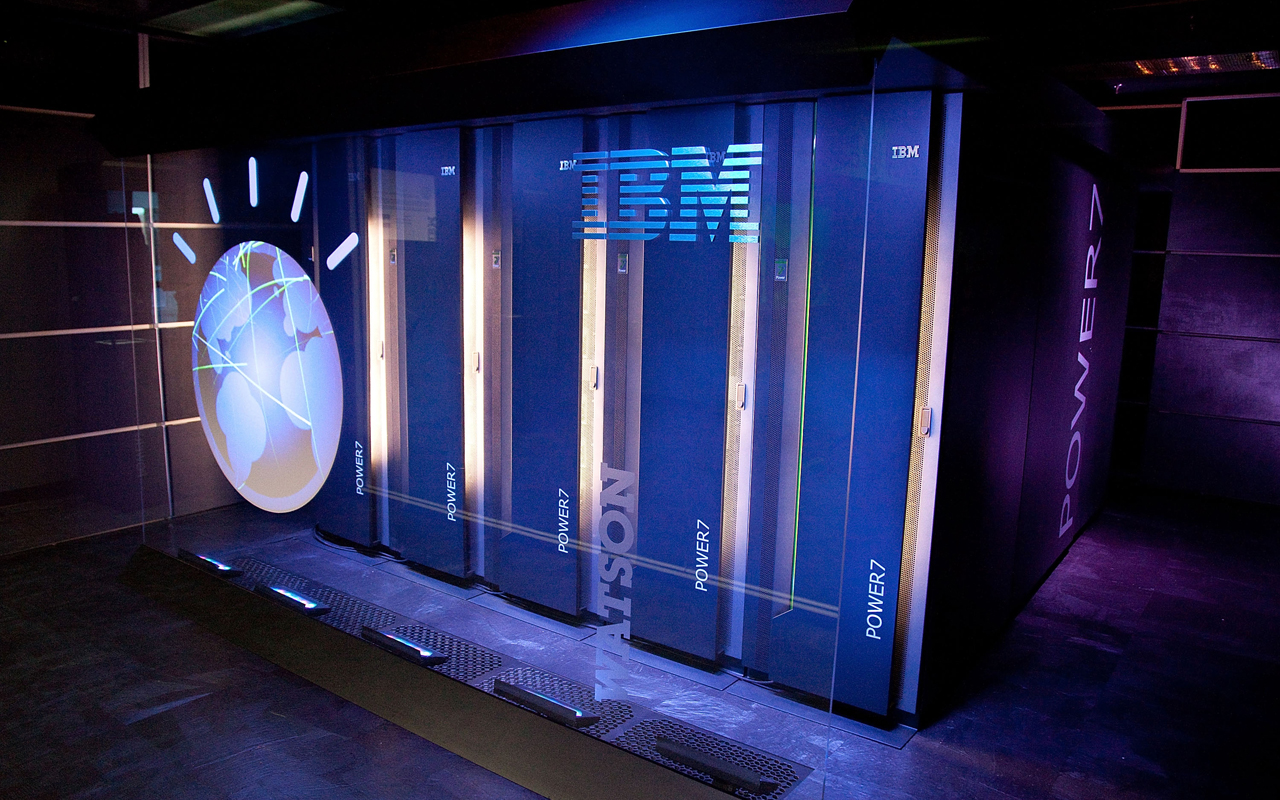

International Business Machines

- Action: Reduced stake

- Shares held: 2.05 million (-94.5% from Q3)

- Value: $317.2 million

Buffett and his crew gave technology giant International Business Machine (IBM, $154.76) the benefit of the doubt as long as they could, sticking with their sizable position for all of the 27% decline since 2013’s high. Indeed, vindication reared its head, even if only in a small way, last quarter. That’s when the top line grew on a year-over-year basis for the first time in 23 quarters.

Berkshire wasn’t waiting around, however, using the fourth-quarter rebound from IBM shares as a chance to get out at a palatable price regardless of what appeared to be on the horizon.

In Buffett’s defense, he opened up his position in Big Blue in 2011, when the technology landscape looked a bit different, and when International Business Machines was more relevant. That was before cloud computing became commonplace, and before cybersecurity was the overarching concern it is now. Those are opportunities IBM simply missed, and the company is now struggling to catch up.

Monsanto

- Action: Added to stake

- Shares held: 11.7 million (+32.0% from Q3)

- Value: $1.4 billion

During the fourth quarter of 2017, Berkshire picked up another 2.7 million shares of Monsanto (MON, $120.18), bringing the total position up to 11.7 million shares. The $1.4 billion stake still is only a tiny fraction of the fund’s total value, but it’s a curious indicator of optimism in a company and an industry that has been relatively inconsistent in recent years.

It’s also worth noting that Berkshire Hathaway has been regularly adding to its holdings, buying 831,469 shares in the third quarter of last year. The core position is a relatively young one that started with an 8 million-share purchase in Q4 2016.

Whatever the fund’s chiefs see in Monsanto is eluding most other investors. Though shares are up for the past couple of years, little of that progress was made during 2017. It’s trading at more than 20 times its trailing 12-month earnings, too, and the 1.8% dividend yield isn’t exactly a show-stopper, either.

Nevertheless, the Oracle of Omaha has spoken.

Teva Pharmaceutical

- Action: New position

- Shares held: 18.9 million

- Value: $391.1 million

Perhaps Berkshire’s most surprising purchase last quarter was an all-new stake in beleaguered generic drug company Teva Pharmaceutical (TEVA, $19.33). Although it still only accounts for less than 1% of the $186 billion fund, more may be added in the future … as was the case with Apple.

The value argument can certainly be made here. Warren Buffett has long encouraged investors to be greedy when others are fearful, and down 70% from its mid-2015 peak, there’s little doubt most investors are afraid to own Teva Pharmaceutical shares.

More than that, though, there’s a fundamental argument in favor of getting into Teva at such low prices. As Bernstein analyst Ronnie Gal explained on Thursday, “It’s a classic value situation. If you think they can make $3.5 billion to $4 billion a year in free cash flow to pay down debt, you buy the stock. If you think it’s $2.5 billion to $3 billion, you sell the stock. If interest rates go up, they’re in trouble because they have to refinance at higher rates. If rates stay low, they will be able to take down the debt.”

Gal went on to explain that Teva Pharmaceutical has been cutting costs, which should allow it to create the debt-reducing cash flow that Berkshire may be counting on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

Risk Is On Again, Dow Jumps 381 Points: Stock Market Today

Risk Is On Again, Dow Jumps 381 Points: Stock Market TodayThe stock market started the week strong on signs the government shutdown could soon be over.

-

Stocks at New Highs as Shutdown Drags On: Stock Market Today

Stocks at New Highs as Shutdown Drags On: Stock Market TodayThe Nasdaq Composite, S&P 500 and Dow Jones Industrial Average all notched new record closes Thursday as tech stocks gained.

-

Stocks Slide to Start September: Stock Market Today

Stocks Slide to Start September: Stock Market TodaySeasonal trends suggest tough times for the stock market as we round into the end of the third quarter.

-

9 Warren Buffett Quotes for Investors to Live By

9 Warren Buffett Quotes for Investors to Live ByWarren Buffett transformed Berkshire Hathaway from a struggling textile firm to a sprawling conglomerate and investment vehicle. Here's how he did it.

-

A Timeline of Warren Buffett's Life and Berkshire Hathaway

A Timeline of Warren Buffett's Life and Berkshire HathawayBuffett was the face of Berkshire Hathaway for 60 years. Here's a timeline of how he built the sprawling holding company and its outperforming equity portfolio.

-

Berkshire Buys the Dip on UnitedHealth Group Stock. Should You?

Berkshire Buys the Dip on UnitedHealth Group Stock. Should You?Buffett & Co. picked up UnitedHealth stock on the cheap, with the embattled blue chip one of the newest holdings in the Berkshire Hathaway equity portfolio.