Should You Take the Survivor Option on Your Pension?

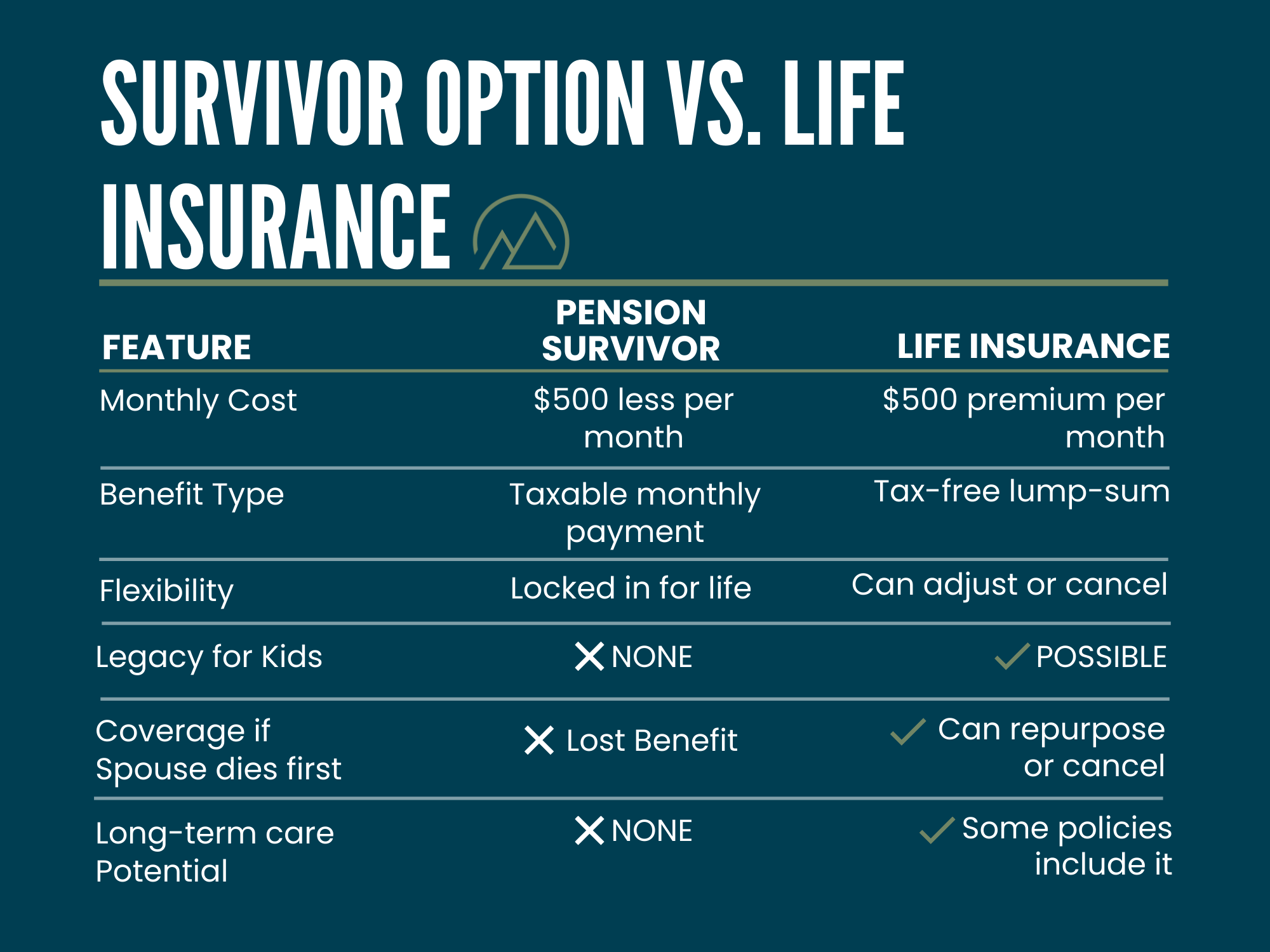

In some cases, you could buy life insurance instead and get a better deal in protecting your spouse. There are some things to keep in mind, though.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Often, one of a client’s biggest goals is making sure their spouse is protected if they pass away. Choosing the best distribution option for your pension when you retire is an important decision.

Many people think they should take the survivor option to make sure their spouse is left in the best financial position. However, if you get creative with your planning, you may be able to create a better outcome than just taking the survivor option.

Taking the survivor option means you have to pay for that benefit, which in turn means that you don’t get as much money from your pension while you are alive.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For example, we had a client whose pension paid $5,000 a month for their lifetime. If they selected the survivor option (which would pay the spouse 50% of their pension for life), they would give up 10% of their pension going forward.

This means $500 per month would be deducted from their benefit, and they would receive $4,500 per month. When they pass away, the spouse would receive $2,500 a month for the rest of their life.

It may not be obvious whether this is a good or bad option without digging into the numbers. I don’t know about you, but $500 a month seems very expensive. Just think what you could do with an extra $500 a month in retirement.

Since the No. 1 goal of many people reading this article is for their spouse to be taken care of, let’s see what other protection options there may be for that $500 a month.

Consider life insurance

Some clients we work with consider replacing this survivor option with life insurance. What type of life insurance could you get for $500 a month? Someone who is 60 years old, depending on health, could get a permanent life insurance policy with a death benefit of about $350,000.

This means that if you passed away, $350,000 would go to your spouse at any time as long as you continued to pay on the policy. Or you could get around $1 million of death benefit with a 20-year term life insurance policy. This would last for 20 years, then go away, which is why you get more benefit for what you pay.

Typically, we would look at utilizing a combination of both to ensure the spouse has enough to live on if something were to happen.

How much does your spouse need to live the retirement they want? That is a determination you would need to make for yourself, but I can tell you that typically the life insurance benefit could be nearly as much as, if not more than, the $2,500 a month benefit they could have gotten by taking the pension by finding the right combination of term/permanent life insurance coverage.

The life insurance benefit would also be tax-free, while the pension payment would be taxable each year — and it could be taxed at the single rate vs the married rate, which is less advantageous for your spouse. (This is known as the “widow’s penalty.”)

An additional benefit is that if your spouse passes away first, you could now leave this insurance money to your kids tax-free. Also, many life insurance policies have a long-term care option that allows you to accelerate the death benefit if you were to need that care.

If you purchase a permanent life insurance policy, many have a cash value buildup that you could access and then cancel the policy if your spouse passes away first — meaning that what you paid into the policy is not wasted.

Keep in mind that you must be insurable to take advantage of this option, and the cost will depend on how healthy you are. For those who are younger and healthier, this can be a viable option.

I would suggest working with a financial planner who specializes in comprehensive planning — including pension and life insurance planning — to help you run the numbers to see if this is a good option for you. If it is, they can help you find the best vehicle to fit your situation and goals.

Another concern to keep in mind

This type of planning can also be beneficial for those who may be concerned about the long-term viability of their pension. In recent years, pensions have shown signs of stress as people are living longer and there are fewer people paying into them. As a result, many pensions are underfunded.

Exploring options beyond your pension could mean more control for your retirement.

It could also be beneficial not to choose the pension survivor option if your spouse is older than you or is not expected to live as long as you. The bottom line: You don’t want to pay for something you may never benefit from.

If you decide not to take the pension survivor option, it’s very important that you have a plan in place to make sure your spouse is taken care of in the event that you pass away first.

If you’re not eligible for life insurance, or you don’t have enough investments to self-insure, then in some cases, I would counsel you to take the pension survivor option to ensure your spouse is covered, even if that means not maximizing your pension benefit. In this case, the risks outweigh the potential benefits.

Related Content

- If You Have a Pension, Smart Tax Planning Should Start Now

- Is Your Financial Adviser Doing a Good Job for You?

- Will You Pay Higher Taxes in Retirement?

- Five Estate Planning Things You Need to Do Now

- Do You Have at Least $1 Million in Tax-Deferred Investments?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Your 'Buy and Hold' Retirement Strategy Needs an Update Now

Your 'Buy and Hold' Retirement Strategy Needs an Update NowOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

Will Real Estate and Private Equity Start to Shine Again in 2026?

Will Real Estate and Private Equity Start to Shine Again in 2026?Real estate, private equity and general partner stakes could benefit from future interest rate cuts. What are the risks and rewards of investing in each?

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.

-

Fix Your Mix: How to Derisk Your Portfolio Before Retirement

Fix Your Mix: How to Derisk Your Portfolio Before RetirementIn the run-up to retirement, your asset allocation needs to match your risk tolerance without eliminating potential for growth. Here's how to find the right mix.