Rising Interest Rates Change the Math on Pensions for Some Would-Be Retirees

Now is a good time to think about when and if to take a lump sum on your pension and what to do with it. Let’s explore the pros and cons.

Higher interest rates are good for our cash and checking accounts but are not always good for pension holders. Rising interest rates have an inverse relationship to a pension’s lump-sum value. As interest rates increase, the value of a pension holder’s lump sum could decrease. Because of this, I am seeing more pension holders who want to take a lump sum do so now vs. waiting.

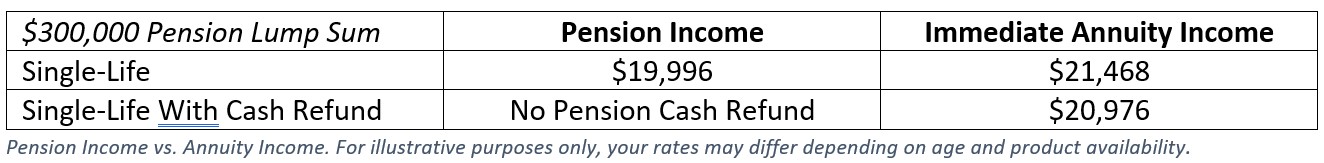

I am also seeing annuity rates improve with rising interest rates, pushing annuity income potentially higher than pension income (see chart below). There is much to consider if you are a current pension holder. Let’s review.

Pros and Cons of Taking a Lump Sum

If you have a pension, you may be eligible for a lump sum – not all pensions have a lump-sum option. The lump sum is a one-time payment in lieu of the traditional single life or joint life pension income. The lump sum can be transferred to an IRA tax-free. Once in the IRA, the lump sum can be invested in mutual funds, stocks, CDs, an annuity or most other investments (there are some limitations).

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here are four reasons pensioners move a lump sum to an IRA, including the drawbacks:

- More control. If you move a pension lump sum to an IRA, you control how the money is invested and when to take distributions (or not). In effect, an IRA gives you more control over the pension asset. Of course, you could deplete the account faster if you end up spending too much, or the account can lose money if you invest in the stock or bond market. Conversely, if you fail to invest the lump-sum IRA properly, i.e. stay in low-yielding cash or CDs, it may not grow as much as the pension.

- Money for the kids. A pension is first and foremost a retirement planning tool. The kids are important, but not the sole reason for how to make your decision. The nice thing about moving a lump sum to an IRA is the children can inherit the remaining account balance at death if they are primary or secondary beneficiaries. Not so if you elect for pension income, the income stops at the second death if you elected a joint option, there is no remaining asset for the kids to inherit Keep in mind, children of a deceased parent must deplete the IRA account by year 10, according to IRS rules. Also, IRA withdraws are income taxable, just like pension income (state tax laws vary).

- More potential growth. A pension is considered a conservative investment, usually earning low-single-digit returns. Low risk may suit your needs, but if you want more growth, you can move the lump sum to an IRA and invest accordingly. Of course, you can also lose money in the IRA, so you must know what you are doing if you choose to invest with an IRA.

- You never know with pensions. Pensions may be guaranteed by the Pension Benefit Guaranty Corporation, but up to certain amounts. While the guarantee is comforting, I am skeptical. The PBGC can change its rules and guarantees. Also, if you have a pension from a company that runs into trouble, is bought or sold or goes bankrupt, I do fear it may have to rework its pension offer.

Moving a pension to an IRA may not make sense if the pension payout ratio is higher than your withdraw rate. You should also calculate the rate of your return on your pension and evaluate the tradeoffs. A qualified professional can also help you decide what is right for your overall retirement.

A Compromise? Buying an Annuity With a Lump Sum

If you like the idea of guaranteed income for retirement, but don’t want to disinherit the kids, now is the time to compare the pension income with an annuity income. Since interest rates have increased this year, I have seen annuity payout rates increase, and more and more annuities are beating the pension income.

Additionally, unlike with a traditional pension income, the annuity balance can be left to the kids. Annuities come with many payout options, including a “cash refund” option that pays the balance of the account to the beneficiary. The chart below is a real-life example.

This client has a pension with a lump-sum option of $300,000 or a single-life income option that pays $19,996 a year. If the individual dies at the end of year 10, they collected $199,960 over their lifetime. The balance – $100,040 – is forfeited. Contrast this to moving the lump sum to an immediate annuity with a cash refund. Not only does the annuity pay more annual income, but if the client dies in year 10, the kids or other beneficiary can inherit the remaining account balance of $100,040.

The kids are not the primary reason to select a lump sum, but the annuity idea is like having your cake and eating it, too – retirement income for as long as you and your spouse live (if you select joint income), and the remaining account balance can pass to the kids.

There are various types of annuities to consider. An immediate income annuity pays income now. A deferred annuity pays later. Personally, I lean toward using a fixed deferred annuity, which is conservative, like most pensions. It’s best to talk to an experienced, independent adviser who can help you navigate the choices.

What to Watch for With Annuities

No investment is perfect. The annuity income is level for life, like a pension, and is usually not adjusted for inflation. There may be an option for inflation-adjusted income, but then the overall income is usually less, especially in the early years.

There is creditor risk, too. An annuity investor relies on the solvency of the issuing company. For this reason, stick to a highly rated carrier and consider diversifying carriers – sprinkling some of the pension lump sum into different companies.

Liquidity is another drawback; some annuities have early-surrender penalties if you take out more than the scheduled income stream.

Finally, make sure you understand the fees. Some fees are variable, while some may be fixed.

Final Thoughts

“When the facts change, I change my mind,” said John Maynard Keynes, the great economist. Rising interest rates are changing the math for pension holders. If interest rates continue to increase, lump sums may not be worth as much as they are today. Now is a great time to evaluate your choices.

Michael Aloi is a Certified Financial Planner with 22 years of experience. For more information or a complimentary review of your pension options, please feel free to send him an email at maloi@sfr1.com

Investment advisory and financial planning services are offered through Summit Financial LLC, a SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Summit is not responsible for hyperlinks and any external referenced information found in this article. 10282022-0778

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

The Five Social Security Blind Spots Retirees Often Miss

The Five Social Security Blind Spots Retirees Often MissUnderstand how benefits work before applying, so you don’t lose money for which you qualify.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs After Vietnam Trade Deal

Stock Market Today: S&P 500, Nasdaq Hit New Highs After Vietnam Trade DealAhead of a key July 9 tariff deadline, President Trump said the U.S. has reached a trade deal with Vietnam.

-

Social Security's First Beneficiary Lived to Be 100: Will You?

Social Security's First Beneficiary Lived to Be 100: Will You?Ida May Fuller, Social Security's first beneficiary, retired in 1939 and died in 1975. Today, we should all be planning for a retirement that's as long as Ida's.

-

An Investment Strategist Demystifies Direct Indexing: Is It for You?

An Investment Strategist Demystifies Direct Indexing: Is It for You?You've heard of mutual funds and ETFs, but direct indexing may be a new concept ... one that could offer greater flexibility and possible tax savings.

-

Q2 2025 Post-Mortem: Rebound, Risks and Generational Shifts

Q2 2025 Post-Mortem: Rebound, Risks and Generational ShiftsAs the third quarter gets underway, here are some takeaways from the market's second-quarter performance to consider as you make investment decisions.

-

Why Homeowners Should Beware of Tangled Titles

Why Homeowners Should Beware of Tangled TitlesIf you're planning to pass down property to your heirs, a 'tangled title' can complicate things. The good news is it can be avoided. Here's how.

-

A Cautionary Tale: Why Older Adults Should Think Twice About Being Landlords

A Cautionary Tale: Why Older Adults Should Think Twice About Being LandlordsBecoming a landlord late in life can be a risky venture because of potential health issues, cognitive challenges and susceptibility to financial exploitation.

-

Home Equity Evolution: A Fresh Approach to Funding Life's Biggest Needs

Home Equity Evolution: A Fresh Approach to Funding Life's Biggest NeedsHomeowners leverage their home equity through various strategies, such as HELOCs or reverse mortgages. A newer option: Shared equity models. How do those work, and what are the pros and cons?

-

Eight Tips From a Financial Caddie: How to Keep Your Retirement on the Fairway

Eight Tips From a Financial Caddie: How to Keep Your Retirement on the FairwayThink of your financial adviser as a golf caddie — giving you the advice you need to nail the retirement course, avoiding financial bunkers and bogeys.

-

Just Sold Your Business? Avoid These Five Hasty Moves

Just Sold Your Business? Avoid These Five Hasty MovesIf you've exited your business, financial advice is likely to be flooding in from all quarters. But wait until the dust settles before making any big moves.