Why Retirees Could Be Hit With a Higher RMD in 2025, and What to Do About It

A financial planner explains why it's important to know how to calculate your RMDs and what to do if they're higher this year than they were in 2024.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Because the market ended 2024 on a very positive note, many retirees' 2025 required minimum distribution (RMD) obligation could be higher than it was last year — which could increase their tax bill.

If large portions of your pre-tax 401(k) accounts and traditional IRAs were invested in stocks, chances are that the value of your retirement portfolio ended 2024 significantly higher than it was at the end of 2023. That's largely because the S&P 500 closed 2024 with a total gain (including reinvestment of dividends) of 23.3%.

While most retirees will be happy with these results, they may also be hit with a higher total RMD amount this year. Why? Because the RMDs they’ll pay in 2025 are calculated based on the value of their accounts on December 31, 2024, the last day of trading.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

RMDs are taxable income. However, since the IRS has raised the standard deduction amount and adjusted income tax brackets for inflation, the amount you owe in taxes may not be as much as you may think, even if your RMD is higher.

If a good portion of your retirement nest egg is invested in a Roth IRA or Roth 401(k) account, there’s more good news: Not only are distributions from these accounts totally tax-free, but you’ll never have to take annual RMDs.

The process for calculating RMDs

While the process of calculating RMDs may seem mysterious, the methodology is rather simple.

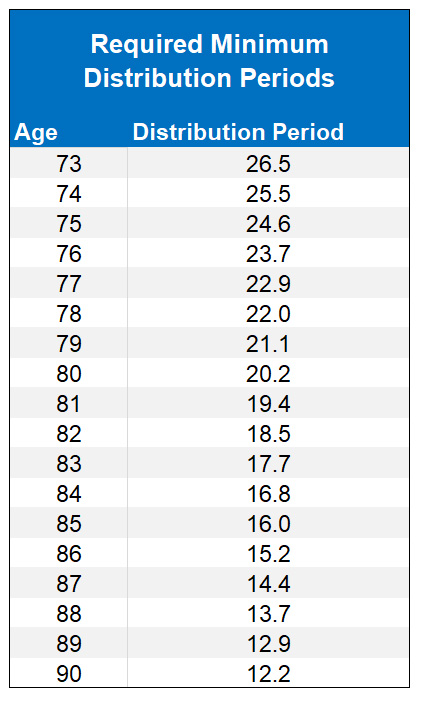

Your yearly RMD is calculated using a formula based on the IRS’ Uniform Lifetime Table. The table and its associated distribution periods are based on complicated actuarial calculations of projected life expectancies.

But basically, this table estimates the maximum number of years (also known as distribution periods) your retirement account may need to make RMDs to you and your surviving spouse (please see the note at the bottom of this article).

Your distribution period gets shorter every year, based on your age. For example, if you take your first RMD in 2025 at age 73, your distribution period is 26.5 years. When you turn 74, it will be 25.5 years. When you turn 90, it will be 12.2 years.

Will you or your surviving spouse need your retirement assets to last this long? Maybe, if longevity runs in your family.

In any case, the distribution period is designed to gradually increase the percentage of RMDs from your retirement accounts over time without prematurely draining your nest egg should you live to a ripe old age.

Calculating your own RMDs

So how do you calculate your RMD for a given year? By dividing the value of each retirement account at the end of the previous year by the distribution period based on what your age will be in the year you take the RMD.

Here are two hypothetical examples using the table above. Say your IRA was worth $500,000 at the end of 2024, and you were taking your first RMD at age 73 this year. Your distribution amount would be $18,868 ($500,000 divided by 26.5).

Likewise, if you were turning 85 in 2025, your RMD would be $31,250 ($500,000 divided by 16).

Making smart RMD decisions

Calculating RMDs is relatively simple. Where it can get complicated is figuring out which accounts you should take them from.

With 401(k) plan accounts, it’s pretty much a no-brainer. If you’re no longer actively participating in the plan (i.e., you’ve left the company or retired), most plan providers will calculate your annual RMD.

However, it's generally your responsibility to make these withdrawals from your accounts in a timely fashion.

With other accounts, you have more flexibility and thus more options to consider. For example, if you have several traditional or rollover IRAs, you first need to calculate the RMD for each individual account.

Many IRA custodians will do this for you. The challenge comes when you decide how much to withdraw from each account.

- You can take separate RMDs from each IRA

- You can take the total combined RMD from one IRA

- Or you can withdraw different amounts from several IRAs that, when combined, add up to the total RMD amount

Keep in mind that RMDs from 401(k) accounts don’t offset RMDs from IRAs or vice versa. You’ll need to take those as separate distributions.

Alternative RMD strategies

You may also want to consider other strategies for simplifying RMDs or reducing their taxable impact.

For example, you may be able to offset the taxable impact of RMDs from your IRA by donating some or all of the RMD amount as qualified charitable distributions (QCDs) to eligible nonprofit organizations.

QCDs can lower or eliminate your taxable RMD amount, up to an aggregated maximum amount per year withdrawn from one or more IRAs.

In 2025, this maximum is $108,000, and it will be adjusted for inflation every year. Keep in mind that QCDs are not eligible as charitable deductions.

Or, you might want to consolidate all of your various IRA and 401(k) accounts into a single rollover IRA with a custodian that calculates one aggregated RMD amount for you every year and automatically takes the distribution from the account on a date you specify.

All of these scenarios have retirement and tax planning consequences that aren’t always easy to figure out on your own.

Working with an accountant and a financial adviser can help you figure out which distribution strategies make sense.

Note that the IRS Uniform Lifetime Table and the various RMD calculations discussed in this article apply only to unmarried retirement account owners; retirement account owners whose spouse is not their sole beneficiary; or retirement account owners whose spouse is their sole beneficiary and is not more than 10 years younger than the account owner. Different calculations are required if your spouse is your sole beneficiary and is more than 10 years younger than you. Learn more at the IRS website.

Related Content

- Required Minimum Distributions (RMDs): Key Points to Know

- How to Optimize Your RMDs in Retirement

- Stressing About RMDs? Two Ways to Reduce or Even Eliminate Them

- Three Ways You Can Cut the Tax Stress of RMDs

- Here’s a Way to Save Social Security and Defer RMDs

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Chris Gullotti, CFP®, is a financial adviser and partner at Canby Financial Advisors in Framingham, Mass. He has an MS in Financial Planning from Bentley College. He brings a big picture view to each client's situation and works cooperatively with his clients' other financial professionals, including family attorneys, tax professionals and insurance advisers.

Advisory services offered through Canby Financial Advisors, an Investment Adviser registered with the U.S. Securities and Exchange Commission. SEC registration does not constitute an endorsement by the SEC nor a statement about any skill or ability.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.