The Odd Couple: Renting Out a Room in Retirement

Whether you're more Golden Girls or Felix Unger, renting out a room in retirement might make financial sense. You might even have fun.

Ellen B. Kennedy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you're of a certain age, the staccato piano lines that open the Odd Couple theme song call up fond memories of the 1970s TV show, in which neatnik Felix tries the patience of his sloppy housemate, Oscar. Sure, they drove each other nuts, but their friendship was endearing.

Have you ever wanted the same kind of shenanigans (and a nice side income) while sharing your home in retirement? Or is it a perfectly awful idea? It likely depends on your temperament, the tenant laws in your state and your home's layout.

If you've planned well for retirement, you may find that you're able to cover your expenses comfortably with a combination of savings and Social Security. But recent economic uncertainty may have some retirees questioning whether they're really as financially secure as they thought.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Although retirees commonly shift assets around ahead of retirement to protect against stock market volatility, it can be unsettling to see the value of your portfolio take a plunge. And if that has you worried, you may be willing to resort to creative ways to drum up cash, such as renting out a room.

Incidentally, it could be an option worth considering even if you're doing just fine financially and don't have any money-related worries

Renting out a room is easiest for boomers

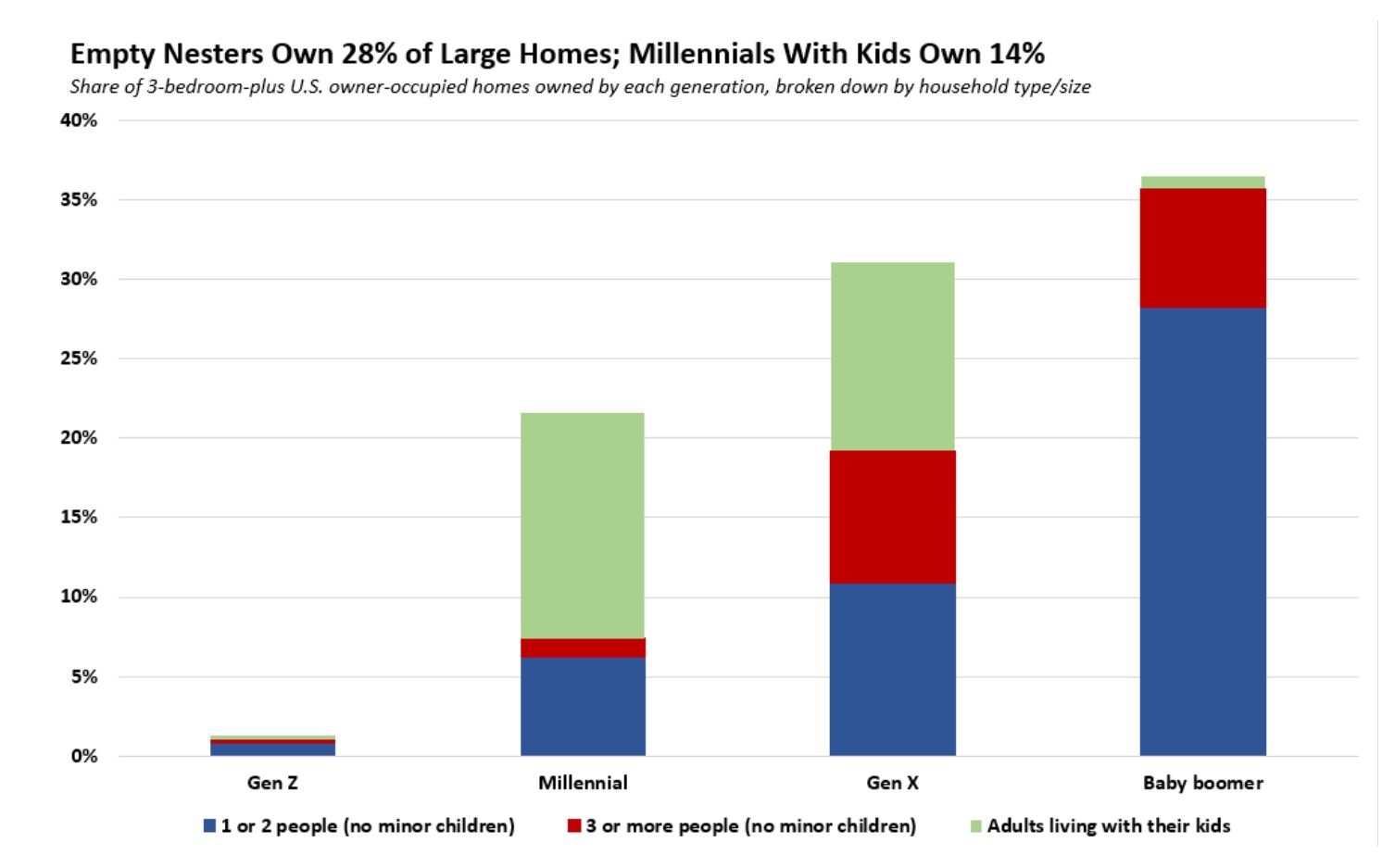

If you have not downsized to a smaller property, you may want to consider renting out a room in your home for extra income. A 2024 Redfin study found that empty nesters own 28% of three-bedroom-plus homes, and that most of the homeowners are boomers and Gen Xers. Most boomers have no mortgage, or they refinanced for a very low mortgage, so they lack the incentive to sell.

If you value your privacy, you may be able to retrofit your existing home into two units or install an accessory dwelling unit (ADU) as a small, backyard house to rent. Both of those options can be expensive, however.

Before you think seriously about becoming a landlord, consider the layout of your home. If you and your tenant can have rooms on different floors or wings of the house, you're likely to feel less bothered by them.

Here are additional considerations for renting out a room or section of your home.

The upside of renting out a room

The financial benefit of renting out a room in your home is obvious — you'll have an income stream you didn't have before. That buys you the flexibility to pad your savings, invest in repairs you may have been putting off, or simply have more spending money to get out of the house.

But there can be benefits to renting out a room beyond the extra money.

The company, even if you're opposites. A recent Transamerica survey found that 17% of retirees feel isolated and lonely. Having another person living under your roof could provide you with some companionship, which is better for your physical and mental health. Also, if you find the right renter, you might have a lot of fun.

Safety. You may also appreciate having another person living in your home from a safety perspective. Many older people worry about living alone as they’re nervous about getting injured and having no one around to help. Even though the tenant-landlord relationship may be primarily transactional, what decent person wouldn’t help out if their landlord took a spill and needed to get to the emergency room?

Help around the house. Additionally, while home maintenance is something you may have done easily when you were younger, as you age, you may find certain aspects of it challenging. You may be able to find a tenant who’s willing to do some of that handiwork in exchange for reduced rent.

The downside of renting out a room

The company! If you've been living on your own for quite some time, sharing your space with a tenant could be a huge adjustment. And depending on your needs, finding the right tenant could prove tricky.

Clashing lifestyles. It may be that you're someone who likes to go to sleep early and wants noise levels kept to a minimum. You may have a more limited tenant pool if you want a renter who will live by those rules.

Lack of privacy. There's also the potential for disruption to your daily routine. If you're used to hosting a book club meeting every Thursday night, that could be less comfortable with a tenant lurking.

Potiential pitfalls to think about

You may be excited at the prospect of renting out a room in your home. But there are a few pitfalls to consider.

Taxes. First, rental income is generally taxable income. That could have implications on your broad tax picture. Depending on your situation, it could also push you into the category of having to pay taxes on your Social Security benefits or pay IRMAA for Medicare by boosting your overall income. Still you may be able to work around these tax hits by relying on income from Roth accounts rather than traditional IRAs or 401(k)s.

State and local housing law. Also, not every state makes it easy to become a landlord. And if your state’s rules are complex, navigating them could be more than you’ve bargained for. You may want to reconsider renting out a room unless you happen to live in a landlord-friendly state. Check your county's rental regulations as well.

Bad tenants. You should also know that any time you take in a tenant, there’s the chance they may not be able to pay rent or may violate a term of the lease. You’ll need to think about whether you have the stomach to deal with matters like a potential eviction. One workaround for this issue is using a third-party app like Roomster or SpareRoom to help broker the legal and paperwork issues for you. These apps can also help vet potential tenants to ensure they have good credit.

If the idea of having a full-time tenant isn’t so appealing, but you like the idea of bringing in extra money, you could look into renting out your home while you’re not using it. This is an arrangement worth considering if you’re someone who spends a good chunk of time in another state, for example, snowbirding in Florida from January through March every year while your New York home sits vacant.

Ultimately, renting out a room in your home may be worthwhile. If you’re not sure how you feel about it, see if you can find a short-term tenant and do a trial run of sorts before committing to a year-long arrangement. If Oscar and Felix made it work, so could you.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Maurie Backman is a freelance contributor to Kiplinger. She has over a decade of experience writing about financial topics, including retirement, investing, Social Security, and real estate. She has written for USA Today, U.S. News & World Report, and Bankrate. She studied creative writing and finance at Binghamton University and merged the two disciplines to help empower consumers to make smart financial planning decisions.

- Ellen B. KennedyRetirement Editor, Kiplinger.com

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.