The Cost of Loneliness in Retirement

Accounting for the cost of loneliness is just as important as financial planning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While we often worry about saving enough to follow our retirement checklist, the cost of loneliness is rising as an equal threat to a happy, healthy retirement. But there are steps you can take now to build your social capital.

Loneliness and social isolation are a serious health epidemic, according to former U.S. Surgeon General Dr. Vivek Murthy. And older adults can be at increased risk due to their greater likelihood of living alone, losing friends or family, or dealing with illness.

The numbers are alarming; more than one-third of older adults experience feelings of loneliness at least once a week, according to the University of Michigan’s National Poll on Healthy Aging. It’s tempting to attribute this rise to recent events like social media or the pandemic, but the truth is that loneliness has been on an upward trajectory for the past two decades.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This trend underscores the importance of acknowledging and addressing loneliness as a critical component of our well-being, especially as we age. Thus, alongside our financial assets, nurturing and sustaining social connections should receive equal focus in retirement planning.

The deadly serious cost of loneliness

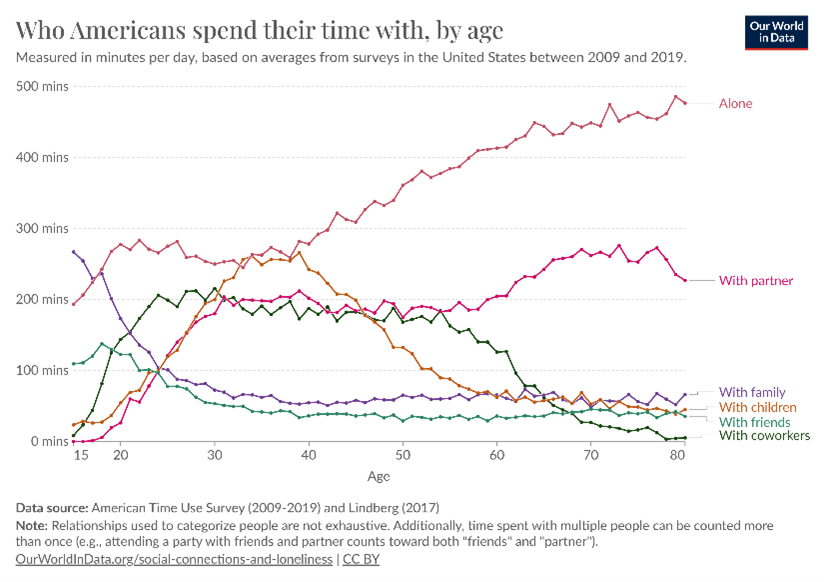

Research indicates that around age 40, we reach the peak in the diversity of our social connections. After that, there’s a significant shift toward spending more time alone, as reported by Our World in Data.

While being alone doesn’t always equate to loneliness, the overall picture shows our social networks are diminishing. In 2024, an astonishing 17% of Americans said they have zero friends, up from 1% in 1990, according to the Survey Center on American Life.

The impact of this social isolation is profound and can be life-threatening. Loneliness is linked to a slew of health issues, including heart disease, stroke, type 2 diabetes, depression, anxiety, addiction, dementia, and even premature death, according to the Centers for Disease Control and Prevention (CDC).

To put it in an even starker perspective, the health risk of social isolation has been equated to smoking 15 cigarettes a day.

Considering these findings, it’s clear that letting our social networks go up in smoke is a health risk we can’t afford.

The financial impact of loneliness

The potential financial consequences of loneliness add another layer of urgency.

Research, like a study from the Keck School of Medicine of USC published in Aging & Mental Health, reveals that Americans over 50 who feel lonely or dissatisfied with their personal relationships are more susceptible to financial scams. Isolation limits their opportunities to discuss financial issues with others, making them prime targets for scammers pretending to offer emotional support while exploiting them financially.

Moreover, as chronic illnesses worsen due to social isolation, medical expenses and stress levels spike, particularly impacting those without a support network during times of illness. A 2017 AARP study found that social isolation is associated with an estimated $6.7 billion in additional federal Medicare spending annually.

A 2021 study published in the International Journal of Public Health concluded that loneliness increases health care costs for types of medical care, regardless of age, income or lifestyle.

Essentially, a social support network is as vital to the quality of life in later years as any financial asset, highlighting the dual importance of nurturing both financial and social health.

Combatting loneliness

Now imagine a solution to loneliness that’s more effective than any pill, offering protection from its harmful effects and boosting your health and happiness. That solution is friendship.

Simply put, nurturing good relationships keeps us healthier and happier.

The CDC suggests combating loneliness by spending time with loved ones, joining clubs or groups, enjoying nature with others, expressing gratitude, and volunteering.

Author and Harvard lecturer Dr. Jeremy Nobel emphasizes the power of connection in various forms, whether it’s a chat in the grocery line or engaging in creative activities. Art and physical exercise, for instance, reduce stress and boost “feel-good” hormones that sustainably enhance your emotional well-being.

Ultimately, overcoming loneliness lies in proactive steps. Each day, do something that connects you with others or the wider world.

Using technology to stay connected in retirement

Many blame technology — particularly social media — for increasing isolation, but digital tools can help foster meaningful connections when used intentionally. Research suggests that technology-based interventions can improve social connectedness in older adults. Video calls, messaging apps and online communities allow retirees to stay in touch, seek support and maintain meaningful relationships, even across long distances.

While these tools are most effective for strengthening existing ties (think of reconnecting with school friends, for example), they can also help expand social networks. By thoughtfully embracing technology, retirees can turn it into a bridge rather than a barrier, ensuring that distance or life changes don’t lead to isolation.

If you are unfamiliar with social media, ask someone you trust for help. These apps are rife with scams targeting older adults and others may foment distrust or discord. So, use them with care.

Start early: the compound interest of friendship

The key to combating loneliness and reaping the benefits of social connections might just be to start early, much like the approach to saving and investing.

A 2024 Harvard and Making Caring Common report found that one in every three young adults (ages 18 to 25) feels lonely. And among that 34%, more than half reported lacking a sense of meaning or purpose. This highlights the prevalence of loneliness and the importance of addressing it from a young age.

The earlier you build connections intentionally, the more robust these bonds will become over time. Like a financial investment, the sooner you start, the greater the compound benefits you’ll enjoy later in life.

Take the legendary 56-year friendship between Charlie Munger and Warren Buffett as an example. No wonder Buffett once advised, “The friends you have will form you as you go through life. Make some good friends, keep them for the rest of your life.”

So, the next time you’re out with friends, remember: picking up the tab isn’t a cost, it’s an investment in your well-being and future happiness.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.