Everyone Is Talking about Roth IRA Conversions – Here’s Why

Two reasons to consider a Roth conversion now, plus some traps to avoid.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As investors emerge from a tumultuous market in the first quarter of 2022, the current volatility may pose an opportunity for IRA account holders. Those who hold IRAs (and 401(k) accounts that allow for Roth conversion) may be considering whether it’s advantageous to convert a portion of their pre-tax IRAs to a Roth.

Here I provide two reasons why current market conditions are favorable for Roth conversion planning:

1. Current Market Conditions

Converting a pre-tax traditional IRA to a Roth IRA will result in taxable income based upon the fair market value of the assets in the IRA at the time of conversion. However, once the account is converted to a Roth IRA, current law allows any future growth to be withdrawn income tax-free, so long as the account owner is at least 59½ years old and has had at least one Roth IRA opened for five years on the date of withdrawal. Thus, it may be advantageous to utilize a Roth conversion at a time when markets are down and the tax liability will be based off a lower valuation.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For example, if an individual in the 24% federal tax bracket converts a $100,000 traditional IRA to a Roth IRA, her taxable income for the year will increase by $100,000. Assuming she remains in the 24% bracket with this additional $100,000 of income, she would owe roughly $24,000 in federal taxes at the time of conversion. If a market correction reduces her account balance by 20% and she converts the account at an $80,000 value, her federal income tax from the conversion would fall to $19,200, yielding a $4,800 tax savings. Once the funds are held inside a Roth IRA, any future market rebound and appreciation will be free of tax.

2. Possibility of Tax Increase

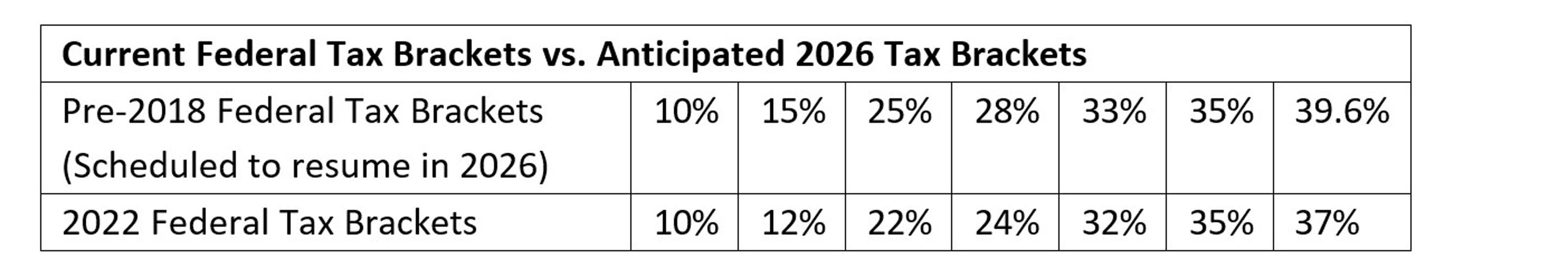

Absent congressional action, reduced tax brackets initiated by the Tax Cuts and Jobs Act (TCJA) in 2018 will sunset on Jan. 1, 2026. The chart below illustrates the reduced tax rates brought on by the TCJA.

Unless Congress changes the 2022 tax brackets through tax reform, converting a traditional IRA to a Roth in 2022 could result in a lower marginal federal tax rate than would be applied in 2026 or later. Given that traditional IRAs are subject to required minimum distributions, it may be advantageous to consider converting a portion of the IRA to a Roth while tax rates are reduced.

Other Considerations

The decision to convert all or a portion of your pre-tax IRA accounts depends upon an individual’s own facts and circumstances. Taxpayers are advised to speak with their tax and financial advisers prior to undertaking a Roth conversion. Some of the additional considerations include:

- State and local taxes: Roth conversions will increase taxable income in the year of conversion, which will also increase state and local taxes. Taxpayers should consider their retirement goals before executing a Roth conversion. If an individual currently lives in a high-tax state but plans to retire in a state without income taxes, there is a disincentive to convert to a Roth now. Furthermore, state and local taxes paid are currently deductible only up to $10,000 for federal tax purposes. Absent congressional action, state and local taxes paid will be fully deductible in 2026 (subject to the Alternative Minimum Tax).

- Current vs. Retirement Tax Brackets: For individuals still in their earning years, consideration should be given to their projected income tax bracket in retirement. For example, a taxpayer presently in the top tax bracket may be in a lower tax bracket during retirement, even with the scheduled increase in tax brackets. That could mean waiting to make a conversion may make sense.

- Legislative Risk: While Roth IRAs are presently income tax-free upon distribution and are not subject to required minimum distributions, there have been some legislative efforts to limit Roth IRAs. For example, there is a risk that Congress may change the laws in the future, so that taxpayers in higher tax brackets must pay tax on Roth earnings or required minimum distributions must be taken from Roth IRAs.

- Cash-Flow Planning to Pay Tax Liability: Ideally, the taxes triggered by a Roth conversion should be paid out of other after-tax accounts, allowing the entire IRA being converted to continue to grow income tax-free. Individuals looking to convert their traditional IRA to a Roth IRA should understand the tax implications of a conversion and how much additional tax liability will be generated.

- Avoid Required Minimum Distributions: Under current law, holders of traditional IRAs are required to take annual distributions from their IRAs beginning the year after they turn 72. Unlike traditional IRAs, a Roth IRA currently does not have required minimum distributions. Converting an IRA to a Roth would allow the account holder to continue growing their retirement account without any need to take required minimum distributions.

Final Thoughts

There are many reasons to consider a Roth IRA conversion. However, one should consult with a qualified financial adviser equipped to understand the individual’s entire financial picture to determine whether this strategy may be appropriate.

For more information on Roth conversions please email me at maloi@sfr1.com.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.