Estate Planning for Women: Married, Single or Divorced

Yes, estate planning for women is different than for men. And it's crucial for women's financial and physical health.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Estate planning for women is crucial for a safe retirement and to protect their property and health in case they are incapacitated. Women face unique circumstances: They tend to live longer, typically make less money than men and are more likely to leave the workforce to care for loved ones. That means they need to ensure that their estate plans meet their financial and medical needs and that they can leave something for their loved ones if they so choose.

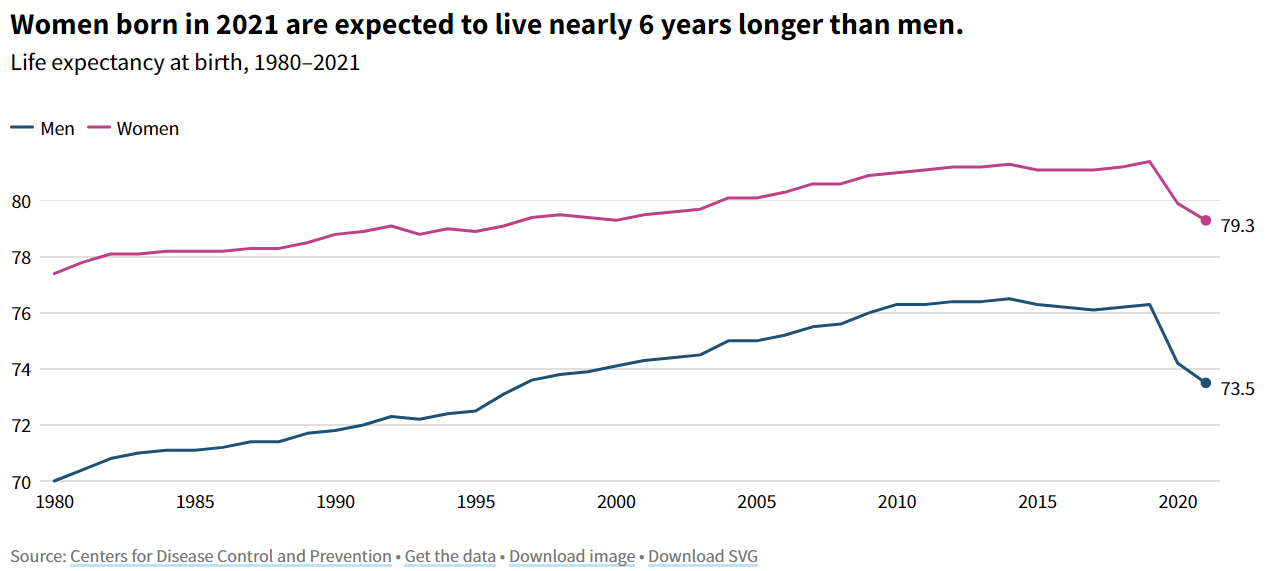

Women live, on average, six more years than men. In the U.S., the life expectancy at birth is 77.5 years for both sexes; for males, it is 74.8 years and for females, it is 80.2 years, according to the CDC.

American women have many demands on their time and devote more of it to their loved ones in caregiving. Women are more likely to provide unpaid elder care to loved ones and more childcare at home, even when they out-earn their spouses. A Pew Research study revealed that "the only marriage type where husbands devote more time to caregiving than their wives is one in which the wife is the sole breadwinner." Sadly, when women become caregivers, they are 2.5 times more likely to end up in poverty and five times more likely to depend on Social Security.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While women need more resources because of their longer average life spans, they have less time to work and accumulate assets. This also holds true for some government benefits; women's average social security check by age is lower than that of their male peers — running $464 less per month starting at age 67. Planning earlier can help women understand how much money they should strive to save and how to achieve it.

Estate planning for women — now more than ever

A generational shift is coming: $30 trillion is expected to pass into the hands of women over the next decade from their spouses or parents due to women outliving men or from divorces, according to Leila Francis, national head of fiduciary advisory services at BMO Wealth Management. Also, more women are becoming business owners than ever before, said Francis, which means they may have substantial assets to pass down.

These factors mean that women of all ages will eventually need to shoulder great financial responsibility. So, they must organize their affairs to fund their longer lives, set up a way to pay for long-term care, and direct the distribution of their assets in a way that they desire — whether they are married, widowed, divorced, single or in blended families where there are kids from prior marriages.

“We have a set of unique factors that we need to plan for,” said Lorna Kapusta, head of women and engagement at Fidelity Investments. “Because of that, it becomes even more important for us to have that financial plan, retirement plan, estate plan — and get that in order.”

Kapusta said women make about 80 cents for every dollar their male counterparts earn, and the figures are even lower for minority women. Moreover, two-thirds of caregivers are women — and many assume that role more than once in their lives, she added. Women also outlive men on average by six years. So not only do women face 18% to 20% higher health care costs, Kapusta said, but a common scenario is the husband gets ill and his medical expenses eat into their savings, leaving her with less money.

The good news is that women are more empowered than ever before to take charge of their finances and retirement, said Liz Windisch, a financial planner with Aspen Wealth Management in Denver, Colo., who serves mostly single women clients. “Women want to learn and understand their investments more than they have in the past.” They are more engaged and proactive, especially if they are the main decision-makers, she said.

That means women are not “sitting there quietly” anymore as their spouses make retirement and estate planning decisions, said Daphne Jordan, senior wealth advisor at Pioneer Wealth Management in Austin, Tex., who is also chair of the National Association of Personal Financial Advisors (NAPFA), a group whose members charge fees instead of earning product commissions.

Don't put it off

Many people tend to delay estate planning until they are within striking distance of retirement. But that is a mistake because anything can happen at any age, said Catherine Arnet-Valega, wealth consultant at Green Bee Advisory in Winchester, Mass., which serves just female clients.

“What happens if you’re out hiking in Colorado and break your neck or fall into a coma for six months? Who’s going to pay the mortgage? Who’s going to keep the utilities on? … (Or make) the medical decisions?” Arnet-Valega said. “And should you pre-decease (your heirs), what do you want to happen to those funds? An estate plan ensures that your decisions are respected.”

Passing away without an estate plan will put a court in charge of distributing your assets and paying your debts and taxes. This is a process known as probate, and it can be lengthy and costly. Some might argue and say, “I’m a teacher. I’m only making $65,000 a year” and don’t need a plan, said Matthew Harrison, founding member of Harrison Law in Gilbert, Arizona. But you could still trigger probate if your assets include a home, he added.

How to get started

Harrison said these are the basic legal documents everyone needs in an estate plan, which can be customized to meet women’s unique situations:

- General power of attorney: grants broad authority to someone you designate to make financial and legal decisions on your behalf. A sound power of attorney helps protect your interests when you cannot do so.

- Medical power of attorney: grants someone the power to make medical decisions for you if you are ill, injured or incapacitated.

- Living will: sometimes called an advance directive, outlines your wishes, typically for end-of-life care and other medical preferences. Unlike a medical power of attorney, in which your designated person can make decisions on your behalf, a living will only carry out your predetermined wishes.

- Will or last will and testament: a will specifies how a person’s assets and property should be distributed after death. But don't go overboard; there are a few things you should leave out of your will.

- Trust: a legal entity that can house your assets, including bank and investment accounts, real estate, business interests, personal property, insurance policies and others. It is overseen by a trustee you designate to manage the assets according to your wishes for your beneficiaries. It can be a revocable or irrevocable trust.

To the list, Jordan adds the HIPAA Authorization or Release Form, which gives your doctors and other health care providers permission to disclose your health information to others.

Expect to pay several thousand to execute an estate plan, but consider that hiring attorneys for probate typically costs a lot more, Harrison said. However, there are ways to save on estate planning costs, and whether it’s better to choose an attorney who charges a flat fee or by the hour.

Strategies for different life stages

With women living longer, it is even more critical for them to be part of the conversation in developing an estate plan, said Lauren Wybar, a senior wealth advisor at Vanguard. Don’t be afraid to educate yourself about money, such as by reading or listening to podcasts, she said.

Consider joining financial clubs for women. Fidelity has its “Women Talk Money” community that offers education, events and tools to level up women’s financial skills. It has more than 600,000 members. The goal is to make financial topics approachable. “The financial industry has made finances and investing more complex than it needs to be,” Kapusta said.

Source: https://preview.thenewsmarket.com/Previews/FINP/DocumentAssets/651505.pdf

BMO has its “Women & Wealth” program that caters to female clients, said Francis. She also recommends building a team of financial and legal experts you feel comfortable with, including a financial adviser, an attorney, an accountant and a banker. “Find people you click with,” she said. “If you like them, you won’t feel embarrassed asking questions.”

According to financial advisers, here are specific questions to ask as you plan your estate based on whether you are married, widowed or divorced/single.

For married women

- Are you and your spouse aligned on your wishes?

- Are you the power of attorney for your spouse?

- Do you know what the estate plan entails?

- Do you agree on who is the designated executor? Beneficiaries?

- Who should be the guardian of your kids?

- If you have a business, who will take care of it after you pass?

For widows

- Is your deceased spouse still the executor?

- Do you like the backup executor?

- Do you still agree with the estate plan and who gets what?

- Did you update your beneficiaries?

For single or divorced women

- Is your ex-spouse still listed as your beneficiary? If your spouse has remarried, your assets could potentially flow over to his new wife and their kids unless you update your plan.

- If you don’t have children, have you designated your beneficiaries such as a charity?

Make a plan

Start getting your affairs in order with proper estate planning, or update your current plan if your life circumstances have changed. Make sure it goes hand in hand with a sound financial plan that puts you on track to retire well. Afterwards, sit back and relax. “Make a plan, trust the plan, and stick to it,” Windisch said.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Deborah Yao is an award-winning journalist, editor, and personal finance columnist who has held editorial roles at Kiplinger, The Wharton School, Amazon, The Associated Press, S&P Global (SNL Kagan) and MarketWatch. She specializes in writing and editing articles on finance and technology, with particular expertise in the areas of stock analysis, monetary policy, fintech, blockchain, macroeconomics, financial planning, taxes, among others. She has been published in The New York Times, USA Today, CBS News, ABC News, Wharton Magazine, and many other news outlets.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.