Does Gold Belong in Your Retirement Plan?

There’s something sexy about a shiny gold bar, but should you go for the glitter? If you're tempted, a four-pronged investing approach could be best.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Gold has been in the headlines lately. Maybe you’ve noticed. I’m specifically talking about the shiny metal being sold by warehouse giant Costco. The bars are selling out within hours, if you can get them at all.

With so much enthusiasm around gold, it begs the question: Should gold be a part of your retirement plan?

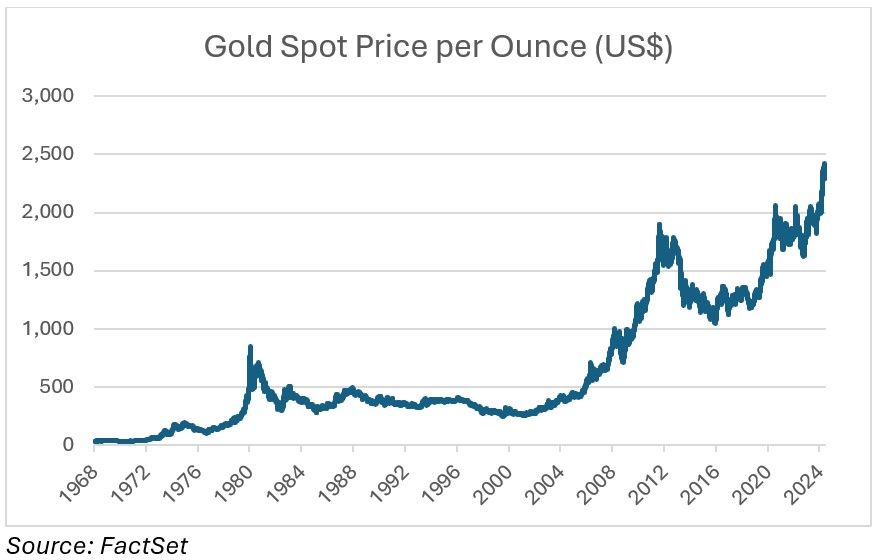

Gold prices over the decades

It’s important to recognize how gold behaves. If you pull up a price chart that spans several decades, you’ll notice something. Gold has relatively short periods where it rockets up and then longer periods where it does nothing (or worse).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If you’re an expert market timer, then you can obviously profit from buying during the uptrends and avoiding those long periods of underperformance. Unfortunately, during my time in this business, I’ve noticed something. There are very few investors who have even a remote shot at successfully timing the market. For most of us then, it’s the long term that we should concern ourselves with.

So how does gold do over the long term?

Here is one way to think about gold prices. Two hundred years ago, an ounce of gold could have afforded you one quality men’s suit. Today, that same ounce of gold will also buy you a high-quality men’s suit. In other words, it does a fantastic job of preserving purchasing power over the long term.

Physical gold has its plusses and minuses. There’s nothing quite like holding a bar of gold in your hand. And if we’re ever in some sort of doomsday scenario — the grid has collapsed, paper currency is worthless and so on, you’ll likely want your gold close at hand. Of course, hoarding coins and bars can make you a target for thieves. And since the IRS classifies physical gold as a collectible, you may be taxed at a steeper tax rate (currently as high as 28% on long-term gains) if you ever need to sell your gold.

Investing in gold without buying bars

Fortunately, there is more than one way to invest in gold. At SAM, we take a four-pronged approach. Part of that is owning physical gold, but there are three other categories that can benefit when the price of gold appreciates:

Major miners. Stocks of the largest companies that explore and produce gold, like Newmont Corp. (NEM) and Barrick Gold Corp. (GOLD), can be attractive at the right prices. They have operational leverage, meaning that while the price of gold rises, their costs stay the same, which can result in windfall profits when gold is a hot investment.

Emerging producers. This is the high-risk, high-reward part of the gold universe. Some of these companies don’t even produce gold. Rather, they are valued on their “pounds in the ground.” The lack of an operating history means these stocks carry greater uncertainty, but they can trade at a fraction of the value of their proven gold reserves.

Royalty companies. These are like banks for the mining industry. They provide capital to miners in exchange for a percentage of their production. Royalty companies have few employees and low overhead costs. When they’re not hunting for deals, they pretty much sit back and collect money. This superior business model has resulted in high profit margins and outstanding returns over time.

Is gold for you?

Whether you should own gold, how you should own it, and how much you should own ultimately depends on you and your financial goals. If capital preservation over the long term is a top priority for you, that argues for a larger allocation. But if you are growth- or income-driven, perhaps a small bit of exposure makes more sense for you. This sort of planning can be done on your own or with the assistance of a financial adviser.

Just know that if Costco is yet again out of stock or limits how many gold bars you can buy, you have many other options.

Related Content

- Disgusted With Your Savings Interest Rate? Time to Switch

- How to Find the Best Gold Stocks

- Why You Shouldn’t Ignore Investing in Commodities

- The Best Gold ETFs With Low Costs

- Why I Still Won't Buy Gold: Glassman

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.