Do Alternative Investments Belong in Your Retirement Plan?

There’s a lot of promotion of ’alternative investments’ these days, from gold to real estate and even to Bitcoin. Are you missing out?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you do any research on your own about how to create a solid retirement, you’ve read about alternative investments, financial managers who boast great performance and the tech stock your friends cashed in on.

You’re also seeing that your kids could use your help with the down payment on a house or condo with more space.

Can you afford to make that riskier investment or help your kids — without jeopardizing your own retirement plans?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Your plan for retirement income

Before you make a decision about whether alternative investments would work, you need to understand whether you have a retirement plan set up with the foundational building blocks:

- Investment portfolios that are traded, have a daily market value, have low fees and must pay out distributions under proscribed regulations

- Income annuities that are issued by highly rated insurance companies that either pay out guaranteed lifetime income or can be exchanged to contracts that do

- Equity in the value of your house that can be extracted without risk to the homeowner

As we’ve reported in previous Kiplinger.com articles, we take a pretty conservative approach to constructing your plan for retirement income. For example, in How to Get More Retirement Income From Your 401(k), I wrote about making conservative assumptions about long-term market performance and creating “an integrated approach with both investments and annuities that provides more income and protection against inflation and late-in-life expenses.”

Now, about the “outside the plan” investments.

What are alternative investments?

I asked ChatGPT about the investments that might be considered “alternative.” Here’s AI’s list:

- Investment real estate

- Private equity and hedge funds

- Commodities

- Gold, other precious metals and collectibles

- Peer-to-peer lending

- Farmland and timberland

- Green energy and sustainable investments

By the way, cryptocurrency was not on the list. If AI didn’t include it, that’s good enough for me.

Well-read DIY investors understand the upside and downside of most of these, but let’s go over some of AI’s thinking:

Pros for alternative investments:

- Diversification. Alternatives can provide diversification benefits because they often have low correlations with traditional asset classes like stocks and bonds. This can help spread risk and reduce the impact of market volatility.

- Potentially higher returns. Some alternative investments, such as private equity and hedge funds, have the potential to deliver higher returns than traditional investments over the long term.

- Portfolio customization and risk management. Alternatives allow investors to tailor their portfolios to specific goals or preferences, whether it's ethical investing, impact investing or a focus on a particular sector. And certain alternatives, like real estate and commodities, can act as hedges against inflation and provide stability during economic downturns

Cons for alternative investments:

- Lack of liquidity. Some alternative investments, such as private equity or certain real estate investments, are illiquid, making it difficult to access your funds on short notice.

- Higher risk. Alternative investments can be riskier than traditional assets. Strategies like leveraged investments or investments in startups can result in significant losses.

- Tax and regulatory complexity. Regulations and tax treatment for alternative investments can be complicated and vary by jurisdiction, potentially leading to unexpected tax liabilities or compliance challenges.

Intrafamily loans or advances

While ChatGPT did a good job of identifying and critiquing alternative investments, many of us are exposed to other, more personal investments that also limit our choices and opportunities for due diligence. That may happen when the kids ask about providing the down payment on their first or even second house.

The intrafamily loans offer an interest rate, but you cross your fingers that you’ll get paid back. Or the kids, again, have some property where they could build or renovate and generate some rental income. Finally, with college costs continuing to soar, you may need to fund that 529 plan at an even higher rate.

You’d like to be available, but also get a decent return, and your money back.

More aggressive stock and bond investments

Another approach may come from a neighbor or broker who brags about the great return on some investment they got, typically by taking more investment risk. Here are two examples:

Small cap stocks. These investments in smaller, often early-stage companies, are volatile because the firms have fewer resources if they get into financial trouble and are more likely to fail. But when one succeeds, its stock can flourish. Fidelity reports that now might be a good time to invest because, “Small caps were recently trading at substantial and attractive discounts relative to large-company stocks, and could be due for a stretch of outperformance.” At the same time, NerdWallet points out that “as small-cap businesses expand, their stocks offer a higher growth potential compared with larger companies. But that comes with a greater risk of volatility — including more (and bigger) fluctuations in stock prices and earnings reports.”

High-yield bonds. It’s easy to find companies offering “to help investors navigate today’s income problem,” with high-yield bond funds, some of which offer annual returns of 9% to 12%. You can also easily find this description from Morningstar, which discusses risk: “High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB (considered speculative for taxable bonds) and below.”

Should retirees consider? If so, in what circumstances?

As I said above, I think you should consider higher-risk investments only when your plan for retirement income is safe. Here are my criteria for a safe plan:

- You need an income stream that will cover your expenses now and in the future. Money that will be deposited in your bank account every month without question. And, of course, income that is paid for life.

- Keep an eye on inflation. Happily, Social Security is indexed for inflation, but most other financial products are not. If you have a solid retirement plan, however — one featuring a portfolio of income annuities and a reasonable amount of stocks/bonds that deliver dividends and interest, along with the potential for growth — you can protect yourself against reasonable long-term rates of inflation.

- Most retirees hope to leave a legacy to family or favored charities, which can be built into your plan. That’s an area where personal objectives vary, but whatever your plan, it should be designed to meet that objective.

- Liquidity is money that you may need in case of unplanned expenses. It can be used to pay for unreimbursed long-term care or health care costs that you can pretty much count on experiencing at some point.

How to free up funds for alternative investments

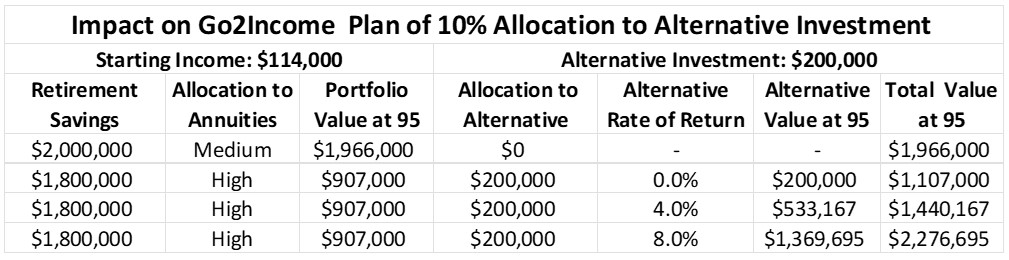

If you have all that under control, yes, you may consider the “outside the plan” investments. Here are examples of freeing up 10%, or $200,000, in our sample investor’s plan, for these investments — while still keeping the plan safe. The Go2Income tool does that in this case in two ways: by increasing the allocation to annuities and by making additional IRA withdrawals. It’s doable, but it’s a highly personal call, impacting the portfolio value late in retirement for both legacy and liquidity.

Note how the return on the alternative investment determines whether it was a profitable decision.

Take your time to make this decision

Investing in alternative investments requires lots of research as well as the nerves to do something most other retirees aren’t considering. You probably also need time to save up the money that you can invest without worrying about losses. But the sector does offer unique opportunities that may pay off when everything else is crashing.

To find out whether you can build a plan that allows you to experiment with alternative investments, visit Go2Income and answer a few questions. You may not end up making unusual investments, but you will have a plan that can guide you in retirement.

related content

- How to Get into Alternative Investing

- Don’t Bet Your Retirement on Stocks: Follow These Four Tips

- Do You Have Enough Income to Retire? That Is the Question

- Remember: Retirement Accounts Are Not All Taxed the Same

- Can AI Plan Your Retirement Better Than I Can?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.