High Electric Bills? Here's How You Can Save

High electric bills this summer can be blamed on sweltering temperatures and rising demand. Here's what you can do to save.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most Americans should expect to pay more for their electric bills and other utilities this summer. June's heat wave has plunged over 100 million Americans into extreme heat, according to the National Integrated Heat Health Information System (NIHHIS). From April 2021 to April 2024, electric prices have increased by 24%, and you’ve no doubt been feeling the strain on your wallet. Here's a look at what's causing this rise in energy prices and what you can do to save money.

Where are electric bills rising the most?

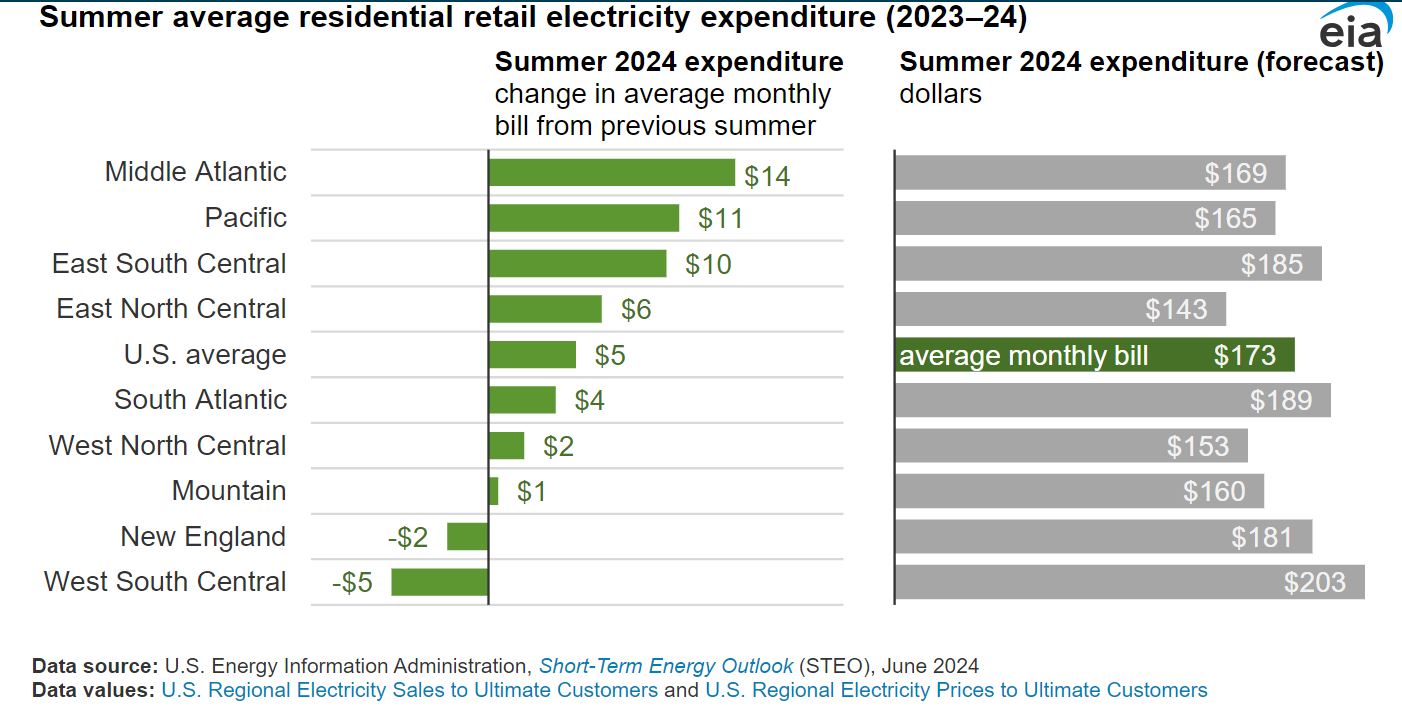

The Mid-Atlantic, Pacific and Eastern South will see the greatest monthly increases in electric bills, according to a recent report from the U.S. Energy Information Administration (EIA). Although New England and West South Central states will see declines in their monthly electric bills, they will still pay over the national average.

Why are energy prices rising?

Increased costs are due to several factors, including increased demand, especially among energy-intensive data centers. Electricity consumption is expected to grow 4.7% in the next five years, up from the 2022 forecast of 2.6%. “Data centers whose chips run artificial intelligence are especially energy-intensive, and more are coming,” Jim Patterson writes in the Kiplinger Letter. “Data centers in general account for 4.6% of demand. By 2026, that figure stands to rise to 6%."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

He also shares that increased construction of high-tech manufacturing facilities, appliances switching from natural gas to electricity and more electric vehicles are also driving up electricity consumption. But along with this increased demand comes supply constraints. And this all results in higher rates on electric bills.

“How much higher depends on a lot of factors, such as your region, the price of natural gas (the leading fuel source for generation) and how quickly government officials try to ramp up renewable power,” Patterson writes.

2024 one of the hottest summers ever

This summer's heat waves will surely cause you to crank up your air conditioning and, in turn, your power bill. The more energy you use to combat those roasting temperatures, the more money you’ll inevitably spend.

From June through August, temperatures are expected to reach 2 degrees above historical averages across more than half of the country, Accuweather notes. Experts believe that there’s a good chance this summer could be one of the hottest on record in the U.S., especially from the Rockies to the East Coast.

“We expect electricity consumption will grow in all major consuming sectors this year, but especially in the residential sector, which we expect will increase by 4%” reports the U.S. Energy Information Administration in the March edition of its Short Term Energy Outlook. “Much of the forecast year-over-year growth in residential electricity occurs during the summer months of 2024.”

How to cut your electric bill summer 2024

While you can't directly control how much your electricity costs, you can control how much you use. One of the best ways to save on energy bills, and also one of the easiest, is to keep your thermostat at the right temperature. According to the U.S. Department of Energy (DOE), the smaller the difference between indoor and outdoor temperatures, the lower your overall cooling bill will be.

They recommend keeping your thermostat set to 78 degrees in the summer months while you're at home, and even higher while you're away. You can easily control the temperature in your home by opting for a smart thermostat. "Programmable thermostats will avoid any discomfort by returning temperatures to normal before you wake or return home," states the DOE.

This is also a great time to invest in more efficient heating and cooling systems, like a heat pump. There's solid evidence that a heat pump will help most people save money over standard air conditioning. While there are pretty steep upfront costs for installing a heat pump, your state could soon be launching an energy rebate program to help you save on those costs.

Wisconsin just became the first state to launch the Home Efficiency Rebate (HOMES) program, which could cover 100% of the costs (up to $5,000) to purchase and install a heat pump or other energy-efficient home improvement, depending on household income.

There are a few other ways to stay cool this summer. Check out our 12 tips to stay cool without air conditioning, which include maximizing shade in your home, prioritizing good insulation and properly using fans to beat the heat. Did you know your fan should rotate in a different direction depending on the season? Particularly, counterclockwise in the summer months? By reading the article, you'll find more information on how to save money — and not sweat to death in those record-setting temperatures.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)Five lessons to learn from the 2026 Winter Olympics for your career and finances.