Heat Pumps Can Help You Save on Home Cooling and Heating — and There's a Tax Credit for Installation

Heat pumps can save you serious cash with tax credits and energy efficiency, but they aren't for everyone.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Heat pumps can keep your home cozy in the winter and — despite their name — cool your home efficiently in the summer. You can save up to $2,000 with federal tax credits by installing a heat pump, and some states and utilities provide additional incentives. But should you install a heat pump or make do with your current HVAC system?

I talked to homeowners in cold climates like Maine to see if they effectively heat in the deep cold. And I was surprised to learn that some historic homes can stack heat pump incentives for a tidy tax credit or rebate.

Whether a heat pump makes sense for your home depends on several factors: the condition of your home, how old your existing HVAC system is and how it is powered or fueled, where you live and your preferences. Read on for a comprehensive guide to this technology.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How do heat pumps work?

Ask a technician how a heat pump works, and you may get an answer that sounds almost magical. In layman's terms, heat pumps absorb heat from the air and move it from inside your house to the outside (when you want to cool your home) or from outside to inside (when it is heating your home). Even when the air outside is frigid, a heat pump will "find" the warm air and bring it inside your house.

Heat pumps can replace or complement your furnace and your air conditioning systems. Most models are extremely energy-efficient and are thus better for the environment. In fact, heat pumps are three to five times more efficient than natural gas boilers, according to the International Energy Agency. Yet most U.S. home heating systems still run on fossil fuels like natural gas, heating oil or propane. Old-school space heaters rely on electricity but are inefficient and expensive to operate. About 2% of homes use wood pellets or logs for heat.

The most common type of heat pump is "air-source" and can be "ductless" or a "mini-split" system. If your home has vents for forced air heating and/or cooling, you may replace both the furnace and the AC unit with an outdoor heat pump. If you don't have ducts or, like me, you added an addition to your home and want to save on the cost of extending an existing duct system, you can install a mini-split on the wall. Contractors usually site mini-splits near the ceiling so that you can adjust the vents to blow overhead, and they connect to an outdoor compressor. Most mini-splits come with a remote control wand to help you select heating and cooling. Some also have a "dry" setting to dehumidify.

There are other types of heat pumps not covered here. Heat pump water heaters use similar technology for heating water. Geothermal heat pump systems take advantage of the near-constant temperature of the earth for heat exchange rather than air.

How much does a heat pump cost?

The cost of buying and installing a heat pump depends on the system's size and efficiency, your location and other variables. Ductless mini-splits are the cheapest, averaging $4,000 to $5,000. For a ducted system, the average cost is about $5,600 but can exceed $10,000. Ask your contractor whether your area requires permits and how much they will cost.

Will a heat pump save me money?

The short answer? It depends, but with the generous federal and other incentives outlined below, it's worth your time to crunch the numbers.

Like electric vehicles, heat pumps tend to have steep up-front costs but may save money over many years by virtue of greater efficiency. A recent National Renewable Energy Lab (NREL) study found that heat pumps would lower energy bills for most Americans (62% to 95% of households, depending upon heat pump efficiency).

Your existing HVAC system is one of the biggest determinants of how much you can save. Almost 50 million U.S. homes use electricity, fuel oil or propane for heating and cooling. NREL found that almost 100% of these homes would enjoy energy bill savings; median savings would be $300 to $650 per year depending on heat pump efficiency.

If you rely on natural gas for heating, installing a heat pump is less of a no-brainer. EnergySage can help you estimate your potential savings or whether you might lose money by replacing your gas unit with a heat pump.

Your home's level of weatherization is also important. The NREL report's co-author, Prateek Munankarmi, said homeowners can "save thousands of dollars on average" by installing a small heat pump with improved insulation and energy efficiency.

Your location is also key. Heat pumps have enjoyed the greatest adoption rates — across income groups — in locations where electric prices are low and the climate is mild, according to a study by the U.S. Energy Information Agency as reported in MIT Review.

For more help parsing the economics of heat pumps, check out Consumer Report's helpful buying guide.

What incentives are available?

Federal tax credits

With incentives from the Inflation Reduction Act, homeowners may claim a credit for up to $2,000 or 30% of the project cost. There are important conditions, so review the rules before you begin an installation project.

Federal incentives for low- or moderate-income households

Low- and moderate-income households may be eligible for a heat pump rebate of up to $8,000 in the near future. There are many requirements, so be sure you qualify. This program is managed by the Department of Energy and requires that states apply and receive approval. Only New York has received approval, and 13 states have applied and are waiting for approval, according to the Energy.gov rebate tracker.

Existing state and utility incentives

Several states and utilities also offer incentives. For example, California provides $1,000 to state residents, and some California electric utilities also offer rebates up to $3,000. Some towns, like Newton, MA also provide incentives. To see incentives offered by your local utility, go to the Energy Star rebate finder and search by zip code.

These incentives are stackable with the federal $2,000 tax credit, substantially reducing the cost of a new system. You can also access advice and planning help from Rewiring America, whether you are a homeowner or renter. Live in Maine? You will pay less for your electricity if you install a heat pump.

And if you're a Wisconsin resident, you can now save even more on home energy improvements, thanks to the state's recent launch of the Home Efficiency Rebate (HOMES) program. Depending on your household income, you could receive a rebate for up to 100% of the costs (on up to $5,000) to purchase and install a heat pump or other energy-efficient home improvements.

Nine U.S. states have committed to increase heat pumps

To speed the transition from gas furnaces to electric heat pumps, these nine states recently signed an agreement to increase new heat pump installations to 65% of residential HVAC and water heating projects by 2030, and to 90% by 2040.

The states involved are California, Colorado, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon and Rhode Island. Most of their efforts will focus on training technicians and working with manufacturers, so it is unclear if residents will benefit from additional incentives.

Historic preservation tax credits

Your heat pump project may qualify for state or local government incentives if you live in a historic home. For example, The Town of Washington Grove, MD offers up to $1,500 rebates for a heat pump conversion. Some state programs provide even higher amounts for HVAC work, but may not mention heat pumps as qualifying technology.

For example, programs offered to historic homeowners by New York State allow for a range of energy-efficient improvements as long as they do not change the property's appearance. The program covers 20% of qualified rehabilitation expenses up to a credit value of $50,000 per year.

The National Trust for Historic Preservation publishes a guide to historic tax credits by state. Contact the historic preservation society, council or state agency before planning your project to check on HVAC replacement requirements.

Heat pumps in cold climates

To understand how heat pumps perform in very cold climates, I turned to Tina Holt, a family doctor from South Portland, Maine. She's installed a heat pump on her own property and has seen some of her patients use them. Surprisingly, extreme heat is a growing concern in South Portland, Maine, where most homes do not have air conditioning, adding to the burden of cold and snowy weather. Since heat pumps can cool as well as heat a home, she has seen how they may benefit her elderly patients hoping to age in place. Maine has been a leader in heat pump adoption.

Holt's 1910 home has a finished apartment above the garage that she rents out as an accessory dwelling unit (ADU). With an oversized oil heat system, the unit used to cost about $1,000 per winter to heat. Holt modified her home in the proper order, focusing first on overall weatherization and efficiency. Under the Efficiency Maine program, she had an energy audit and added insulation, snagging a $2,500 rebate.

A few years ago, she added a mini-split heat pump to the ADU but kept the oil heater in place. Her tenant finds the heat to be quieter and at a more constant temperature. However, a few days a year the heat pump has trouble managing the very cold temperatures, and the tenant supplements with the oil heater.

With a more efficient heat pump, Holt likely wouldn't need the oil heater. Such efficient heat pumps are costly, however, and for many homes in cold climates, it makes sense to keep supplementary heating. This hybrid approach to home heating is becoming more common in places like Alaska and Minnesota, according to research by Yale Climate Connections.

Holt thinks that heat pumps may play an important role in local public health. When she worked in a small town in coastal Maine, she found her patients with asthma and COPD were relying on wood stoves for heat, since firewood was free or cheap. Some of these patients asked her to write a doctor's note asking the power company to keep their electricity on if they were behind in payments. "They were probably just using resistant electric heaters like baseboard or space heaters," she said, recognizing how inefficient and expensive they would be for low-income patients to operate compared to heat pumps.

Heat pumps for a historic home

Jay Lee and his family have lived in a 100-year-old home in the Takoma Park, Maryland Historic District for nearly twenty years. Like many historic properties, it had outdated HVAC systems and poor insulation. Their home only had AC window units, which were noisy, inefficient and ineffective. The home's heating system relied on a gas furnace and radiators, resulting in "huge" energy bills in the winter.

In 2022, Lee's family installed a heat pump on the main floor and upstairs, giving them zones that they can control separately. Through a program sponsored by the Maryland Historical Trust, they got a tax credit of 20% of the project's cost for adding the heat pumps and painting, or about $7,000. They also received a tax credit through their county's Historic Preservation program.

Was it worth it? Financially, Lee isn't sure they are saving money, because the house is still leaky. Under historic preservation rules, they can't replace windows, so he's been adding costly storm windows piecemeal. "I knew we wanted a heat pump because it generally saves money and is good for the environment," he said. "But having the confidence that it is indeed saving us money is something we need to substantiate."

Still, Lee said he would do it again. And as they consider adding an Airbnb apartment in their basement, he's sizing up adding a mini-split for comfort and efficiency.

FAQs on heat pumps

Can a heat pump replace an air conditioner?

Yes, heat pumps can replace window units or ducted air conditioning systems. For smaller spaces, a mini-split on the wall may provide enough capacity for a room or two. You can also take a look at our breakdown of heat pumps vs air conditioning.

What is the return on investment (ROI)?

When you sell your home, how much of the cost you incurred from installing the heat pump will you recoup? As discussed in our article on the home features today's buyers want most, energy-efficient HVAC is highly prized. According to Remodeling magazine’s 2023 Cost vs. Value report, the highest return on investment (ROI) comes from swapping an HVAC system from oil or gas heat to an electric heat pump, yielding 104% ROI.

Can a heat pump cool a house in 100-degree weather?

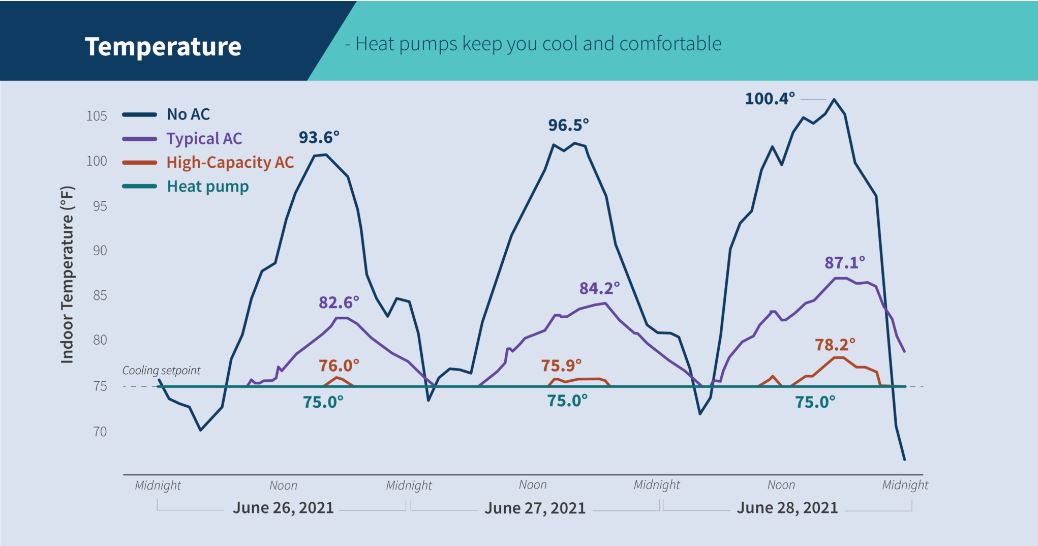

Yes, a heat pump performs better than other technologies when it comes to maintaining a cool home when it's hot outside. A study by Rocky Mountain Institute modeled the home temperature and cost of running no AC, a typical AC system, a high-capacity system and a heat pump in the three-day Seattle heat wave of 2021.

They found that the heat pump was best for comfort and cost $228 less per year to operate than a dual-fuel AC and gas furnace system. The graph below shows the indoor temperature in the four scenarios, with the heat pump maintaining a comfortable 75 degrees throughout the heat wave:

Do heat pumps actually help reduce emissions if they rely on electricity powered by fossil fuels?

Yes, several studies have shown that heat pumps lower emissions even when powered by a "dirty" grid.

Read More Articles on Home Energy Savings

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.