Wisconsin Launches First Home Energy Rebate Program

Wisconsin residents can save up to $14,000 on energy efficiency improvements.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you're a Wisconsin resident, you can now save even more on home energy improvements, thanks to the state's recent launch of the Home Efficiency Rebate (HOMES) program. Depending on your household income, you could receive a rebate for up to 100% of the costs (on up to $5,000) to purchase and install a heat pump or other energy-efficient home improvements.

The HOMES program will benefit not only Wisconsin families but also the environment. White House national climate advisor Ali Zaidi says that these rebates will "both reduce emissions and lower energy costs for Wisconsin families using tried-and-true insulation, heat pumps, and efficient appliances and lighting." These savings may be stacked with existing energy efficiency incentives.

Here's what you need to know about the program, which could be heading to your state soon.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What is the Home Efficiency Rebate Program?

Wisconsin just became the first state to launch the nation’s first-ever Home Efficiency Rebate (HOMES) program, supported by the Inflation Reduction Act. The rebate program, in partnership with the U.S. Department of Energy, will enable Wisconsin residents, particularly those with lower and middle incomes, to save on energy-saving home improvements, which includes insulation, air sealing and heat pumps that reduce whole-home energy consumption. It's just one part of the Biden-Harris Administration’s initiative "to provide $8.8 billion in Federal funding" to "lower energy costs and increase efficiency in American homes."

How much can I save?

By participating in the HOMES program, households could save up to $14,000 for energy-efficient home upgrades, not to mention the hundreds more you'll save on monthly energy bills.

According to the National Renewable Energy Lab (NREL), a majority of Americans (62% to 95% of households, depending upon heat pump efficiency) would see a drop in their energy bills by using a heat pump — $300 to $1,500 annually, according to the DOE. And since heat gain and loss through windows is responsible for 25% to 30% of residential heating and cooling energy use, installing or upgrading windows to be more energy efficient is likely to lower your power bill.

To qualify for the program, Wisconsin residents will first need to get a home energy audit to understand how their home uses energy and where they can save. Certain tax credits can offset the cost of the energy audit, and low-income households are eligible for a rebate.

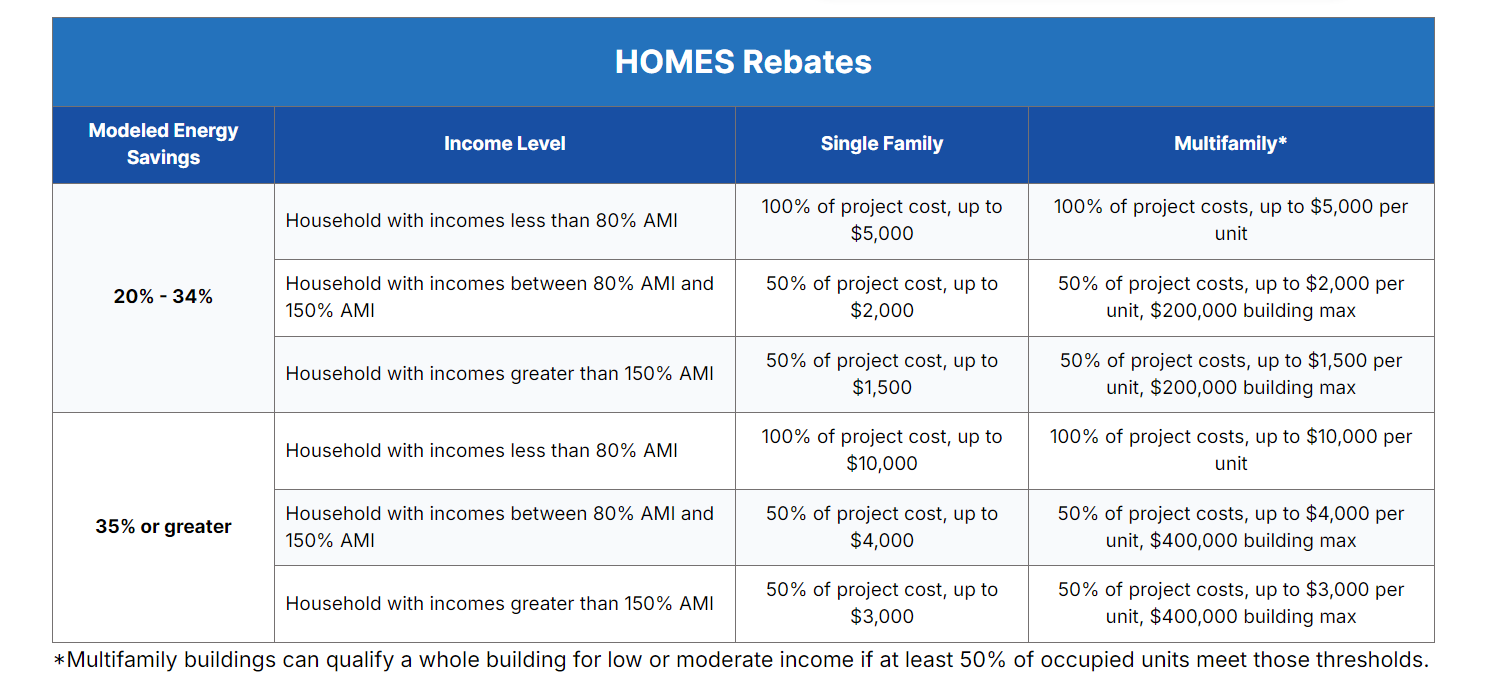

Both single-family and multifamily properties are eligible for the program. Qualifications for rebates are based on both household income and how much energy can be saved. Single-family homes making less than 80% of their area median income (AMI) can save up to $10,000, while those making between 80% to 150% AMI can save $4,000. Those making at or above 150% AMI can save up to $3,000. If you are unsure what your AMI is, you can look up your AMI through Fannie Mae.

Review the following chart from Focus On Energy to learn more about how much you can save.

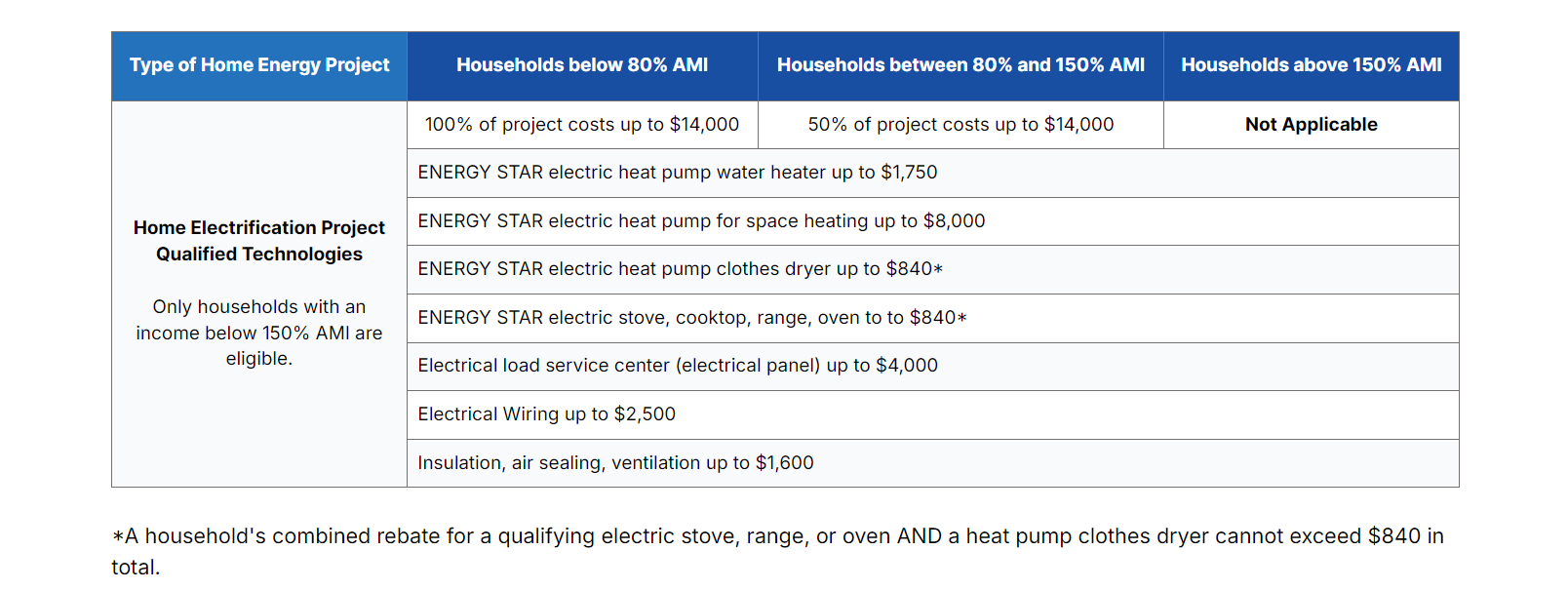

Wisconsin will also launch the Home Electrification and Appliance Rebates (HEAR) later this year, which also offers up to $14,000 off high-efficiency electric appliances and home upgrades. This program is only for households earning 150% of Area Median Income or less. One thing to note about the program, however, is that households will not be eligible to receive a rebate from both programs for the same upgrade.

The following chart from Focus on Energy shows how much low- or moderate-income households can save with HEAR later this year.

Ten other states — Arizona, California, Hawaii, Indiana, Maine, New Mexico, New York, Rhode Island, Washington and Wisconsin — have also received funding from the DOE to launch one (or both) of the above rebate programs. You can use this map to check your state’s progress toward launching its rebates.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.