How Prices Changed in Trump's First Year

Trump campaigned on bringing prices down for Americans. Here's where prices stand one year into his second term.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

One of President Donald Trump's key issues during the last election was about bringing prices down. In a December speech, he recommitted to that goal, saying, "I have no higher priority than making America affordable again."

In that same speech, the president also said prices are already coming down rapidly while wages are getting higher. As we come to the end of his first year back in office, let's take a look at what the data says about prices and wages across the United States.

Overall, in President Trump's first year in office, inflation fell from 3% year-over-year in January 2025 to 2.7% in December. That's down but still stubbornly stuck above the 2% rate the Federal Reserve is targeting. The picture also looks different when you zoom in on some of the categories that matter most to your wallet.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How I tracked prices and wages during Trump's first year

To get a sense of how the cost of living has shifted since Trump returned to office, I looked at food, housing and transportation to see how much your daily essentials cost. I also looked at wage data to get a sense of whether income is keeping pace with those prices.

Unless otherwise noted, all data below was pulled from either the Bureau of Labor Statistics or the Federal Reserve Bank of St. Louis. In some cases, data for October is missing in some categories due to the government shutdown.

It's also worth noting that this data simply shows how prices and other economic indicators have changed over the year across various categories. It doesn't reflect the cause of those changes — whether they're tied to policies enacted under the Trump administration, longer-term trends or other factors.

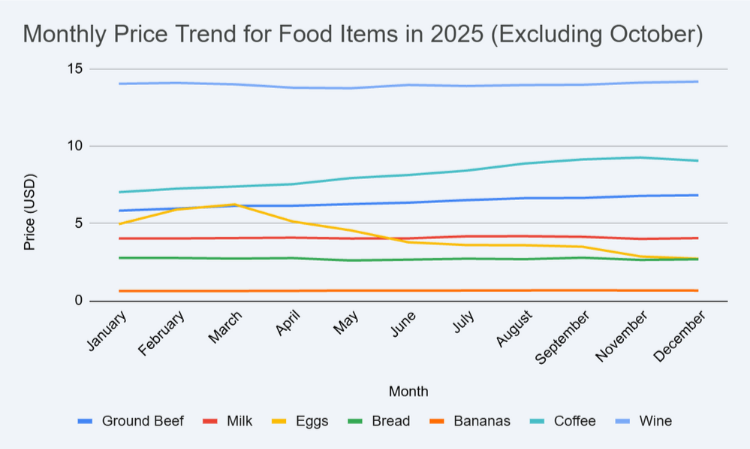

How food prices changed in Trump's first year

Among all the foods tracked in the chart above, prices rose on average 2.31% from January to December, which is slower than the overall inflation rate. But some foods fared better than others.

Notably, egg prices have fallen sharply (about 45% from January to December) in Trump's first year back in office. That's likely tied to prices settling down after the bird flu outbreak that sent them soaring at the start of the year. Bread also fell slightly over the year.

Meanwhile, other food categories have gotten significantly more expensive. Coffee prices are up nearly 29% since the start of 2025, for example. Beef prices are up over 17% in the same time period.

Overall trend: Food prices are generally not coming down, though a couple of items have gotten cheaper.

Top Picks for Grocery Reward Credit Cards

Earning cash back on every grocery trip can help put a little of that money back in your pocket. See Kiplinger's top credit card picks for groceries, powered by Bankrate. Advertising disclosure.

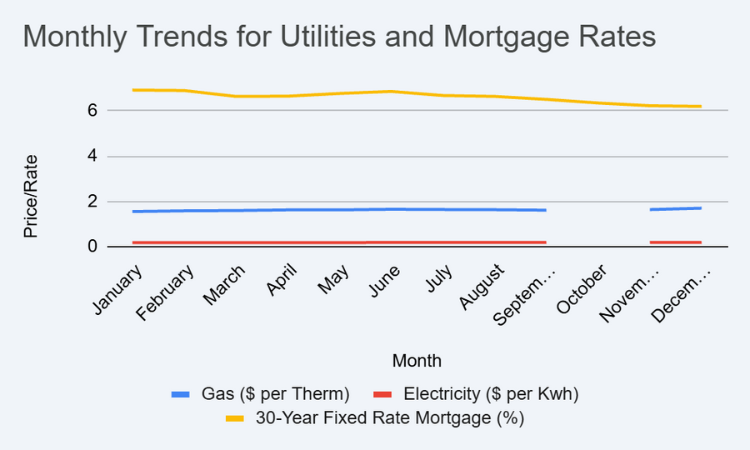

How housing prices changed in Trump's first year

Aside from higher grocery prices, housing costs also rose in 2025. You might have noticed a higher gas or electric bill as the costs of those utilities are up 9.6% and 5.59%, respectively, since last January. While mortgage rates have come down almost a full percentage point, they're still above 6% as we head into 2026, according to Freddie Mac.

At the same time, home insurance premiums also rose 6.25% from January to November last year. Though some homeowners might be living in states where home insurance is cheaper than the national average.

Some good news on the housing front: If you're in the market to buy a new house, median home prices trended downward in 2025, according to the Census Bureau, dipping from $429,600 in January to $392,300 in October. While that might partially reflect seasonal shifts in demand, that does mean now might be the right time to start house hunting.

If you're not ready to buy just yet or you're considering renting instead of downsizing, another encouraging sign is the slightly slower pace of rent increases. In 2025, average rents climbed 2.6%. That's much slower than the 3.9% increase in 2024 and 5.7% spike in 2023. Though your monthly rent is still likely sitting about 30% higher than it was pre-pandemic.

Overall trends: Utility bills and home insurance continued to surge, but mortgage rates, rent, and home prices stabilized somewhat in 2025.

How transportation prices changed in Trump's first year

If you're looking to buy a car soon, you may already know that new car prices are high. Despite tariffs, however, those higher car prices remained pretty flat during President Trump's first year in office. With the average price surpassing $50,000 for the first time last year, according to Kelley Blue Book, those flat prices might not exactly seem affordable.

If you already own a car, though, you're faring much better. Gas prices were low throughout 2025 and kept getting cheaper. From January to December, your price at the pump fell 4.4%.

Those gas savings might be slightly offset by your rising car insurance rates. Premiums rose 2.41% over the year. That modest bump means your bill may be higher, but rates aren't spiking nearly as much as home insurance premiums.

Overall trends: Buying a car is expensive, but the cost to insure it and fuel it are fairly steady.

Income

Now that we've looked at prices across some of the key daily essentials, let's look at how those prices stack up against what Americans are earning. For those who are employed, wage growth has remained relatively modest.

Total compensation — which includes wages and other benefits, like paid leave — grew 3.4% year-over-year in the first quarter for the private sector. By the third quarter of 2025, the pace of growth ticked up slightly to 3.5% year-over-year.

That slower growth is part of a longer-term trend stretching back to 2022, when wage hikes peaked at 5.5%. After the pandemic-era surge, growth fell sharply, and 2025’s gains are now below the 3.8% average growth workers saw in 2024.

Moreover, when you factor in rising prices, even that peak wage growth back in 2022 wasn't enough to keep pace with inflation, which peaked that same year at over 9%. For many Americans, paychecks have been falling behind for several years. And for wages to truly catch up, they would need to outpace inflation for an extended period, not just match it, to recover the buying power lost during the pandemic.

Overall trends: Total compensation is up slightly, but not growing as fast as it was in previous years, and not fast enough to offset years of inflation.

Is America more affordable today than it was one year ago?

Overall, prices are not coming down except in a few limited categories. While the rate of inflation is slowing in some categories, prices are still going up (just at a slower pace).

Meanwhile, wages are still lagging behind inflation and the pace of wage growth is falling. When you combine slowing wage growth with major price hikes in some key categories, like home insurance, beef and coffee, it's easy to see why many Americans are feeling the pinch in their pocketbooks.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rachael Green is a personal finance eCommerce writer specializing in insurance, travel, and credit cards. Before joining Kiplinger in 2025, she wrote blogs and whitepapers for financial advisors and reported on everything from the latest business news and investing trends to the best shopping deals. Her bylines have appeared in Benzinga, CBS News, Travel + Leisure, Bustle, and numerous other publications. A former digital nomad, Rachael lived in Lund, Vienna, and New York before settling down in Atlanta. She’s eager to share her tips for finding the best travel deals and navigating the logistics of managing money while living abroad. When she’s not researching the latest insurance trends or sharing the best credit card reward hacks, Rachael can be found traveling or working in her garden.