How to Calculate RMDs (Required Minimum Distributions) for IRAs

Understand when and how to calculate RMDs and avoid stiff penalties from your tax-deferred IRA.

Ellen B. Kennedy

It pays to calculate RMDs (Required minimum distributions) as you approach retirement or if you are already retired. RMDs are the minimum annual withdrawals you must make each year from most tax-deferred retirement plans (excluding Roth accounts). Your funds have grown tax-free in these accounts over the years, so RMDs are the government's way of taxing those funds incrementally. That's why RMDs are taxed as income.

Although you may be required to take RMDs from 401(k), 403(b) or other employer-sponsored retirement plans, the calculator we profile here focuses on RMDs from a traditional Individual Retirement Account (IRA).

Starting RMD withdrawals at the right age is critical, and the rules have changed recently.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- In 2020, the age for withdrawing from retirement accounts was increased from 70.5 to 72.

- The SECURE 2.0 Act raised the age to 73 for anyone who turns 73 in 2024 through 2032. You must take your first RMD by April 1 of the year after you turn 73.

- Starting in 2033, the RMD age will increase to 75 for anyone who turns 74 after Dec. 31, 2032.

Not sure how to calculate your RMD? We’ll walk you through the steps and point you to other practical resources to use.

For more detailed information, seek guidance from a qualified financial adviser or tax professional.

Calculate RMDs for a traditional IRA

We recommend using the RMD calculator designed by Fidelity, though you may also search for an RMD calculator on your broker's website. The Fidelity tool allows you to calculate the amount you must withdraw even if you are not yet 73, and accounts for your spouse's age as well. It also projects your RMDs for future years. Follow these steps:

- Input your birthdate into the Fidelity RMD Calculator.

- Choose whether your spouse (if you have one) is your only beneficiary.

- Input your IRA account balance as of December 31 of the previous year.

- Input your spouse's date of birth (if applicable).

- Input your estimated rate of return. This is the average annual growth you expect in your retirement account.

RMD calculation example:

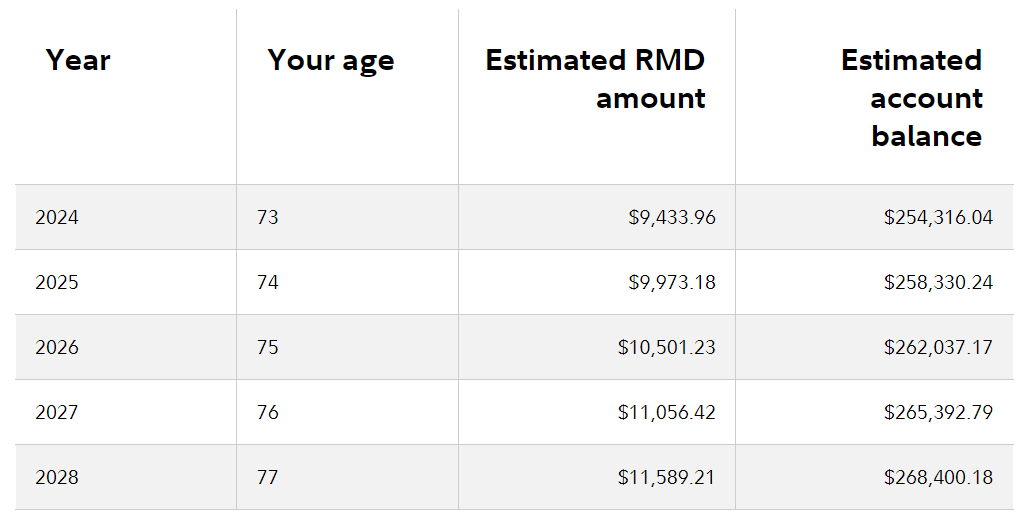

John is a single man who turned 73 in 2024. The balance in his IRA was $250,000 on December 31, 2023, and he estimates it will grow by 5% annually. He has no spouse. This year, his required minimum distribution is $9,433.96. As the graph below shows, his annual RMD will increase over the next four years, but his account balance will not dip below its original value, assuming it continues to earn the estimated 5% interest.

RMD dates to remember

Once you turn 73, it's important to be proactive about taking required minimum distributions for IRAs, or you may face penalties. Also, you can withdraw or use your traditional IRA assets at any time, but a 10% additional tax may apply if you withdraw or use IRA assets before you reach age 59-½.

Officially, RMDs are due every December 31, but the IRS allows you some wiggle room for your first withdrawal. If you decide to delay your first withdrawal, you'll have to take a second RMD before December 31. Remember that taking two RMDs in one year creates two taxable events, which may push you into a higher tax bracket.

Penalties

The IRS imposes serious penalties for taking RMDs that are too small. If you withdraw less than required, the IRS takes 50% of the difference between what you pulled out and what you should have withdrawn. You can always take larger distributions, but the required minimum distribution lets you know the smallest withdrawal you can make to meet IRS requirements. Unfortunately, you can’t use withdrawals above the minimum requirement in one year to satisfy RMDs in future years.

What accounts require RMDs?

These are the accounts that will require you to withrdaw RMDs (as long as they are not Roth accounts).

- Traditional IRAs

- Traditional 401(k)s

- Nonprofit 403(b) plans

- Government 457 plans

- Simplified Employee Pension (SEP) IRAs

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs

- Profit-sharing plans

- Other defined contribution plans

You must calculate your RMD for each IRA, and you must withdraw the total amount each year. However, you may make the withdrawal from just one of the IRA accounts. This allows for easier bookkeeping and can help you draw down an IRA that is performing poorly.

What are the RMD rules for an inherited IRA?

The IRS states that beneficiaries of inherited IRAs must follow specific RMD rules (which can be very complicated) based on when the original account owner passed away, the beneficiary's relationship to the account holder, and whether the account holder died prior to January 1, 2020.

Generally:

Spousal options: If you inherit a Traditional, SIMPLE IRA, Rollover, or SEP-IRA from your spouse, you have several options, depending on whether your spouse passed away before or after the date they were required to start taking RMDs. It's common for a spouse who inherits an IRA to transfer the funds to their own IRA. However, other options exist, such as taking a lump sum distribution.

Non-spousal options: If you inherited an IRA from someone other than your spouse, different withdrawal rules exist depending on the type of beneficiary you are — designated beneficiary or eligible designated beneficiary. Other rules apply if the beneficiary is a non-individual, such as a trust, estate or other entity.

Read Retirement Topics—Beneficiary on the IRS website to fully understand the rules and how they apply to your personal situation.

Other useful resources

Calculating your RMDs manually.

You may calculate RMDs yourself. Start by determining how much you had in your IRA account as of December 31 of the previous year. Next, you can find your life expectancy factor, or the number of additional years you are expected to live, according to actuarial calculations. Divide the account balance by the life expectancy factor to get the RMD.

Going to the source.

You can also visit the IRS website to find additional information on RMDs, such as what they are, the types of retirement plans that require RMDs, the timeline for taking minimum distributions and how the amount is calculated.

We strongly recommend that you seek the advice of a financial services professional with whom you have a fiduciary relationship before making any investment or significant financial decision.

And one last word to the wise: To better save for retirement, consider all of your options, such as contributing to a 401(k) or IRA, or a 403(b) in 2025. Different accounts may have different fees that can eat into returns in addition to different tax implications. And you should consider whether you will be required to take minimum distributions once you hit age 73. Roth IRAs don’t have RMDs, but traditional IRAs and other retirement accounts do.

Related Content

- Required Minimum Distributions (RMDs): Key Points to Know

- Roth IRAs: What They Are and How They Work

- Rolling Over a 401(k) Into an IRA

- An IRA Contribution Option You Might Not Know

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

- Ellen B. KennedyRetirement Editor, Kiplinger.com

-

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have TodayBerkshire Hathaway is a long-time market beater, but the easy money in BRK.B has already been made.

-

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor Trusts

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor TrustsThe One Big Beautiful Bill Act's increase of the state and local tax (SALT) deduction cap creates an opportunity to use multiple non-grantor trusts to maximize deductions and enhance estate planning.

-

Ask the Editor, July 4: Tax Questions on Inherited IRAs

Ask the Editor, July 4: Tax Questions on Inherited IRAsAsk the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the rules on inheriting IRAs.

-

Ask the Editor, June 27: Tax Questions on Disaster Losses, IRAs

Ask the Editor, June 27: Tax Questions on Disaster Losses, IRAsAsk the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on paper checks, hurricane losses, IRAs and timeshares.

-

Ask the Editor, June 20: Questions on Tax Deductions and IRAs

Ask the Editor, June 20: Questions on Tax Deductions and IRAsAsk the Editor In our latest Ask the Editor round-up, Joy Taylor, The Kiplinger Tax Letter Editor, answers four questions on deductions, tax proposals and IRAs.

-

Ask the Editor, June 6: Questions on Hobby Losses, Medicare

Ask the Editor, June 6: Questions on Hobby Losses, MedicareIn our latest Ask the Editor round-up, Joy Taylor, The Kiplinger Tax Letter Editor, answers questions on hobby losses, I bonds and Medicare premiums.

-

Ask the Editor, May 23: Reader Questions on Gifts, Estate Tax

Ask the Editor, May 23: Reader Questions on Gifts, Estate TaxIn this week's Ask the Editor Q&A, we answer tax questions from readers on gifts, the estate tax and stepped-up basis upon death.

-

Ask the Editor, May 9 — Reader Questions on QCDs

Ask the Editor, May 9 — Reader Questions on QCDsIn our latest Ask the Editor round-up, Joy Taylor, The Kiplinger Tax Letter Editor, answers questions on qualified charitable distributions (QCDs).

-

Ask the Editor, May 4 — Questions on Tax Deductions, Losses

Ask the Editor, May 4 — Questions on Tax Deductions, LossesIn our Ask the Editor series, Joy Taylor, The Kiplinger Tax Letter Editor, answers readers' questions on tax deductions and losses.

-

Ask the Editor: Reader Questions, April 25 — 529 plans

Ask the Editor: Reader Questions, April 25 — 529 plansIn our latest Ask the Editor round-up, Joy Taylor, The Kiplinger Tax Letter Editor, answers questions related to 529 plans.