What Is Margin Trading?

Margin trading is buying and selling stocks with borrowed money. It can generate big rewards, but margin trading also involves multiple risks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Folks who are new to investing inevitably stumble across the term "margin" after signing up for their favorite trading platform. But what is margin trading, and what does it mean for your portfolio?

Simply put, margin trading is the practice of investing with borrowed money. Some believe the term originates from the old days of physical ledgers, where your balance is recorded in neat columns – while investments made with money you don't actually have are jotted down off to the side, in the margins at the edge of the page.

Some call it using "leverage," because these debts offer a bigger push for portfolios just as levers help lift heavy objects. Others are more direct and simply refer to it as taking out a loan.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the bottom line is that margin trading involves investing with money you don't actually have, and that means it comes with additional risks.

What is margin trading and how does it work?

In a traditional or cash account, you can only buy assets that you can afford. In a margin account, however, you put in a bit of seed money and get to invest a multiple of that amount.

Most brokers allow customers two times leverage. This means you borrow up to 50% of the initial investment capital – say, the ability to make a $20,000 investment despite having just $10,000 funded in your account.

There are exceptions where that percentage is lower, as well as assets where brokers prohibit any margin trading altogether. But 50% is generally the limit for most brokers.

This extra buying power isn't free, however. As with any loan, you'll need to pay interest. And while rates are typically lower than a cash advance on your credit card or unsecured personal loans, they are still pricey.

Consider Fidelity's current margin rate is 12.575% for the typical investor with a modest nest egg. That's a pretty hefty sum that adds up to $1,257.50 annually on a loan of $10,000.

How is margin interest calculated?

Unlike a consumer car loan, where you buy a vehicle at a set price and pay a fixed rate, margin interest is less predictable.

Specifically, your investment account value can fluctuate day to day – and thus, the amount you owe your broker changes, too. Furthermore, brokers have the right to adjust the interest rate based on current market conditions.

Typically, brokers levy a daily fee based on their annual rate. In the aforementioned example of Fidelity, a loan of $10,000 would see charges of about $3.45 each day at the base rate – which, if you multiply by 365 days, gets you to that figure of $1,357.50 annually mentioned above.

Some days you could owe less based on good performance in your portfolio, and on bad days you might owe more. Those daily fees are added up and charged to you once per month.

A few bucks per day might not sound like a lot. But interest continues to accrue while you carry a debit balance. Over time, that can really add up and eat into your total returns.

What are the risks of margin trading?

Most margin traders believe they can borrow a bit of money at the current interest rate then quickly unlock an even higher rate of return in the stock market. They intend to repay the loan quickly and pocket the difference – with any interest payments just the reasonable cost of executing this strategy.

But sometimes this doesn't work out.

You might get a decent rate of return on your investments, but simply not enough to cover the costs of margin trading. If you shoulder Fidelity's rate of 12.575%, for instance, then you must return more than that percentage in gains to come out ahead.

This could lead to frustration if you choose investments that would have been modestly profitable in a cash account but have actually lost you money when you account for the fees of margin trading.

Worse, let's say you invest in an asset that loses value. That asset is your collateral for your loan, so your broker has the right to force you to sell all of your assets and pay your balance – whether you like it or not.

This dreaded occurrence, known as a margin call, is the worst example of what can happen to an investor. And it's more common than you think.

What is a margin call and how does it work?

A margin call happens to margin traders when their broker demands more money. This occurs because a margin trader's account is facing significant losses, and the broker fears it won't get repaid on its loan.

Think of it this way: If you invest $10,000 of your own money and lose $7,500, it's very embarrassing. But it's your choice whether to stay the course. And if your personal budget doesn't add up after the losses, it's unfortunate. But, ultimately, it's your call as to which bills get paid first.

If you had invested $5,000 of your own money and another $5,000 you borrowed from your bank, well, it's not just your money that's gone with that $7,500 loss. The bank is going to want its money back, but your investment portfolio that's now valued at $2,500 doesn't cover the tab – and paying your broker becomes a top priority.

When do margin calls happen?

That previous scenario is actually unlikely to happen, in fact, because your brokerage will demand money before losses ever get that bad.

This is because trading platforms have sophisticated systems that measure risk and predict when you're in danger of suffering a big loss. As a result, your broker will almost always demand more money sooner rather than later.

Your broker will also demand a minimum amount of investor equity in a portfolio – that is, your own personal skin in the game and not just its loan. Equity percentages vary but are generally at least 30%.

Let's do some math to show an example of how this would work.

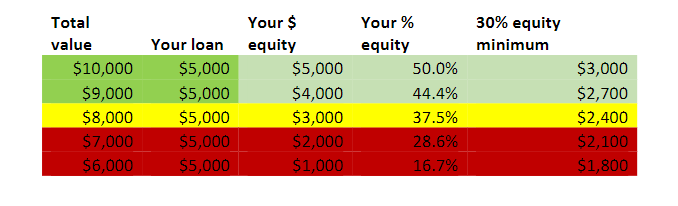

You put up $5,000 of your own money and borrow $5,000 from your broker to make a $10,000 investment. Your investor equity stake is 50% of the $10,000 value.

Now let's say that investment falls to $8,000 in value. The loan is still $5,000, so the losses are not shared equally. Rather, your investor equity takes the hit first, so you only have a $3,000 direct stake – or 37.5% of $8,000.

At this point, your broker may politely warn you are at risk and suggest you deposit more cash. After all, things can change on Wall Street, and you're still above their 30% equity threshold.

Unfortunately, things get even worse and the value of your investment keeps drifting lower toward $7,000. Minus your broker's loan, your personal stake would be a mere $2,000, or about 28.5%.

Now things are serious. Since 30% of $7,000 is $2,100, you'll have to put an extra $100 in your account immediately to meet that minimum.

That might not sound terrible. But what if you pony up $100 and the investment keeps falling to $6,000? Well, 30% of $6,000 is $1,800. So you're still behind, and you have to come up with even more cash.

If you don't have it, you'll be forced to sell some or all of your portfolio to make up the difference.

Fundamentally, margin calls happen because of this lack of investor equity in a portfolio.

So, before you engage in any margin trading, have a full understanding of your broker's structure – including the specifics of margin calls, minimum equity requirements and other fine print.

Related content

- What Is a P/E Ratio and How Do I Use It in Investing?

- What Are Options and How Can Investors Use Them?

- All 30 Dow Jones Stocks Ranked: Buy, Sell or Hold?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Best 401(k) Investments: Where to Invest

Best 401(k) Investments: Where to InvestKnowing where to find the best 401(k) investments to put your money can be difficult. Here, we rank 10 of the largest retirement funds.

-

Fidelity Strategic Income Fund Excels In Hard Year for Bonds

Fidelity Strategic Income Fund Excels In Hard Year for BondsThe fixed-income market was volatile in 2023, but this Fidelity bond fund outperformed its peers thanks to strategic moves by management.

-

How to Find the Best 401(k) Investments

How to Find the Best 401(k) InvestmentsMany folks are likely wondering how to find the best 401(k) investments after signing up for their company's retirement plan. Here's where to get started.

-

How to Master Index Investing

How to Master Index InvestingIndex investing allows market participants the ability to build their ideal portfolios using baskets of stocks and bonds. Here's how it works.

-

Choosing Between Look-Alike ETFs and Mutual Funds

Choosing Between Look-Alike ETFs and Mutual FundsIf you're trying to choose between ETFs and Mutual Funds, some factors to help you decide are how you trade and the type of account you plan to use.

-

How Direct Indexing Could Work for You

How Direct Indexing Could Work for YouTax efficiency is the primary goal for many new direct indexing offerings, but they come with a lot of caveats.

-

How to Invest $1,000: Open a Robo-Adviser Account

How to Invest $1,000: Open a Robo-Adviser AccountSmart Buying It's easier than ever to access low-cost, automated investing advice through a robo-adviser.