Stock Market Today: Stocks Sell Off to Close a Disastrous September

The stock market's latest slide occurred as inflation data came in hotter than expected.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

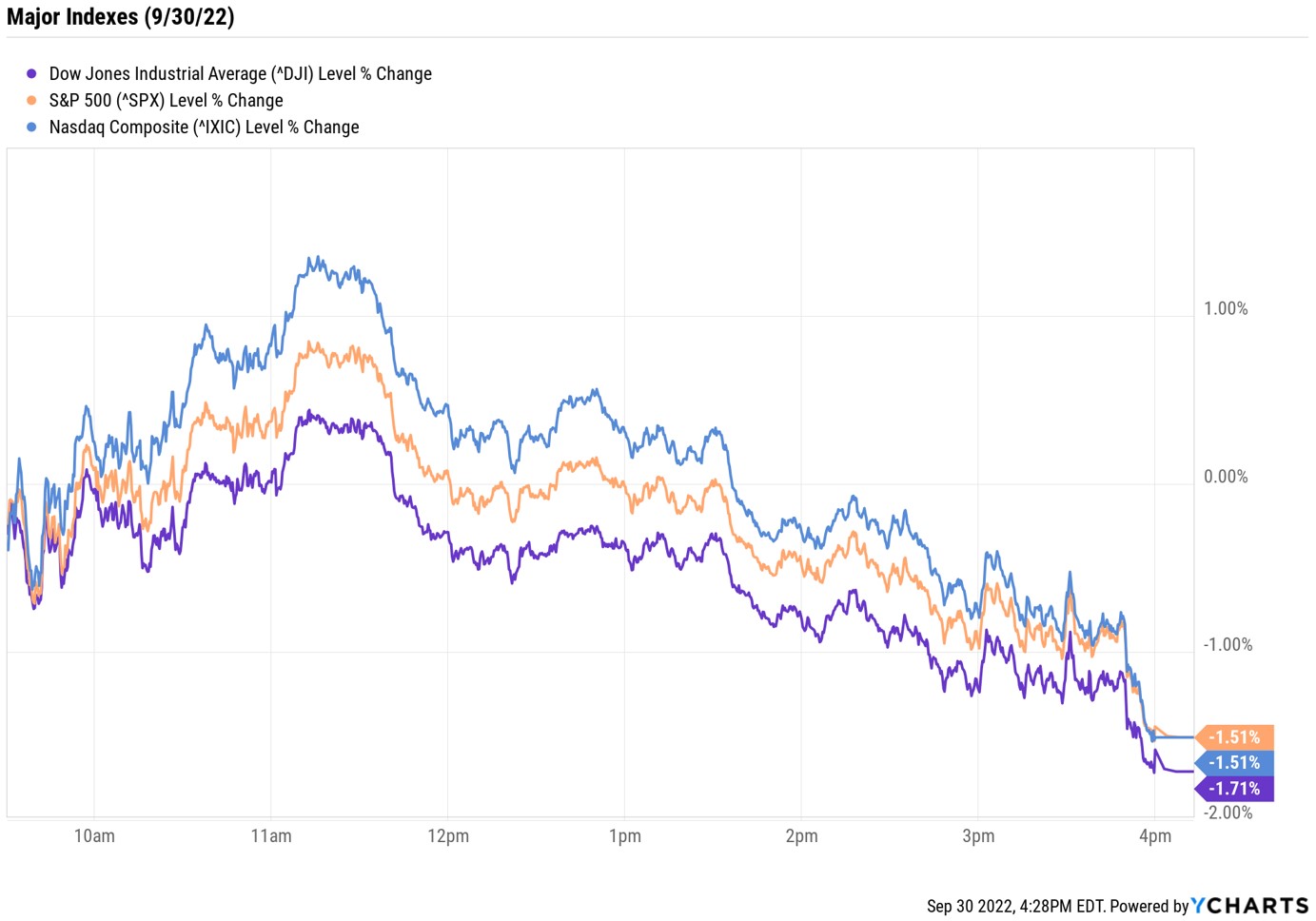

It was a fitting end to what turned out to be a tough week, month and quarter for stocks, with the negative price action driven by fears of Fed rate hikes, stubbornly high inflation and a slowing economy.

Stocks started Friday in the red after this morning's personal consumption and expenditures index, which measures price changes for household spending and is the Fed's preferred measure of inflation, came in higher than expected. Specifically, data from the Commerce Department showed core consumer prices, which exclude volatile food and energy prices, were up 0.6% month-over-month and 4.9% year-over-year in August.

However, stocks pared some of these losses after the Chicago purchasing managers' index slumped to 45.7 in September from August's 52.2. Readings below 50 indicate contraction, and this the index's lowest level in two years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"There were two waves of U.S. economic data, the first suggested inflation remains hot and more Fed tightening pain is justified, while the second wave showed a weakening economy and some relief with inflation expectations," says Edward Moya, senior market strategist at currency data provider OANDA.

Still, the mid-morning push higher couldn't be sustained, and by the close, the Dow Jones Industrial Average was down 1.7% at 28,725, the S&P 500 Index was off 1.5% to 3,585, and the Nasdaq Composite was 1.5% lower at 10,575. This capped off a terrible week for the indexes, whose losses were each around 3%. The monthly declines were even steeper, with the Dow sliding 8.8%, the S&P sinking 9.3% and the Nasdaq spiraling 10.5%. All three finished the quarter deep in the red, too.

Other news in the stock market today:

- The small-cap Russell 2000 slipped 0.6% to 1,664.

- U.S. crude futures shed 2.1% to finish at $79.49 per barrel.

- Gold futures gained 0.2% to settle at $1,672 an ounce.

- Bitcoin ticked up 0.2% to $19,463.96. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Nike (NKE) plummeted 12.8% today, easily making it the worst Dow Jones stock. Weighing on the stock was the athletic apparel retailer's warning that it accumulated an excess of inventory, which it will look to "aggressively liquidate," said Matthew Friend, chief financial officer at Nike. This overshadowed NKE's stronger-than-expected fiscal first-quarter results. "Our view is Nike's Consumer Direct Acceleration strategy is the right one and its China business will continue to rebound," says UBS Global Research analyst Jay Sole. "These are key tenets of our Buy thesis and Nike's first-quarter result didn't give us a reason to change our view on these issues. Plus, Nike's 10% ex-forex year-over-year Q1 sales growth and ~20% fiscal second-quarter ex-forex y/y sales growth guidance give us increased conviction consumer demand for Nike remains robust."

- Generac Holdings (GNRC) rose 2.3% after analysts at Cowen initiated coverage on the stock with an Outperform rating, which is the equivalent of a Buy. The analysts said the maker of generators is "the clear industry leader within a market that still has growth potential." They add that the "instability of the grid continues to drive significant power outages across the U.S. during periods of extreme weather. We believe the clear need for incremental grid investment and hardening has increased baseline demand for Generac's products."

Buffett Buys More OXY. Should You, Too?

A bright spot amidst this selling: Occidental Petroleum (OXY), which rose 4.7%. While some tailwinds came from broader strength in the energy sector (+2.3% for the week), the integrated oil and gas stock also got a little help from none other than Warren Buffett himself.

A recent regulatory filing revealed Buffett's Berkshire Hathaway (BRK.B) bought 6 million more shares of OXY between Sept. 26 and Sept. 28. This brings the holding company's total stake in Occidental to 21%, solidifying its spot as the top shareholder.

Berkshire's been accumulating OXY shares hand over fist in recent months, leading many to wonder if Buffett will eventually just buy the firm. "We continue to believe an outright total purchase of OXY in the near-term could make logical sense for Berkshire Hathaway given the Low Carbon Ventures progress, rapidly shrinking leverage, strong free cash flow forecast, and approaching investment-grade rating status," says Truist Securities analyst Neal Dingmann.

And as Berkshire keeps buying Occidental shares, many investors might be wondering if they should follow suit. Here, we explain why they should think twice.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.