Investing in Cannabis: 3 Top Trends for 2022

What's next for cannabis investors? We look at three vital trends that will define the landscape for the year ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The U.S. cannabis industry is growing at an unparalleled pace. Cannabis sales for 2021 are estimated to finish at $31 billion, an increase of 41% over 2020. And yet, despite this positive sales growth, the outlook for investing in cannabis is mixed.

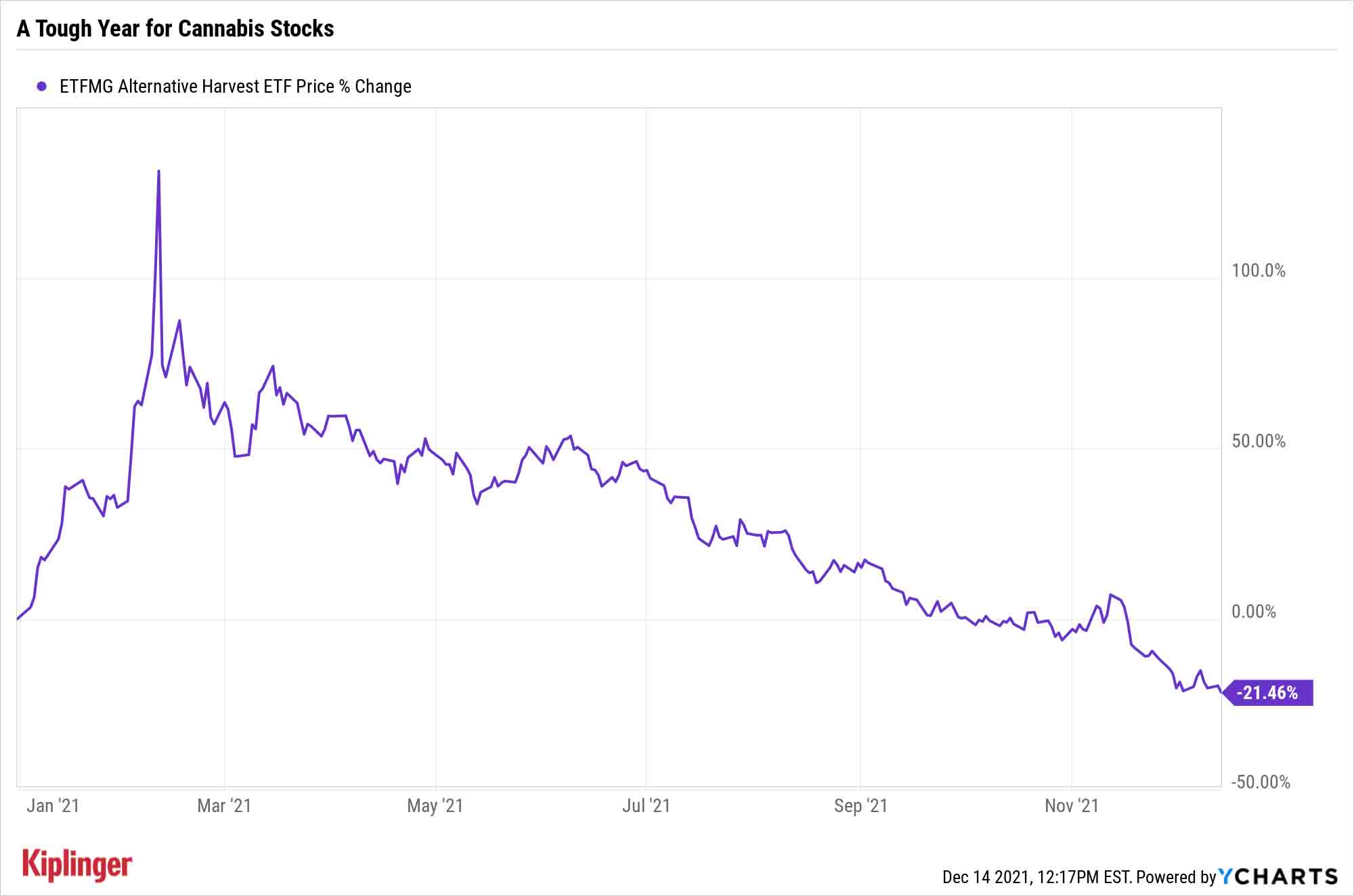

Cannabis stocks slumped in the second half of 2021 after diminished prospects of near-term U.S. federal regulatory reform extended barriers to broad ownership of cannabis equities by institutional investment managers. At the same time, mergers and acquisition (M&A) activity in private markets reached record levels as the industry grappled with increased competition and other byproducts of its latest expansion cycle.

While near-term federal regulatory reform remains in question, three trends are set to play a critical role for those investing in cannabis in 2022.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Financial Optionality Improves

The Secure and Fair Enforcement (SAFE) Banking Act will not pass in 2021 after it was removed from the National Defense Authorization Act (NDAA). Nevertheless, SAFE's initial involvement in the NDAA shows there is bipartisan support to pass federal banking reform.

While politicians' future actions on SAFE are unpredictable, it would seem the November 2022 midterms represent a line in the sand for political leadership to definitively take or not take action on the bill.

While SAFE plays out, companies will continue to rely on alternative financing to fund expansion. Lenders are becoming increasingly comfortable with cannabis businesses' financial sustainability and are accordingly offering better terms. In May, Green Thumb Industries (GTBIF) secured a sub-10% coupon – a first for a large public U.S. multi-state operator. These rates may be high by traditional industries' standards, but cannabis companies were subject to rates closer to 15% just a couple of years ago.

Credit markets are often a better judge of underlying business fundamentals than equity markets. With industry sales set to soar again in 2022, we expect alternative financing terms to also improve.

Notably for those investing in cannabis: Equities tend to follow credit over time, and as institutional capital gains access to the industry, we expect cannabis will be no different.

M&A Activity Will Accelerate

Cannabis-sector advisory firm Viridian Capital Advisors says a record $8.5 billion worth of M&A transactions closed as of mid-November, compared to roughly $3 billion last year and $3.7 billion in 2019.

That included a number of major deals, including:

- In September, TerrAscend (TRSSF) acquired Michigan leader Gage for $545 million.

- In October, Trulieve (TCNNF) acquired Harvest Health and Recreation for $2.3 billion, creating the largest and most profitable U.S. cannabis operator.

- Over the year, Harborside (HBORF) purchased leading California pre-roll brand Sublime for $43.8 million and announced a three-way merger with retailer Urbn Leaf and operator Loudpack, thus creating StateHouse Holdings. As with landmark deals in other states, these mergers signal the consolidation of California's fragmented market.

The latest consolidation push signals that investors are confident about the industry's future, and that confidence will continue into 2022. Competition remains fierce and consolidation will facilitate companies grabbing market share and building scale ahead of legalization and traditional industries' flooding into cannabis.

Established players have cash on hand, partly due to strong cannabis sales throughout the pandemic, and recent capital raises will help buoy M&A further. Viridian says that as of Q2 2021, the 10 largest U.S. cultivators had an average of $193 million in cash – triple the amount they held last year.

Canadians Bet on U.S. Legalization

Canadian licensed producers (LPs) started investing in U.S. cannabis operators in earnest in 2021. In June, Cronos Group (CRON) paid $110.4 million for an option to acquire a 10.5% stake in PharmaCann upon U.S. federal legalization. Then in August, Tilray (TLRY) acquired convertible bonds issued by MedMen in a deal that would allow Tilray to take a 21% ownership interest if, or when, the U.S. legalizes cannabis federally.

Such investments allow Canadian LPs to take part in U.S. cannabis without breaching restrictions on plant-touching companies listing on U.S. exchanges.

According to cannabis data and analytics platform Headset, Canadian sales will only reach $4 billion this year, significantly lower than the $31 billion projected for the U.S. With cannabis already federally legal in Canada, there is less room for growth in the Canadian market. In fact, excluding acquisitions, the largest LPs have seen their adult-use cannabis sales decline in the last year. Canadian companies will need to leverage the U.S. as a means for expansion that they can't achieve at home.

Recent news that the Canadian Securities Exchange (CSE) is considering creating a "senior tier" of companies on the exchange to make public LPs more attractive for inclusion in U.S. small-cap or mid-cap indexes bolsters our perspective on Canadian companies using U.S. markets to access liquidity and scale.

Investing in Cannabis? There's Growth Ahead

Federal reforms to cannabis could turbocharge the industry in 2022. But strong business fundamentals and positive trends will see the industry continue its rapid development regardless.

The federal reform holding pattern provides investors the opportunity to structure attractive deals and deploy capital at a compelling entry point. What's more, a longer regulatory timeline provides incumbents an extended runway to cement moats ahead of the tidal wave of competition that federal legalization will inevitably bring.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Matt Hawkins is the Founder and Managing Partner of Entourage Effect Capital. He has 20-plus years of private equity experience and has founded multiple $500 million-plus alternative firms. Matt also serves on the boards of numerous cannabis companies.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.