Stock Market Today: Stocks Brush Off China Growth Concerns

A number of economic reports released overnight pointed to a slowdown in China's economy in July.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

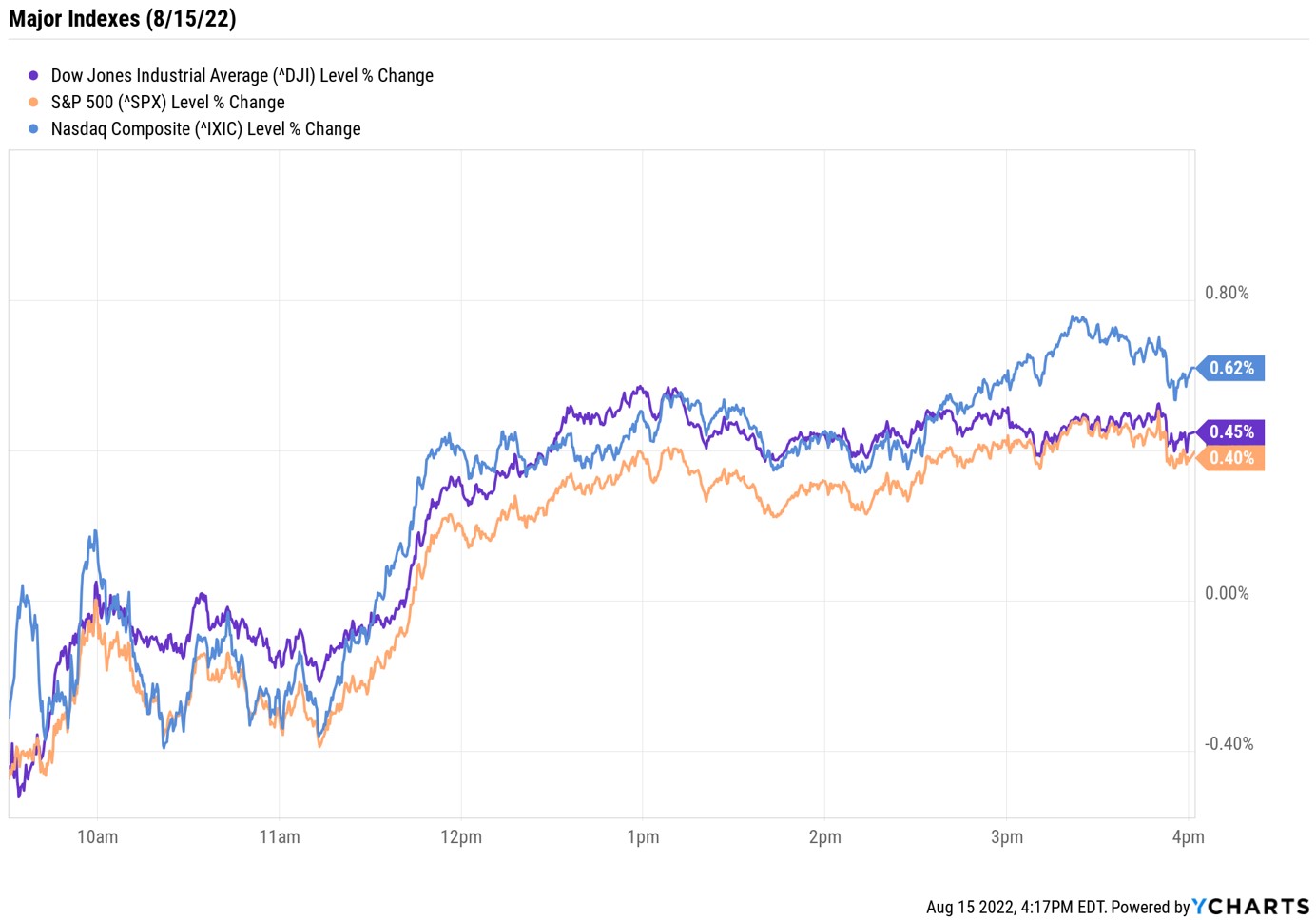

Worries over the strength of China's economy – and a surprising central bank move there – weighed on stocks in early trading Monday, though the major indexes managed to bounce back as the session wore on.

Overnight, a round of data was released that showed economic growth in the mainland slowed in July. The reports included worse-than-expected readings on retail sales and industrial output, as well as a sharp rise in the youth unemployment rate, which hit 19.9% last month – its highest level since the data was first published in 2018.

"The economic data from China overnight was very disappointing, to put it mildly," says Craig Erlam, senior market analyst at currency data provider OANDA. "Combined with the lending figures on Friday, it does not paint a good picture of domestic demand or the growth outlook. It seems the reopening boost was both uninspiring and short-lived." In reaction to the weak data, the People's Bank of China unexpectedly cut two key lending rates to help spark growth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The headlines from China dragged U.S. crude futures down 2.9% to $89.41 per barrel. As such, energy (-1.9%) was the worst-performing sector today, with oil stocks like Valero Energy (VLO, -2.8%) and Devon Energy (DVN, -3.0%) suffering notable declines.

While the major indexes spent most of the morning in negative territory, buyers swooped in around lunchtime to push them higher. By the close, the Nasdaq Composite was up 0.6% at 13,128, while the S&P 500 Index (+0.4% at 4,297) and the Dow Jones Industrial Average (+0.5% at 33,912) also notched modest gains.

Other news in the stock market today:

- The small-cap Russell 2000 added 0.2% to 2,021.

- Gold futures tumbled 1% to end at $1,798.10 an ounce.

- Bitcoin slipped 0.8% to $23,989.59. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Walt Disney (DIS) rose 2.2% after Third Point, the hedge fund founded by billionaire investor Daniel Loeb, unveiled a new stake in the entertainment giant. The activist investor is reportedly suggesting several changes at Disney, including spinning off ESPN and voting in new board members. Third Point previously took a stake in DIS shares in 2020 before selling off that stake in Q1 of this year.

- Bed Bath & Beyond (BBBY) surged 23.4%, marking its fourth straight win. BBBY stock is now up more than 200% so far in August thanks to renewed interest from the Reddit crowd. Other meme stocks weren't in favor today, with AMC Entertainment (AMC, -1.0%) and GameStop (GME, -2.7%) both ending lower.

Making the Case for a Consumer Stock Rebound

It's time for investors to start shopping. This is according to BofA Securities analyst Sara Senatore, who says investors might want to start building a wishlist for when the Federal Reserve starts cutting rates – which BofA economists believe will happen in the second half of 2023 – paying particular attention to high-quality consumer discretionary stocks.

The sector has taken a beating in 2022, which isn't too surprising, given consumer stocks tend to lag in a rate-tightening cycle, as "the Fed's rate hikes are intended to dampen demand," Senatore says. But, investors might want to start looking for opportunities in consumer stocks, as they "materially outperform during Fed easing cycles – historically peaking five to eight months after the Fed's first rate cut," the analyst adds. Plus, "performance is neutral to positive as early as six months before the first cut and strongly positive for consumer services in those periods."

Investors looking for a place to start on their wishlist might want to consider these 11 consumer stocks. The top-rated names featured here have plenty to offer investors, including attractive valuations and impressive long-term growth outlooks. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.