Stock Market Today: Stocks Limp Out of the Starting Gate

Monday's session saw stocks give back a little territory from last week's rebound rally, but experts are seeing a few reasons to be optimistic.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Monday kicked off a fresh week of Wall Street action with a day of calm tradng that saw the major indexes give up just a skosh of last week's rip-roaring gains.

"For the third time this year, the S&P 500 ended the week up [greater than] 6%," says Michael Reinking, senior market strategist for the New York Stock Exchange. "Unfortunately, on each of those occasions, the gains were just recouping losses in the weeks that had preceded it, and ultimately unwound not long thereafter."

The most noteworthy group move of the day came from the energy sector (+2.9%). Stocks including Marathon Oil (MRO, +4.9%) and Valero Energy (VLO, +8.0%) rocketed higher amid a 1.8% jump in U.S. crude oil futures, to $109.57.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Elsewhere, Robinhood Markets (HOOD) shares were temporarily halted and finished with a 14.0% pop following a Bloomberg report saying crypto exchange FTX was exploring ways to acquire the firm. However, late in the trading day, FTX founder and CEO Samuel Bankman-Fried told CNBC "there are no active M&A conversations with Robinhood."

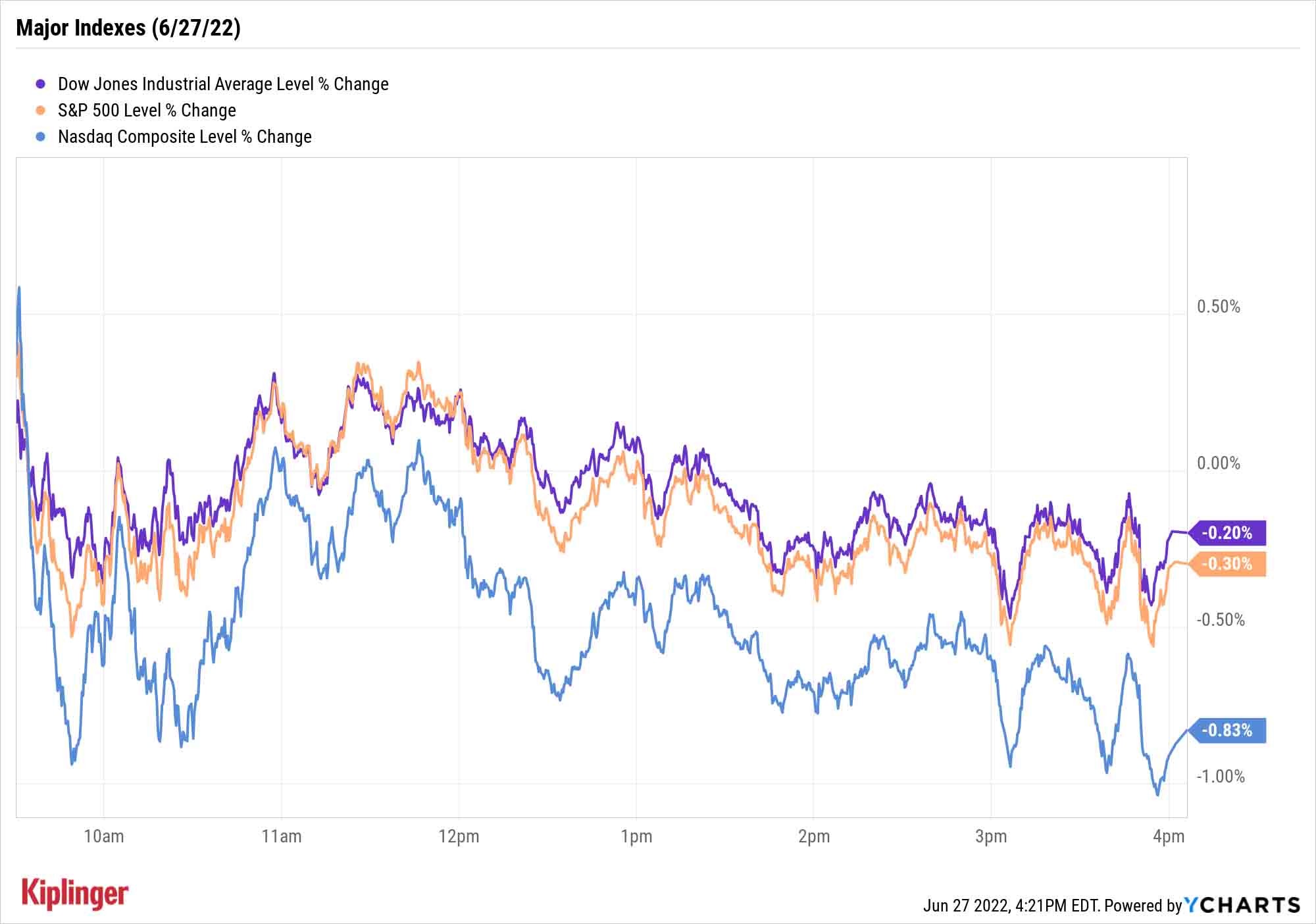

The Nasdaq Composite fared worst of the major indexes, and even then, it declined just 0.8% to 11,520. The S&P 500 slipped 0.3% to 3,900, and the Dow Jones Industrial Average was off 0.2% to 31,438. Regardless, experts pointed to a couple positive signs on the inflation front that could mean better things for equities a little farther down the road.

Peter Essele, head of portfolio management for Commonwealth Financial Network, noted that durable goods orders rose 0.7% in May – the strongest such reading since January.

"Of particular note are the increases in inventories and manufacturers' shipments, which continue to outpace new orders on a year-over-year basis," he says. "The recent moves speak to easing supply constraints across various goods channels. If current trends continue, it's likely that inflation will moderate in the coming months, offering relief to consumers and setting up a strong outlook for equities in the second half of the year."

Meanwhile, Jay Hatfield, CEO at Infrastructure Capital Management, pointed to the Federal Reserve's continued reduction of the balance sheet.

"We estimate that the Fed is more than halfway through its quantitative tightening program," he says. "We project that the quantitative tightening already executed will cause inflation to decrease in the fall. Most commodity prices are off over 20% from the highs and these declines should start to be reflected in lower [consumer price index] numbers to be released in August."

Other news in the stock market today:

- The small-cap Russell 2000 bucked the trend, finishing up 0.3% to 1,771.

- U.S. crude futures rose 1.8% to finish at $109.57 per barrel.

- Gold futures edged up 0.3% to settle at $1,824.80 an ounce.

- Bitcoin slid 1.8% to $20,856.59. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Coinbase Global (COIN) plunged 10.8% after Goldman Sachs Equity Research analyst Will Nance downgraded the crypto exchange operator to Sell from Neutral and slashed his price target to $45 from $70 – a nearly 20% discount to today's close at $55.96. "We believe current crypto asset levels and trading volumes imply further degradation in COIN's revenue base, which we see falling ~61% year-over-year in 2022, and ~73% in the back half of the year," Nance says. The analyst also believes additional job cuts are necessary in order to stem a "cash burn as retail trading activity dries up," even after COIN's recent announcement that it is reducing its workforce by roughly 18%.

- Etsy (ETSY) stock tumbled 3.6% after Needham analyst Anna Andreeva downgraded the online marketplace to Neutral from Buy. While the analyst says she still believes Etsy is "unique with a big opportunity to drive frequency for both buyers and sellers" over the long term, "the discretionary nature of the ETSY model [is] increasingly at risk" in the near term.

Dividends Are Defending Investors

Very few areas of the market are working in investors' favor this year, but dividend stocks have been a sorely needed bright spot.

Our Kiplinger Dividend 15, for instance, has put up positive returns over the past 12 months while the S&P 500 is sitting in red ink – you can thank a much-higher-than-average income stream that's helping to offset a period of weaker price returns.

Investors in the Dow's best-paying dividend stocks have also enjoyed a relative respite. From our Dan Burrows:

"A cap-weighted index of the five top-rated Dow dividend stocks yielding at least 2% as of Feb. 14 [when we compiled our original list] has generated a total return of 11% in 2022. By comparison, the S&P 500's year-to-date total return stands at negative 17.5%."

As we near the second half of 2022, we're taking a refreshed look at the Dow – and seeking out the industrial average's best-rated dividend-yielding components again. While the list has changed somewhat from the beginning of the year, all five stocks appear to pack the tools investors will need to outperform through the end of 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.