Stock Market Today: Stocks Stick the Landing in Successful Short Week

Small hints that inflation might have peaked and that the U.S. might evade recession stoked broad buying Friday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

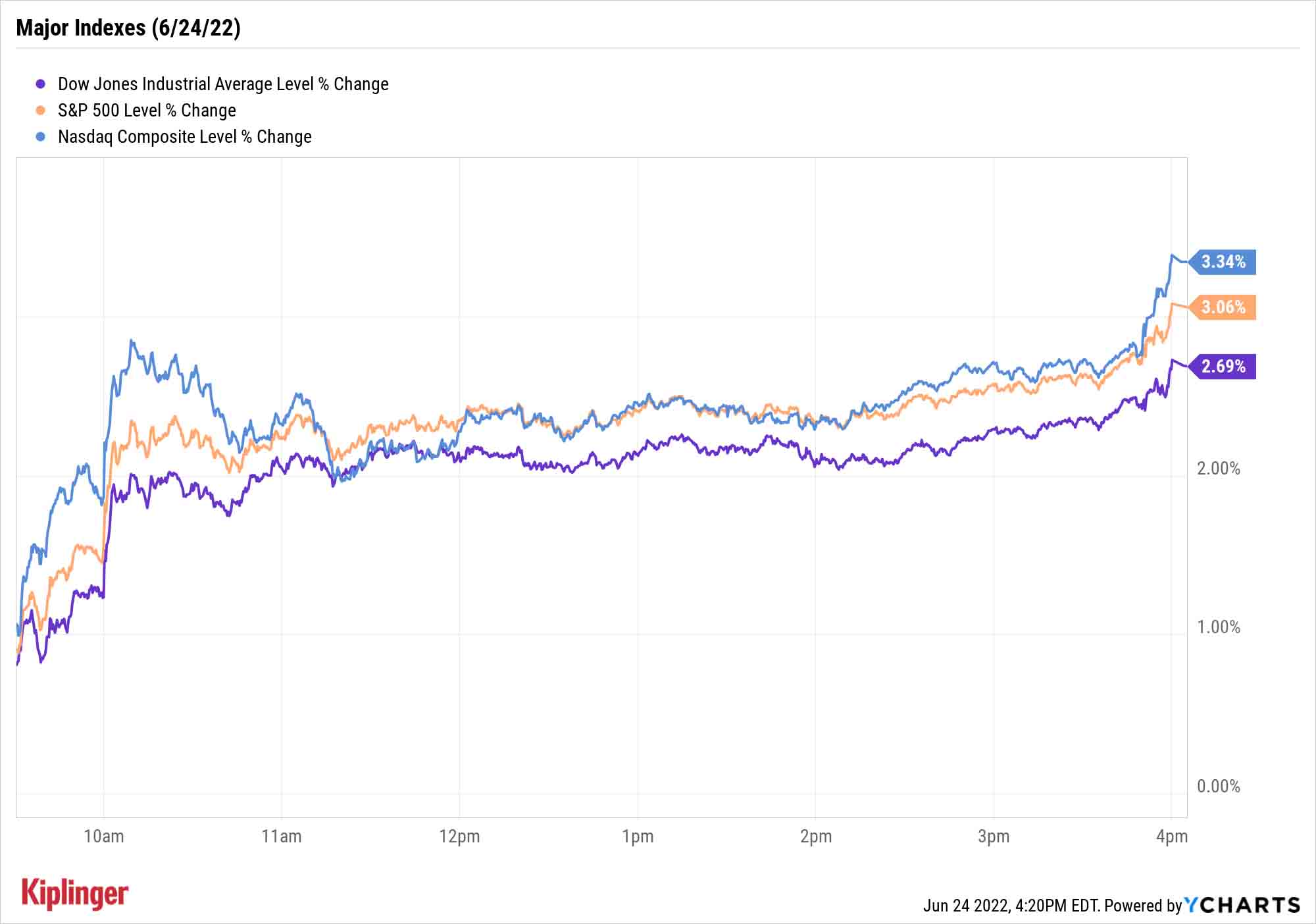

The major indexes finished the holiday-shortened week with a flourish as a recent relief rally chalked up sizable gains across the four-day period.

Federal Reserve Bank of St. Louis President James Bullard said Friday that "it is a little early to have this debate about recession probabilities in the U.S." Meanwhile, he continued to pound the table for continued aggressive interest-rate increases – remember, the Fed is just more than a week removed from its rate hike since 1994 – to repel rapidly rising consumer prices.

"Bullard's optimism is justified if inflation [does] manage to peak," says Edward Moya, senior market strategist at currency data provider OANDA. "The best-case scenario for equities is that inflation continues to show signs of peaking and the consumer remains strong."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What do consumers have to say about that? Well … the University of Michigan's Surveys of Consumers sentiment index dropped to 50.0 for June – its lowest reading since the index was established in the 1970s. But the report had a bright spot: Expectations for inflation in the year ahead dipped to 5.3% from 5.4% in the preliminary report, while the five-to-10-year outlook eased to 3.1% from 3.3%.

All 11 S&P 500 sectors finished solidly in the green Friday. The financial sector (+3.8%) pounced, with names like Wells Fargo (WFC, +7.6%) and PayPal Holdings (PYPL, +5.2%) breathing a large sigh of relief. Other cyclical sectors, such as industrials (+3.5%) and materials (+4.0%), enjoyed significant gains too.

The Nasdaq Composite (+3.3% to 11,607) walked away with a 7.5% weekly gain. The S&P 500 (+3.1% to 3,911) improved by 6.4% over the four-day period, and the Dow Jones Industrial Average (+2.7% to 31,500) was up 5.4%.

Analysts keep souring on the market, however. John Butters, senior earnings analyst for FactSet, notes that the pros have been lowering their target prices on S&P 500 companies over the past few months.

"Since peaking at 5,344.26 on January 20, 2022, the bottom-up target price for the S&P 500 [calculated by aggregating median target price estimates for all the companies in the index 12 months out] has declined by 7% to 4,987.28 on June 23, 2022," he says. "This week marked the first time the bottom-up target price for the index has dipped below 5,000 since Aug. 23, 2021."

If there's a bright side, even with the recent decline in analysts' target prices, Wall Street thinks the S&P 500 will improve by more than 30% over the next 12 months.

Other news in the stock market today:

- The small-cap Russell 2000 roared ahead 3.2% to 1,765.

- U.S. crude futures jumped 3.2% to finish at $107.62 per barrel.

- Gold futures notched a marginal gain to settle at $1,830.30 an ounce.

- Bitcoin cleared the $21,000 level, improving by 1.6% to 21,239.04. Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Carnival (CCL) soared 12.4% after the cruise operator reported earnings. In its fiscal second quarter, CCL reported an adjusted net loss of $1.9 billion – narrower than the $2.1 billion loss it incurred in the year-ago period – and revenue of $2.4 billion, a nearly 50% sequential rise. The company also said booking volumes for all future sailings were almost double what they were in Q1 – and marked the best quarter for bookings since the pandemic started. Carnival's earnings reaction created a halo effect for fellow cruise stocks Royal Caribbean (RCL, +15.8%) and Norwegian Cruise Lines (NCLH, +15.4%).

- FedEx (FDX) was another post-earnings winner, surging 7.2% after its results. In its fiscal fourth quarter, the shipping giant reported adjusted earnings of $6.87 per share on revenue of $24.4 billion, up 37% and 8% year-over-year, respectively. "The revenue growth was entirely due to FDX leveraging its pricing power with 10%-plus rate hikes at all segments," says CFRA Research analyst Colin Scarola (Strong Buy). "By design, the rate hikes helped slow volume, allowing FDX's previously overloaded network to operate more efficiently, in our view. Labor and equipment-related costs were up just 0% and 3% year-over-year, respectively, driving May quarter operating margin to 9.2% vs. an average of 6% since the pandemic began. We see further margin improvement in fiscal 2023 and 2024, and believe shares are materially undervalued even in a recession scenario."

Buffett Keeps Hoovering Up Occidental

One of this week's most interesting developments comes courtesy of Berkshire Hathaway (BRK.B). On Wednesday night, the company disclosed that Warren Buffett is continuing to buy shares of Occidental Petroleum (OXY) with both hands.

Specifically, Berkshire recently bought 9.6 million OXY shares worth about $530 million, according to a regulatory filing. Add that to some massive first-quarter buying, and that brings the equity portfolio's stake in the integrated energy firm to 152.7 million shares worth nearly $9 billion at current prices. Buffett owns $10 billion worth of 8% preferred shares and 84 million warrants, too; all in, he owns about one-third of Occidental.

And at least one analyst thinks Uncle Warren could be set up to buy the rest.

Read on as we explore why Occidental Petroleum could go from part of the Berkshire Hathway equity portfolio holding to a fully owned entity, joining the likes of Dairy Queen, GEICO and BNSF Railway.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.