Stock Market Today: Late Rally Gives Stocks a Sunnier Start to May

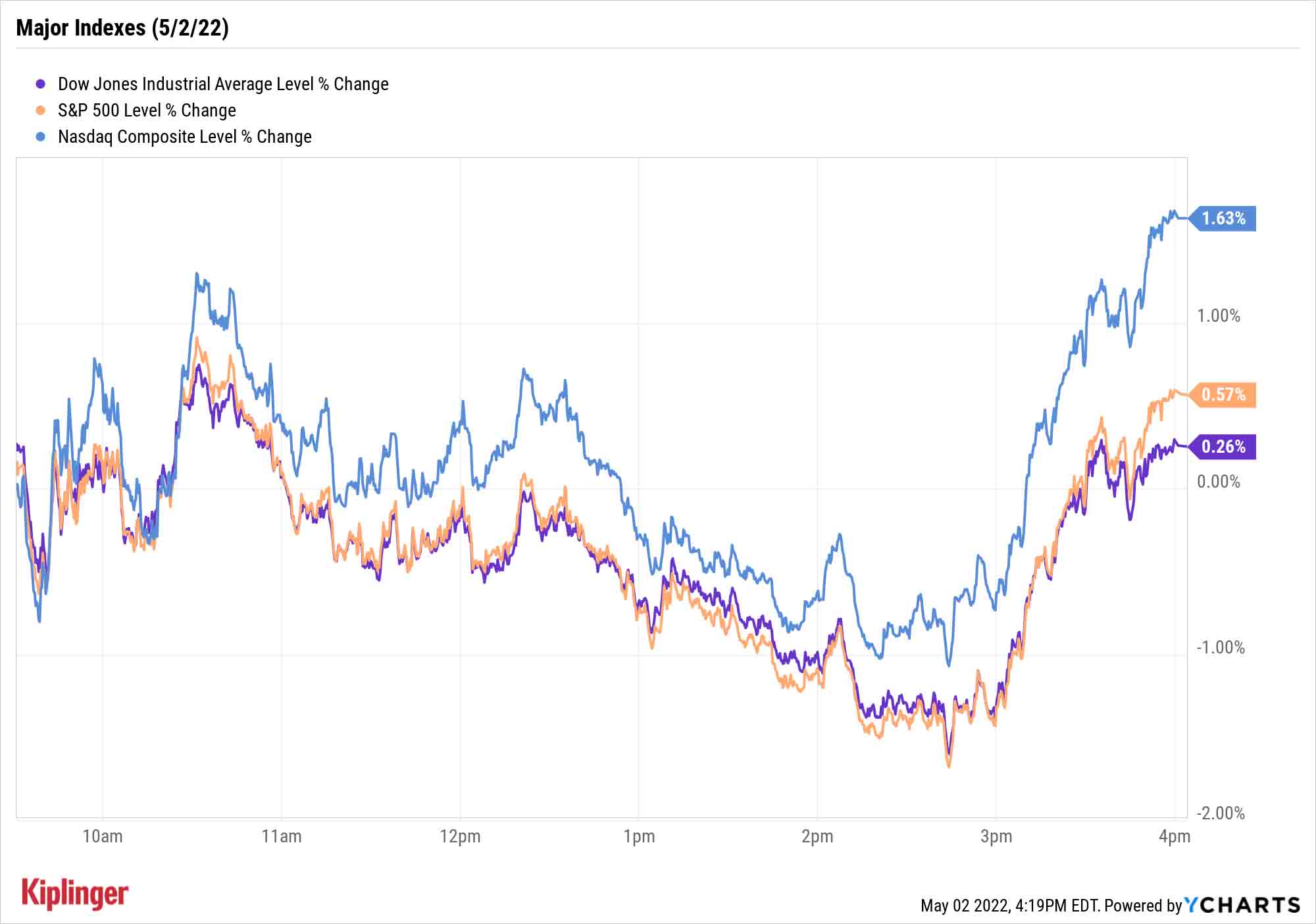

The major indexes appeared ready to plumb new 2022 depths Monday, but an afternoon bounce-back gave investors much-needed relief.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market's 2022 washout, which included an uncharacteristically awful April for equities, looked like it was about to bleed into May, but a late relief rally helped the major indexes finish in positive territory for the month's first session.

Monday's early selling might have in part been triggered by a weak Institute for Supply Management manufacturing purchasing managers' index, which showed activity declining 1.7 points in April to 55.4 (still expanding, but at a slower pace, and below expectations).

"Headwinds from [supply pressures and softer external demand] have intensified in March and April in the wake of geopolitical developments despite strong domestic final demand," says Barclays economist Jonathan Millar.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Nerves also might be frayed ahead of what will prove a busy week. In addition to another full earnings slate and Friday's April jobs report, the next chapter of Federal Reserve monetary tightening is expected to come Wednesday, when the Federal Open Market Committee makes its latest policy statement.

Wall Street is overwhelmingly betting on a 50-basis-point increase to the central bank's benchmark interest rate, and some strategists see Fed Chair Jerome Powell stuck between a rock and a hard place.

"The question becomes 'How many more [rate hikes] does Powell signal?'" says Tom Porcelli, chief U.S. economist for RBC Capital Markets. "The market expects we'll also see [50-basis-point hikes] at the June and July meetings. The next meeting is September, and it's not quite fully priced for a 50.

"And there is part of the challenge for Powell. If he relents at all on his hawkish position, the market will begin to remove this aggressive stance and we'll see an easing in financial conditions and that is exactly what he does not want to happen, not at the moment anyway."

The major indexes, which looked primed to plumb new year-to-date lows early on, flipped into green during the session's final hour. The Nasdaq Composite (+1.6% to 12,536) led the way, followed by the S&P 500 (+0.6% to 4,155) and Dow Jones Industrial Average (+0.3% to 33,061).

Other news in the stock market today:

- The small-cap Russell 2000 joined in on the afternoon rally, improving by 1.0% to 1,882.

- U.S. crude oil futures edged up 0.5% to $105.17 per barrel.

- Gold futures suffered their worst daily decline since early March, sliding 2.6% to $1,863.60 an ounce.

- Bitcoin gained a little bit of ground, improving 0.6% to $38,567.40. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Global Payments (GPN) sank 9.2% after the payments technology firm reported earnings. In its first quarter, GPN reported higher-than-expected adjusted earnings of $2.07 per share on in-line revenue of $1.95 billion, while also maintaining its full-year outlook. As for today's slide, Oppenheimer analyst Dominick Gabriele suggests Wall Street might have been looking for "more top-line growth" following solid results from Visa (V) and Fiserv (FISV).

- Align Technology (ALGN) gained 6.5% after the Invisalign maker said it kicked off a $200 million accelerated stock buyback program. Shares plummeted to a new 52-week low of $270.37 late last week after the company's earnings report reflected "the quarter's underperformance, lower visibility causing ALGN to revoke revenue guidance, and the negative management tone around global headwinds which will likely impact earnings per share growth," says CFRA Research analyst Paige Meyer (Hold).

Investors More Bearish Than They've Been in Decades

Monday's higher close belies investors' deep gloom.

The American Association of Individual Investors has, since 1987, run a weekly survey that gauges investors' sentiment by asking "Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?" In the most weekly survey, optimists are in short supply.

"There haven't been so few "bullish" investors in 30 years," says Ross Mayfield, investment strategy analyst at Baird. "Just as a refresher, that stretch includes the dot-com crash, the 2008 Financial Crisis, and the COVID-19 pandemic."

But before you gnash your teeth or rend your garments, consider that the stock market is often darkest right before its dawn.

"Equity returns from periods of elevated bearishness tend to be outstanding," Mayfield continues. "The average 12-month return from these periods is double the all-period average, and perhaps more importantly, the hit rate for a positive return is nearly 100%. You might not always get the 20% return over 12 months, but you almost never lose money – and that's half the battle. As it turns out, a great time to be bullish is when everyone is bearish. Or, as the saying goes, 'Be greedy when others are fearful.'"

Indeed, rather than "sell in May and go away," investors might consider a springtime spree of dip buys on downtrodden stocks that are potentially poised to ride secular trends higher over the coming year.

Electric vehicle shares, for instance, now trade at far better valuations than they have over the past year-plus.

Another place to look is big data – as companies gather ever-growing troves of data, they're also finding this information increasingly difficult to sift through. But big data firms can help corporate America gain valuable insights from this information, and could become staples of doing business in the future.

Here are five big data names worth a closer look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.