Stock Market Today: Big Tech Carries Wall Street on Its Back

Facebook parent Meta Platforms and chipmaker Qualcomm spearheaded a wild rally during Thursday's earnings-driven session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Technology and tech-esque stocks were the vanguard for a wild (and broad) stock-market rally Thursday that largely ignored an unexpected contraction in U.S. economic activity.

This morning, the Commerce Department reported that U.S. gross domestic product declined at a 1.4% annualized pace during the first quarter of 2022, falling far shy of the 1% gain that economists, on average, expected. However, several experts noted that it wasn't all bad news; a 2.7% rise in consumer spending and other metrics made the report more noise than omen.

"Huge miss on GDP this morning, but just looking at the headline [number] is misleading; we'd rate the report neutral overall," says Cliff Hodge, chief investment officer for registered investment advisory firm Cornerstone Wealth, who believes the report was overall marginally net-bullish for risk assets. "Trade, inventories and government spending all dragged, but the consumer held up and business investment was strong.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The big headline miss also gives the Fed some breathing room," he adds.

Investors and traders seemed more occupied with the earnings calendar. Facebook parent Meta Networks (FB, +17.6%) rocketed higher despite missing revenue expectations; bulls instead celebrated a wide earnings beat ($2.72 vs. $2.56 est.) and a return to user growth. Specifically, the Facebook app's daily active user count grew by 4%, to 1.96 billion, following a thin 1 million decline in Q4 2021.

Semiconductor firm Qualcomm (QCOM, +9.7%) delivered a monster quarter, too. Growth in all four major chip markets sent revenues and earnings per share up 41% and 69% year-over-year, respectively, to easy beat estimates. That news stirred the entire semiconductor industry, with rivals including Nvidia (NVDA, +7.4%) and Advanced Micro Devices (AMD, +5.6%) up big.

Apple (AAPL, +4.5%) and Amazon.com (AMZN, +4.7%) were also bid higher ahead of their quarterly reports, due out after Thursday's close. The latter plunged 10% in early after-hours trading after reporting a $2 billion first-quarter loss and delivering a weak Q2 revenue forecast. The former had yet to report as of this writing.

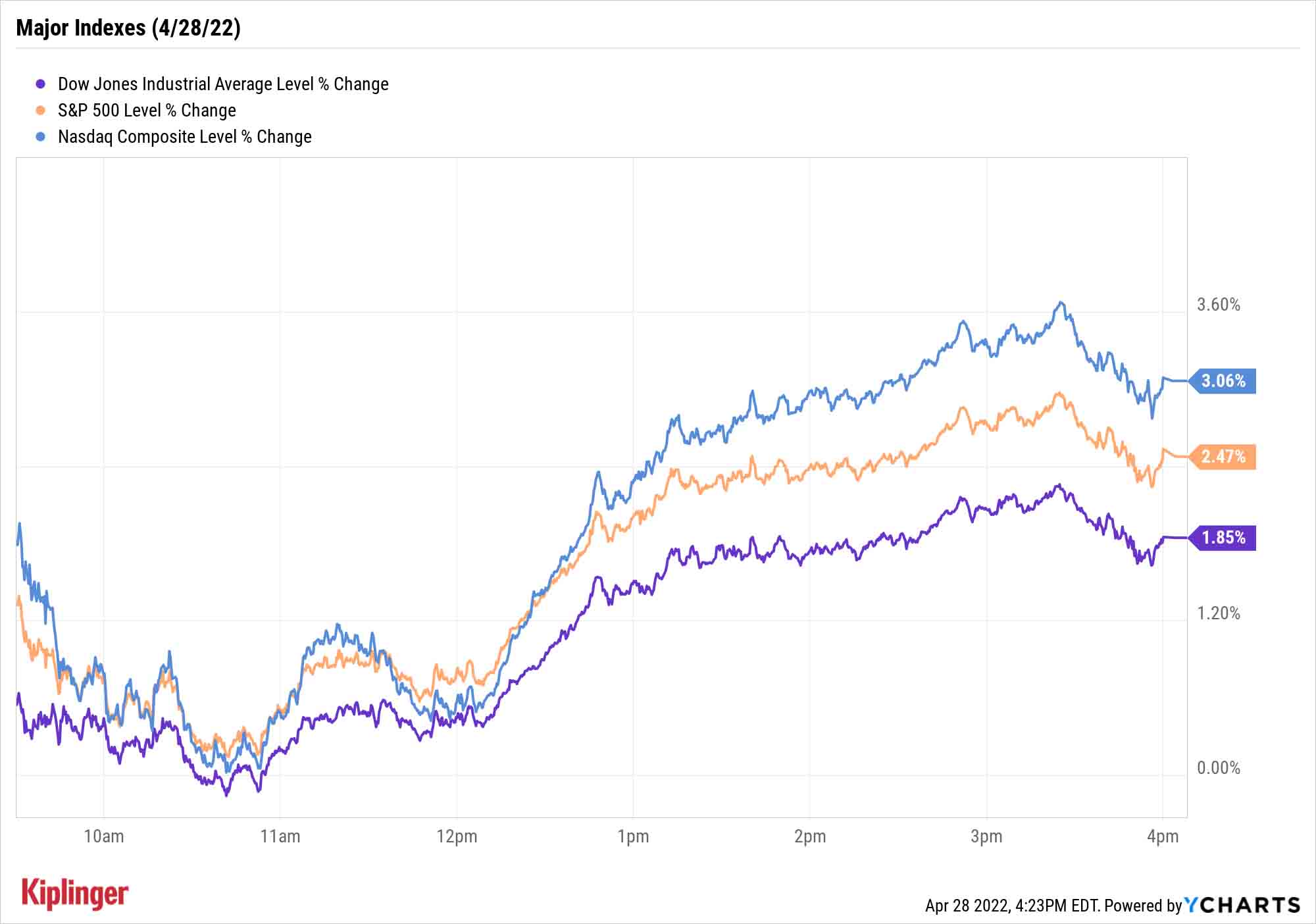

Strength in the technology (+4.0%) and communication services (+4.0%) sectors lifted the recently battered Nasdaq Composite 3.1% to 12,871. The S&P 500 closed up 2.5% to 4,287, while the Dow Jones Industrial Average gained 1.8% to 33,916.

Other news in the stock market today:

- The small-cap Russell 2000 climbed 1.8% to 1,917.

- Reports that Germany is open to a Russian oil embargo sent U.S. crude oil futures up 3.3% to $105.36 per barrel.

- Gold futures edged up 0.1% to settle at $1,891.30 an ounce.

- Bitcoin continued its recent recovery, gaining 2.9% to $39,969.33. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- McDonald's (MCD) improved by 2.9% after the fast food giant reported earnings. While MCD's decision to suspend operations in Russia cost it $127 million, or 13 cents per share, in its first quarter, the company still brought in adjusted earnings of $2.28 per share – more than the $2.17 per share analysts, on average, were expecting. Revenue of $5.7 billion also exceeded expectations, as did U.S. same-store sales growth of 3.5%.

- PayPal Holdings (PYPL, +11.5%) reported adjusted earnings of 88 cents per share in its first quarter, in line with the consensus estimate, on higher-than-anticipated revenue of $6.5 billion. PYPL also lowered its full-year guidance – now calling for revenue growth of 11%-13% from its prior forecast for 15%-17% – amid "more normalized consumer e-commerce spending," said CEO Dan Schulman in the company's earnings call. "Despite the weak guidance, we expect PayPal to continue to show steady long-term growth in payment volumes as it adds merchants, signs additional partnerships, increases the number of transactions per customer, and benefits from the shift to digital payments," says Argus Research analyst Stephen Biggar (Buy).

- Teladoc Health (TDOC) plummeted 40.2% after the telemedicine company recorded a net loss of $6.7 billion, or $41.58 per share, in its first quarter – due largely to a $6.6 billion impairment charge – on revene of $565.4 million, below the $569 million analysts were expecting. TDOC also lowered its full-year revenue and adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) outlooks amid higher costs and longer sales cycles for businesses. Still, Oppenheimer analyst Michael Wiederhorn maintained an Outperform (Buy) rating on TDOC stock. " Overall, although the market has become extremely competitive around customer acquisition, we still believe TDOC is positioned to outlast the irrational behavior from its smaller competitors," the analyst writes in a note to clients.

37 Ways to Earn Up to 9% on Your Money

2022 has flipped the script on income investors, for the worse, but also for the better.

An aggressive Federal Reserve, finally feeling comfortable with the idea of raising its benchmark rate, has sent yields on bonds soaring (and prices, which move in the opposite direction, plunging). However, dividend stocks – especially those of the higher-yield persuasion – have done just dandily; the same Fed moves, as well as worries about U.S. and Chinese economic growth, have dented growthier firms and sent many investors looking for more defensive equities.

Still, regardless of how you typically like to generate investment income, there are attractive opportunities right now in every corner of the market – bonds, regular stocks, even special classes such as master limited partnerships (MLPs) and closed-end funds (CEFs).

And we can introduce you to those opportunities all in one place.

Check out our recent "yieldfest": A look at 37 different ways to produce some investment cash, from extremely low-risk money-market funds to exotic high-yield funds.

Kyle Woodley was long AMZN, AMD, FB, NVDA and PYPL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.