Stock Market Today: Tech Stocks Lag as Treasury Yields Keep Rising

The 10-year Treasury yield rose for a sixth straight day to hit a new three-year high.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tech stocks underperformed in today's session, much as they've done over the last few months.

The technology sector gave back 1.4% as the 10-year Treasury yield climbed 5.2 basis points (a basis point is one-one hundredth of a percentage point) to 2.71% – a level not seen since March 2019. The longer-dated bond yield is up six days in a row amid expectations the Federal Reserve will undergo an aggressive monetary policy tightening campaign with 50-basis-point rate hikes and the sale of $95 billion in assets each month.

Energy, meanwhile, was the best-performing sector, rising 2.8% as U.S. crude futures jumped 2.3% to $98.26 per barrel. Financials (+1.0%) and material stocks (+0.6%) were other pockets of strength in today's trading.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

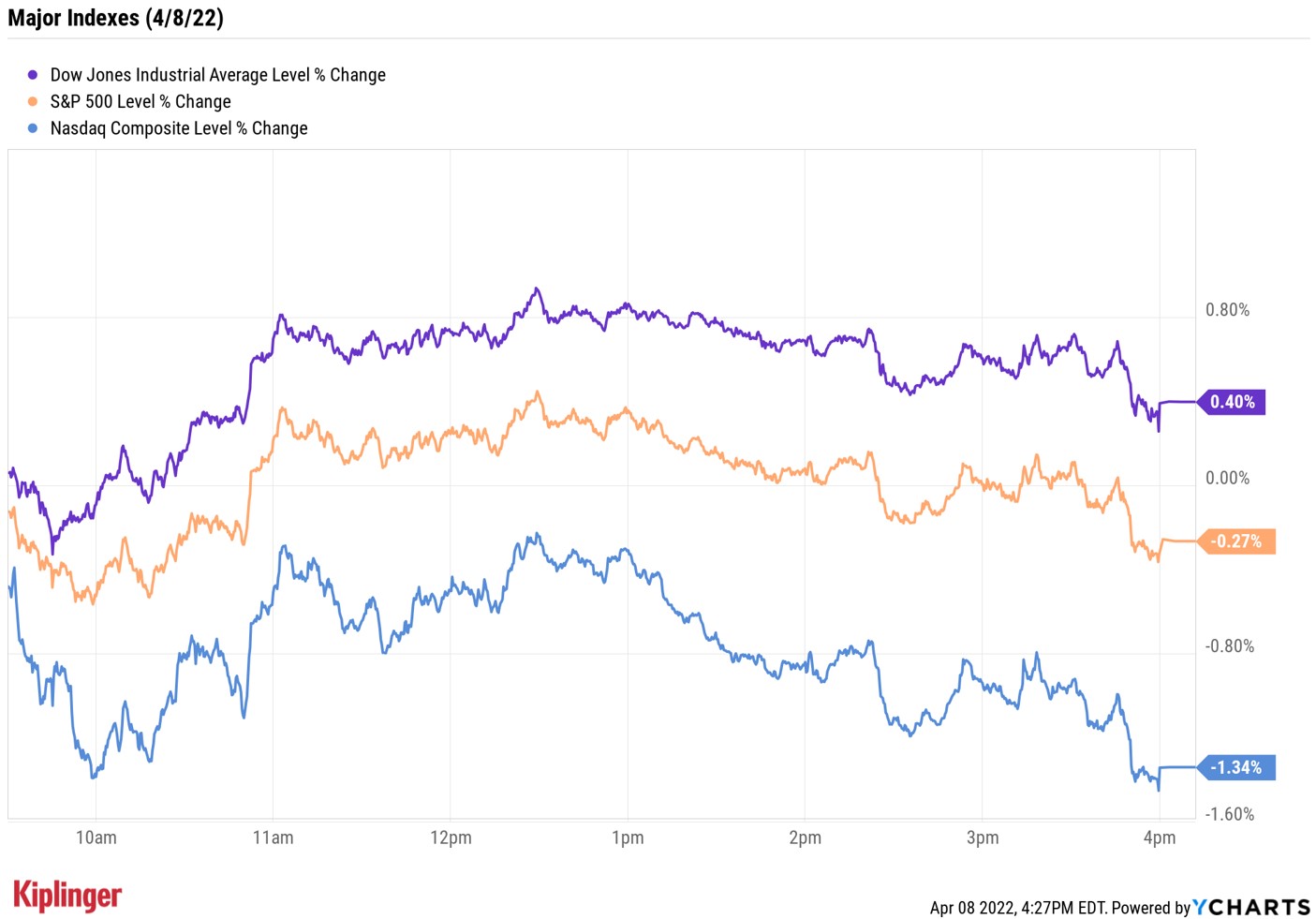

At the close, the Nasdaq Composite was down 1.3% at 13,711, with chip stocks Nvidia (NVDA, -4.5%) and Marvell Technology (MRVL, -3.8%) among the day's biggest decliners. The S&P 500 Index (-0.3% to 4,488) also ended lower, while the Dow Jones Industrial Average (+0.4% to 34,721) finished the day in the green.

For the week, the Nasdaq shed 3.9%, the S&P 500 gave back 1.3% and the Dow slipped 0.3%.

Other news in the stock market today:

- The small-cap Russell 2000 shed 0.8% to 1,994.

- Gold futures rose 0.4% to finish at $1,945.60 an ounce.

- Bitcoin fell 1.5% to $42,777. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- EPAM Systems (EPAM) was one of the biggest gainers today, adding 9.9% after the software development company said it is ending operations in Russia. Stifel analyst David Grossman maintained a Buy rating on the tech stock in the wake of the news. "We interpret today's announcement as a positive as it removes the most visible overhang from a customer standpoint and accelerates EPAM's initiative to geographically diversify its labor base," Grossman writes in a note.

- HP (HPQ, -7.1%) was downgraded to Neutral (Hold) from Buy at UBS Global Research. This came on the heels of yesterday's announcement that Warren Buffet bought HPQ stock and occurred amid a "confluence of factors including incremental signs of softness in low-end Consumer PCs following recent checks over the past month along with the likelihood of a slower buyback next year following the expected close of the Plantronics deal in late calendar-year 2022," writes UBS analyst David Vogt.

Stock Selection is Becoming Increasingly Important

Next week, we'll start to get a look at the latest inflation figures with Tuesday's release of the consumer price index. Plus, the start of earnings season will offer an initial gauge of how corporate America fared during a period of scorching prices.

This will be especially important to investors looking to target firms that have been able to withstand red-hot inflation thanks to rock-solid balance sheets.

A focus on quality stocks will give them a better shot at building resilience in their portfolios, according to Tony DeSpirito, CIO of BlackRock's U.S. Fundamental Active Equities. He says that stock selection is becoming more important as investors "must discern which companies are most impacted by rising costs, and which have the pricing power to pass those higher costs through to consumers and maintain their profit margins."

But stock picking isn't for everyone, and some investors may want to leave making these judgments to the pros. Those looking for a human touch could check out the Kip 25 – Kiplinger's list of our favorite low-fee mutual funds. Another great place to look is the small but expanding group of actively managed exchange-traded funds (ETFs). This list of equity and fixed-income ETFs aligns with a variety of risk tolerances and investing horizons, and all are run by seasoned stock pickers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.