Stock Market Today: Stocks Scratch Out Meager Gains

Lowest jobless claims number since 1968 gives the major indexes just enough oomph to avoid a third straight session in the red.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Wall Street seemed to be en route to another day of losses, but a strong jobless-claims report helped stocks gain some momentum ahead of the week's final session.

The Labor Department on Thursday said that for the week ended April 2, just 166,000 Americans filed for unemployment benefits – the lowest number since November 1968 (though also what they were for the week ended March 19). It also easily flew in lower than the 200,000 claims expected.

"Initial jobless claims looked too good to be true," says Edward Moya, senior market strategist at currency data provider OANDA. "Today's impressive claims data reminds Wall Street that the labor market is 'firing on all cylinders', which should allow the Fed to continue to solely focus on inflation."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, while the markets did manage to turn higher, it was primarily led by defensive names. Pfizer (PFE, +4.3%) and Thermo Fisher Scientific (TMO, +4.2%) were among the best performers in the healthcare sector (+1.9%), while Costco (COST, +4.0%) and Target (TGT, +5.7%) helped lift consumer staples stocks (+1.2%).

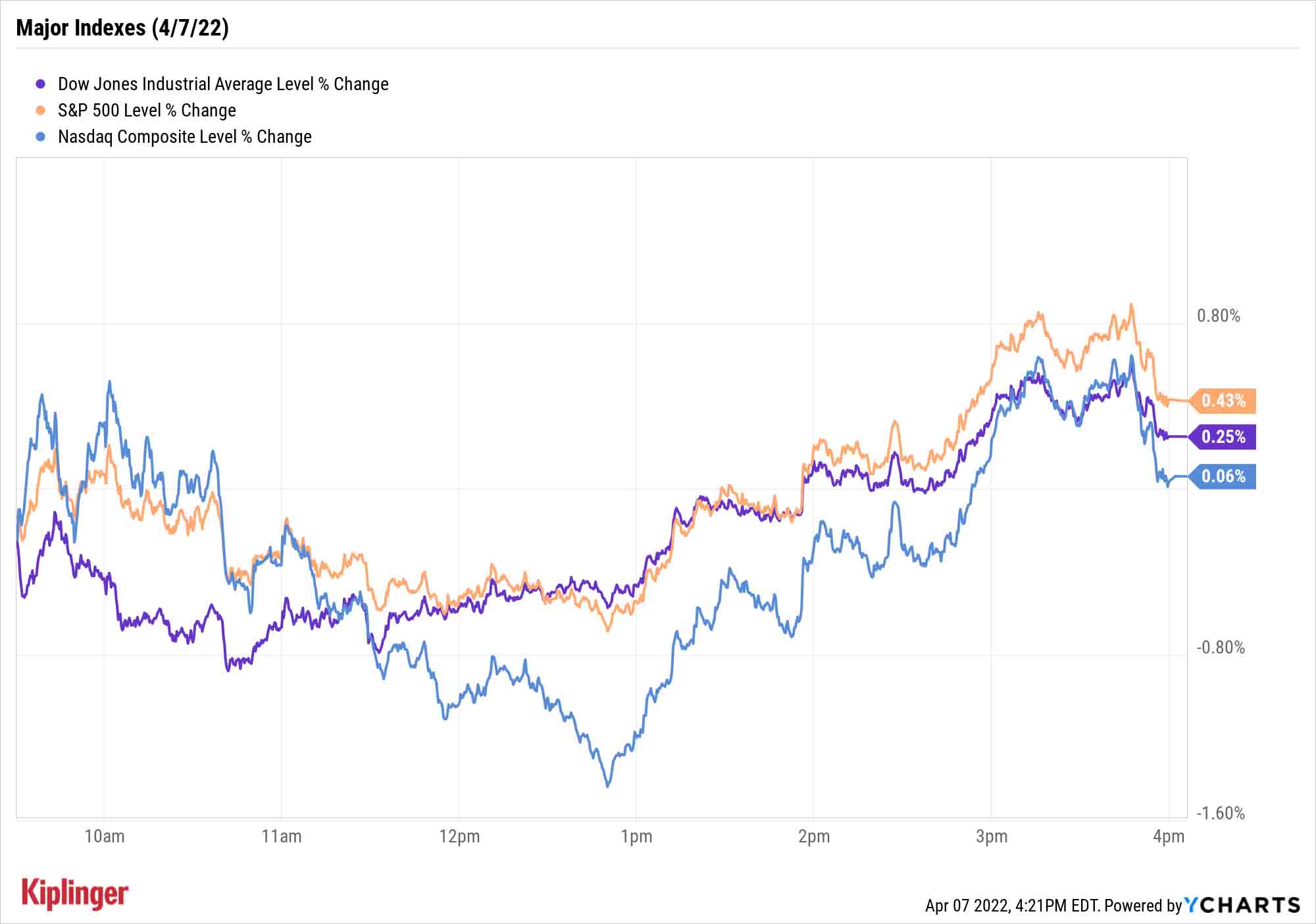

The end result was modest gains among the major indexes. The Dow Jones Industrial Average closed up 0.3% to 34,583, the S&P 500 improved 0.4% to 4,500 and the Nasdaq Composite eked out a marginally higher finish at 13,897.

"We continue to see defensive trading patterns in the options market, especially at the onset of earnings season, and remain surprised that the Cboe Volatility Index, or VIX, remains relatively subdued," says Steven Sears, president and chief operating officer of asset-management firm Options Solutions. "If earnings reports are as stressed as many investors believe they could be amidst these extraordinary economic and risk conditions, we could see a sharp investor re-rating of risk assets."

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.4% to 2,009.

- U.S. crude futures slipped 0.2% to $96.03 per barrel, marking their third straight loss.

- Gold futures gained 0.8% to settle at $1,937.80 an ounce.

- Bitcoin retreated 0.8% to $43,414.98. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Deutsche Bank analyst George Hill downgraded Rite Aid (RAD, -17.2%) to Sell from Hold and slashed his price target on the pharmacy chain to a mere dollar per share from $16. The bruising analyst note comes ahead of RAD's fourth-quarter earnings report – due out after the April 14 close – in which Hill will closely be watching the company's guidance for its next fiscal year. Why? "Because RAD needs to generate $190 million to $200 million in cash annually to cover its debt service costs, plus another $200 to $250 million to cover its store maintenance capital expenditure requirement, meaning RAD needs to generate ~$400 to $450 million in annual adjusted EBITDA [earnings before interest, taxes, depreciation and amortization ] to continue as an operating company," Hill writes in a note. Anything below that $400 million mark and "the equity arguably has no value as the company is not in a position to generate real returns to shareholders," he adds.

- Ford Motor (F) skidded to a 2.9% loss after Barclays analyst Brian Johnson cut his rating on the automaker to Equalweight from Overweight (the equivalents of Hold and Buy, respectively). The analyst said Ford remains "vulnerable" to an ongoing global semiconductor shortage, while additional macro headwinds like commodities inflation could pressure margins. "Despite the selloff, we believe investors are still underestimating risks to the sector – and in particular to suppliers - from inflation and production pressures – as well as the impact of interest rate hikes on portfolio allocations," the analyst says.

Buffett Makes Another Big Buy

One of the day's most noteworthy gainers was printer leader HP (HPQ, +14.8%), but it had nothing to do with any economic indicators. No, HP's good fortune was a vote of confidence from none other than the Oracle of Omaha.

Last night, Warren Buffett's Berkshire Hathaway disclosed a huge 11.4% stake in HPQ stock, immediately making it a dominant shareholder in the PC-and-printers name. Berkshire bought up 121 million shares worth $4.2 million, surpassing asset manager Vanguard as the top holder of HPQ.

Much of the Berkshire Hathaway portfolio represents bets by one of the greatest investors of all time, so as most of our readers know, we regularly keep tabs on what Buffett is buying and selling. But he has been busier than usual of late, also taking a massive stake in oil play Occidental Petroleum (OXY) and outright buying insurer Allegheny (Y) in the past month or so alone.

Berkshire's most recent splash might leave some investors scratching their heads. But we explain why and how the HPQ stake move looks like a classic Buffett bet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.