Stock Market Today: Russia-Ukraine Escalation Knocks S&P Into Correction

The S&P 500 officially is off by more than 10% from its January highs as Russian troops enter Ukraine and world leaders respond with sanctions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Any feelings of relaxation from the long holiday weekend were snuffed out Monday, as the worsening Ukraine-Russia conflict sent the S&P 500 into correction territory for the first time since 2020.

Over the weekend, Russian President Vladimir Putin ordered troops to enter areas of eastern Ukraine – a move that President Joe Biden dubbed an "invasion" and was met with international sanctions.

Among them: Biden prohibited American financial institutions from processing any transactions from large Russian bank VEB and the country's military bank, Promsvyazbank, while U.K. Prime Minister Boris Johnson said his country's first round of sanctions would target IS Bank, General Bank and other Russian financials.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Commodities rose – U.S. crude oil prices were up 1.4% to $92.35 per barrel while gold was up 0.4% to an eight-month-high settlement of $1,907.40 per ounce.

But stocks declined throughout the session, led lower by the consumer discretionary sector (-2.9%), which saw the likes of Tesla (TSLA, -4.1%) and Best Buy (BBY, -7.3%) suffer sizable declines.

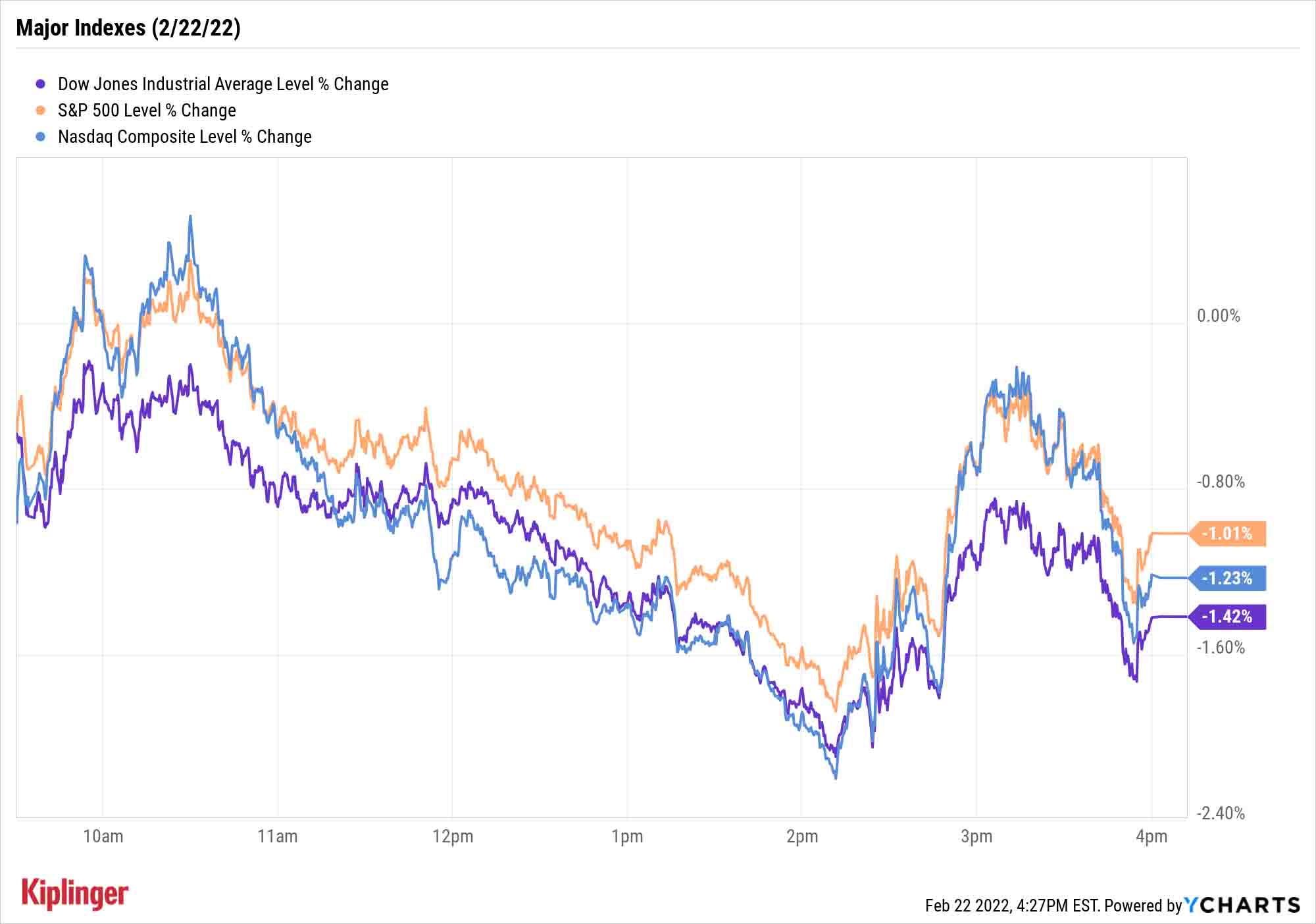

The S&P 500, off 1.0% to 4,304, finally dipped into correction territory (a decline of 10% or more from a peak). The Nasdaq Composite (-1.2% to 13,381) remains in correction, while the Dow Jones Industrial Average (-1.4% to 33,596) would need to decline another 2.0% to mark a 10% drop from its Jan. 3 record high.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 1.5% to 1,980.

- Bitcoin was punished, dropping 5.3% from Friday's levels to $37,925.63 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Home Depot (HD) was the worst Dow Jones stock today, shedding 8.9% after earnings. The home improvement retailer reported stronger than anticipated earnings of $3.21 per share and revenue of $35.7 billion in its fourth quarter, but gave a conservative fiscal 2022 outlook to account for rising inflation. Still, CFRA Research analyst Kenneth Leon maintained a Buy rating on HD stock and called its recent pullback "an enhanced buying opportunity."

- Kraft Heinz (KHC) was a rare splash of green today, with the stock climbing 5.0% after the food and beverage firm raised its long-term growth targets and reiterated its fiscal 2022 adjusted EBITDA (earnings before interest, taxes, depreciation and amortization). "Over the past 18 months, KHC has strengthened its product portfolio, reduced its debt load, and set the foundation for more profitable growth," writes CFRA Research analyst Arun Sundaram (Buy). "Phase three will look to use technology and data-driven solutions to accelerate the pace of innovation and use resources more effectively."

- Tempur Sealy International (TPX) plunged 19.4% after the mattress maker reported earnings. In its fourth quarter, TPX reported adjusted earnings of 88 cents per share on $1.36 billion in revenue, falling short of the 96 cents per share and $1.45 billion expected by analysts. The company also lifted its quarterly dividend by 11.1% to 10 cents per share.

What Russia-Ukraine Means for Your Portfolio

While stocks are facing numerous headwinds this year, military conflict is unlikely to have a lasting effect.

"As devastating as a major conflict could be between Russia and Ukraine, the truth is stocks likely will be able to withstand the geopolitical struggle," says Ryan Detrick, chief market strategist of LPL Financial, who adds that historically, major geopolitical events are often a "nonevent" for U.S. equities.

But that doesn't mean there won't be at least some short-term consequences, as today's declines clearly signal.

In the short term, for instance, commodities of all types are expected to gain additional ground – a boon for commodity funds such as these energy exchange-traded funds or these gold ETFs.

And you can check out our primer for a wider look at the various ways strategists and analysts see the Russia-Ukraine conflict making itself felt in U.S. portfolios.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.