Stock Market Today: Markets Turn Tail as Ukraine Invasion Risk Rises

Warnings that Russia is heading toward an 'imminent invasion' of Ukraine sent investors back toward the exits Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Ukraine-Russia tensions wrested control of investor sentiment from the Fed in a difficult session for the broader markets, which was exacerbated by a few pieces of disappointing economic news.

On Thursday, both U.S. President Joe Biden and British Prime Minister Boris Johnson warned that the shelling of a kindergarten in Ukraine's eastern Donbas region might be a "false-flag operation" meant to give Russia an excuse to invade the country.

"The evidence on the ground is that Russia is moving toward an imminent invasion," Linda Thomas-Greenfield, U.S. Ambassador to the United Nations, told reporters. "This is a crucial moment."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also sending stocks in the wrong direction were a few weak reports, led by initial unemployment claims that came in at 248,000 for the week ended Feb. 12 – well ahead of expectations for 219,000 filings and up from last week's upwardly revised 225,000.

Also Thursday, January housing starts came in shy of estimates, as did a February reading of Philadelphia-area manufacturing activity.

"Some of January's dip in housing starts reflects especially tough winter weather. The January industrial production report released yesterday showed utilities output jumped nearly 10% from December, even after accounting for normal seasonal swings. The severe winter weather that hit much of the country in January held back housing starts," says Bill Adams, chief economist for Comerica Bank. "But supply chain problems also continue to restrain housing activity; one illustration of the ongoing dysfunction in supply chains is the 25% monthly increase of softwood lumber prices in the January producer price index.

Investors skittered away from cyclical and growth sectors alike, with technology (-3.0%) and financials (-2.5%) leading the way down.

There was appetite for defense plays, however, with consumer staples (+0.8%) the day's best-performing sector.

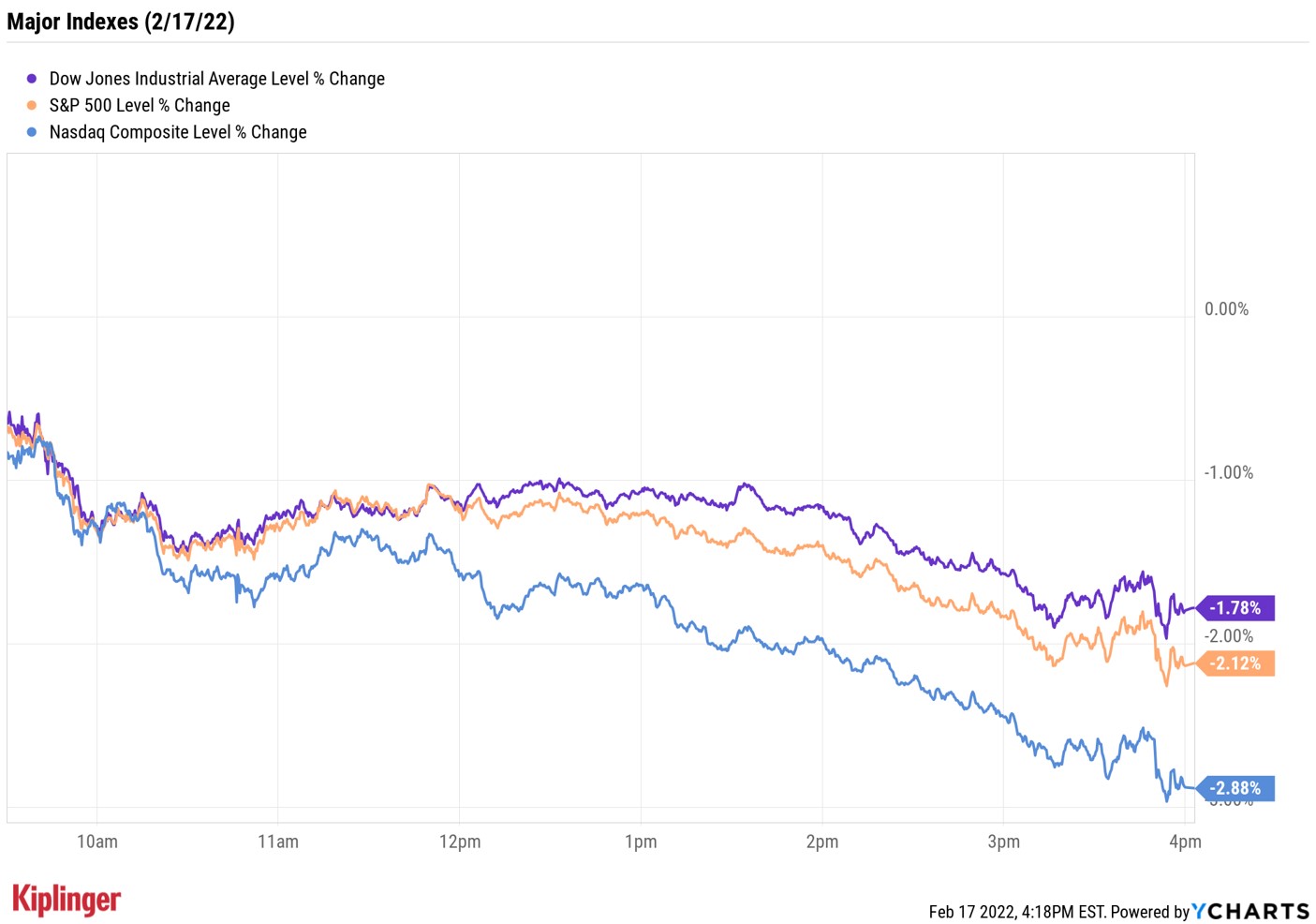

Losses accelerated later in the day, sending the Nasdaq Composite 2.9% lower to 13,716, followed by the S&P 500 Index (-2.1% to 4,380) and Dow Jones Industrial Average (-1.8% to 34,312).

"The S&P 500 has found some footing in recent days but the options market remains skittish," says Michael Oyster, chief investment officer for asset-management firm Options Solutions. "The CBOE Volatility (VIX), often referred to as the market's 'fear gauge' is in the top 15% of its history signaling concern among sophisticated investors. Both weekly and monthly options expire this Friday, which could further spike volatility."

Other news in the stock market today:

- The small-cap Russell 2000 gave back 2.5% to finish at 2,028.

- U.S. crude futures tanked 2% to settle at $91.76 per barrel.

- Gold futures jumped 1.6% to end at $1,902 an ounce.

- Bitcoin plunged 7.2% to $40,948.32. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- DoorDash (DASH) jumped 10.7% after the food delivery firm posted a 34% year-over-year jump in revenue to $1.3 billion and a 35% increase in total orders to 369 million. Plus, the company's net loss narrowed from the year prior, to $155 million. "We think DASH is seeing sustained demand within the food delivery space while momentum in new verticals (convenience, grocery, and pets) (about 14% of sales) coupled with new merchants on the platform will support growth," says CFRA Research analyst Angelo Zino. Still, the analyst kept a Hold rating on DASH.

- Walmart (WMT) was just one of a handful of Dow Jones stocks to finish in the green, jumping 4.0% following the discount mega-retailer's earnings report. In its fourth quarter, WMT reported adjusted earnings per share of $1.53 on $152.9 billion in revenue. Analysts, on average, were expecting earnings of $1.49 per share on $151.1 billion in sales. "We expect this momentum to continue in 2022 as consumers likely become increasingly price conscious, with inflation being at a 40-year high, noting WMT's average price gap relative to the competition continues to widen versus pre-pandemic levels," says CFRA Research analyst Arun Sundaram (Buy). "We also believe investors are underappreciating WMT's evolving business model, including omnichannel transformation and its high-margin alternative profit streams (e.g., advertising is now over $2B in annual revenues)."

Find Opportunity in the Market Upheaval

The market is teeming with too many risks for volatility to just magically disappear. So for now, your best options are to defend against it – or use the dips as an opportunity to invest in longer-term trends on the cheap.

Among those trends on the skids is green energy, which despite generally growing long-term growth estimates has suffered of late; several popular green energy funds are off 40%-50% over the past year.

So why now?

"Inflation and economic reopening have increased fossil-fuel prices, and alternative and clean energy returns typically rise in parallel with increasing oil costs," says exchange-traded fund provider ProShares. "Clean energy was also a priority in the initial $2.2 billion White House infrastructure proposal, and policy tailwinds for increased spending remain."

If you're looking for somewhere to begin, consider this short list of 10 green energy stocks that might be down now – but are nonetheless poised to profit from an expected boom in expanded energy capacity for years to come.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.