Stock Market Today: Dow Drops 652 Points After Powell Signals Faster Taper

Despite a looming threat from the COVID omicron variant, the Fed is likely to discuss speeding up the tapering of its asset-buying program.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Wall Street pendulum swung back to selling early Tuesday amid the growing COVID omicron threat and a surprising cue from the Fed.

Seemingly setting up today's actions was Jake Wujastyk, chief market analyst for technical analysis software firm TrendSpider, who told Kiplinger late Monday that "This week will be all about digesting the current scientific information available and seeing if lockdowns or mandates come back into play," adding that Federal Reserve Chair Jerome Powell's multiple speaking engagements this week could also be a market mover.

He was correct on both counts.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Triggering Tuesday's premarket weakness were overnight comments by Moderna (MRNA, -4.4%) CEO Stéphane Bancel, who told Financial Times he believed there would be a "material drop" in the efficacy of current COVID vaccines against the new strain.

But stocks pulled back even further after the Fed chief told the Senate Banking Committee that in light of a strong economy and high inflationary pressures, he considered it appropriate to wrap up the central bank's tapering of asset purchases "perhaps a few months sooner" than originally planned.

"The reality is hotter inflation coupled with a strong economic backdrop could end the Fed's bond buying program as early as the first quarter of next year," says Charlie Ripley, senior investment strategist for Allianz Investment Management. "Ultimately, the transitory view on inflation has officially come to an end as Powell's comments reinforced the notion that elevated prices are likely to persist well into next year. With potential changes in policy on the horizon, market participants should expect additional market volatility in this uncharted territory."

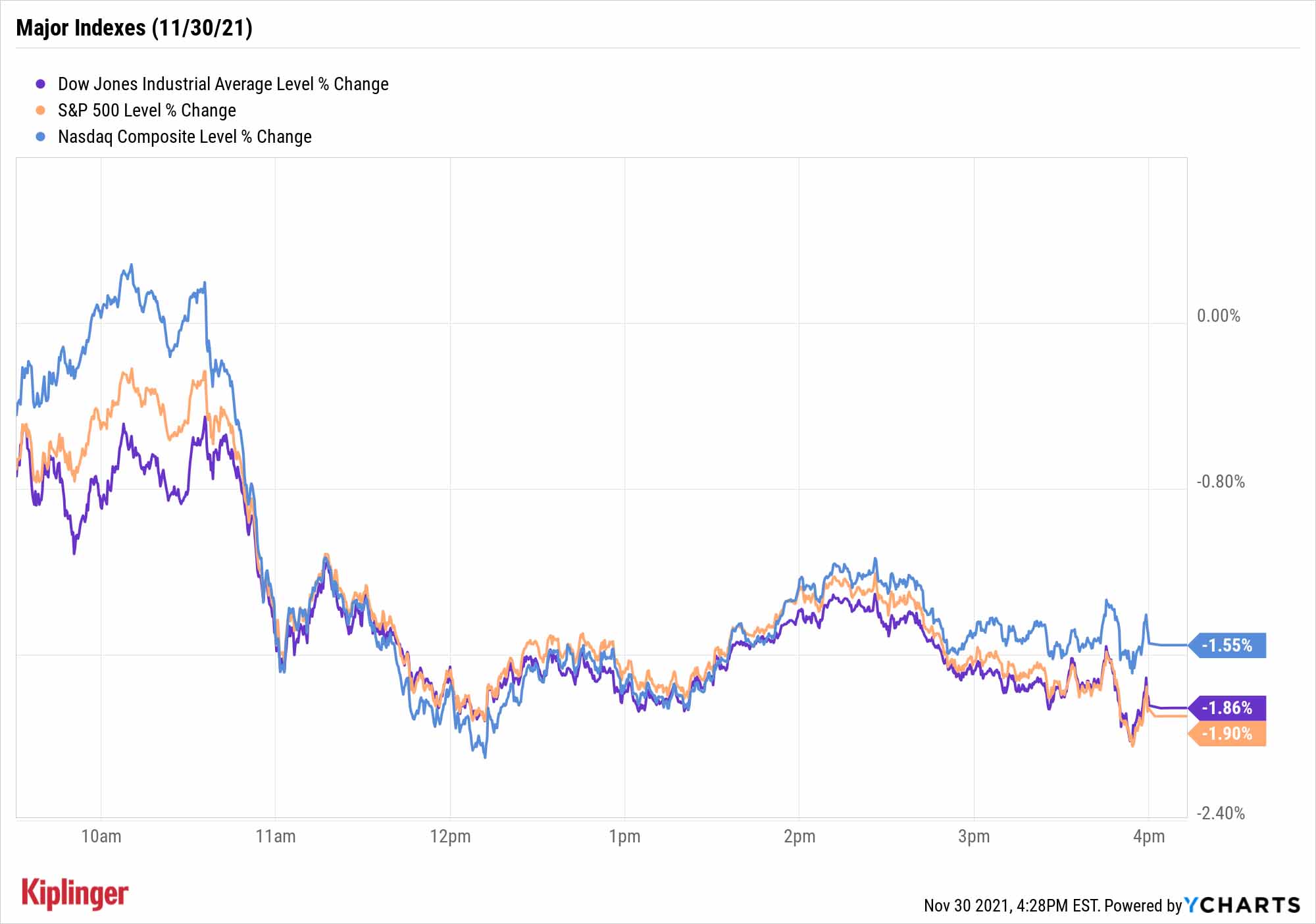

The Dow Jones Industrial Average (-1.9% to 34,483) was led lower by the likes of Salesforce.com (CRM, -4.0%), Travelers (TRV, -3.6%) and Coca-Cola (KO, -3.2%). The S&P 500 (-1.9% to 4,567) and Nasdaq (-1.6% to 15,537) also took a tumble.

"The travel and tourism trade is struggling the most here given the looming prospect of further travel restrictions going into early 2022," says David Keller, chief market strategist at StockCharts.com. "Hotels, cruise lines, and airlines appear especially vulnerable and are breaking key support levels as investors move their capital elsewhere."

Other news in the stock market today:

- The small-cap Russell 2000 declined 1.9% to 2,198.

- U.S. crude futures plunged 5.4% to settle at $66.18 per barrel.

- Gold futures retreated 0.5% to end at $1,776.50 an ounce.

- Bitcoin was off 1.0% to $57,555.73. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Apple (AAPL) was the only Dow stock to finish in the green today, adding 3.2% to close at a record $165.30. Based on its Oct. 29 close at $149.80, AAPL finished November up 10.3%, marking its best monthly performance since June, when it tacked on 9.9%. The stock is certainly well-liked by Wall Street's pros. Of the 44 analysts covering Apple tracked by S&P Global Market Intelligence, 27 say it's a Strong Buy and seven call it a Buy. This compares to eight Holds, one Sell and one Strong Sell.

- Dollar Tree (DLTR) was a notable decliner today, sliding 5.3% after Goldman Sachs analyst Kate McShane downgraded the retail stock to Neutral (Hold) from Buy. The shares jumped more than 9% last week on stronger-than-expected earnings and news of broad price hikes at its stores, and the analyst believes "expected improvements are now priced in the stock."

Omicron Puts Investors on Red Alert

The omicron variant's largest danger to the market right now is the uncertainty about its danger.

"Investors fear a worst-case scenario variant that could send many parts of the world back to the dark days of 2020. With many major economies now experiencing cold weather, and lockdowns in some European countries, this would only add to problems and exert downward pressure on stocks, especially more cyclically sensitive equities," says Invesco Chief Global Market Strategist Kristina Hooper, who notes that it will likely be weeks before there's any concrete knowledge to work with.

"Sectors that may be better protected include technology, healthcare and utilities," she adds, while the most vulnerable areas include travel and leisure, general retail and basic materials.

That latter sector is the latest focus of Kiplinger's 2022 investing outlook.

As of just a few days ago, materials stocks had plenty going for them – namely, a continuing global economic recovery and a gusher of fresh infrastructure spending from the U.S. government. The omicron variant potentially threatens the former.

That makes materials tricky to deal with in the short term, but opportunistic investors might want to take advantage of price dips to buy high-quality sector picks like these 12 best material stocks for 2022.

Kyle Woodley was long CRM as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.