Stock Market Today: Dow, S&P 500 Continue to Hit New Highs

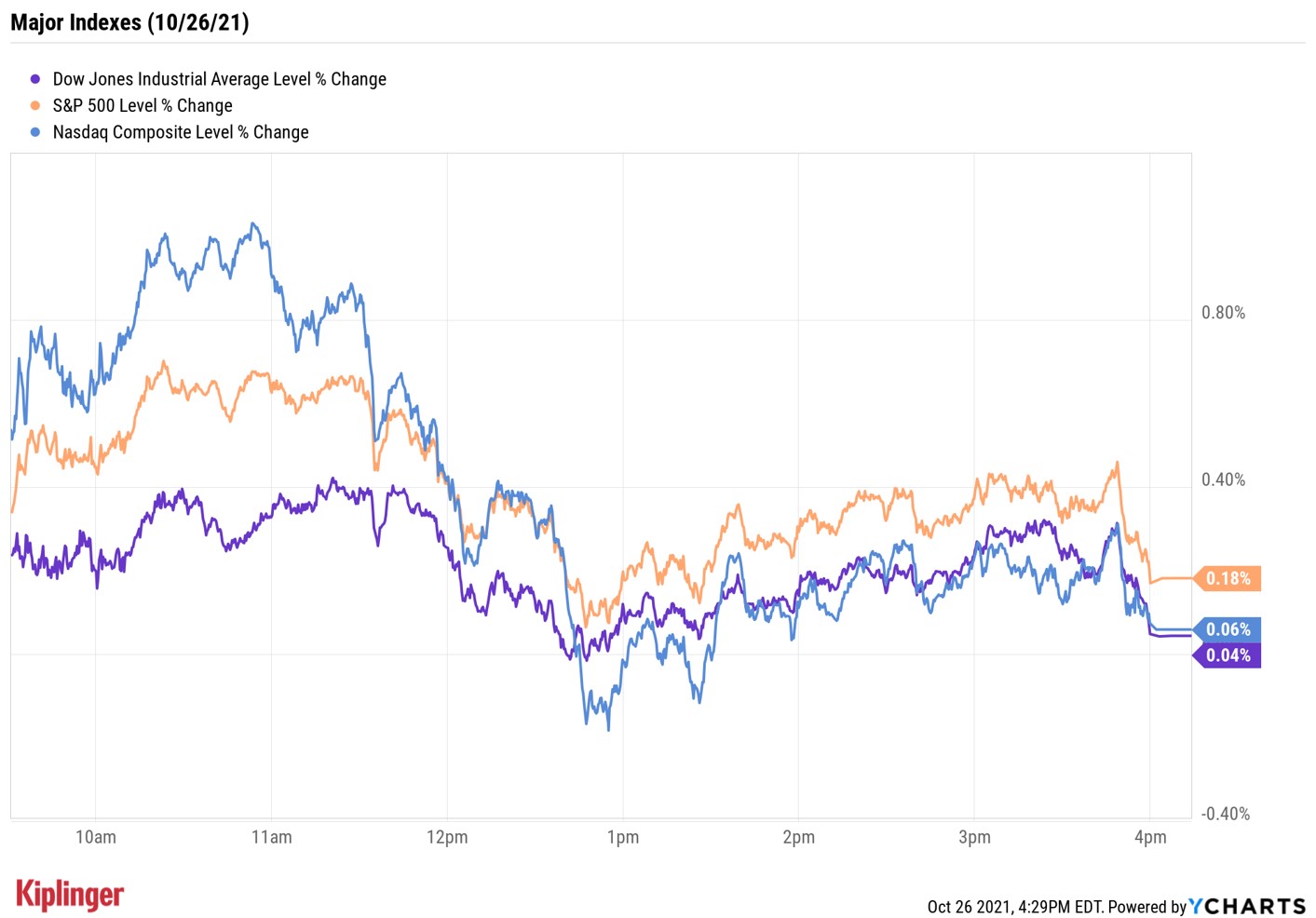

The major market indexes finished well off their session highs, though.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was another record-setting session for the Dow Jones Industrial Average and S&P 500 Index as investors parsed the latest corporate earnings reports.

On the positive side, delivery firm United Parcel Service (UPS, +7.0%) jumped after reporting higher-than-expected earnings and revenue for its third quarter. Industrial conglomerate General Electric (GE, +2.0%) was another post-earnings winner thanks to its upwardly revised full-year earnings guidance.

And while a solid reading on October consumer confidence kept the major benchmarks in the green – with the Conference Board reporting the first month-over-month increase in its composite index (to 113.8 from September's 109.8) since June – negative reactions to revenue misses from social media giant Facebook (FB, -3.9%) and defense contractor Lockheed Martin (LMT, -11.8%) brought them off their session highs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Still, the Dow closed up 0.04% at 35,756 and the S&P 500 gained 0.2% at 4,574 – new record highs – while the Nasdaq Composite added 0.06% to 15,235.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.7% to end at 2,296.

- U.S. crude oil futures rose 1.1% to finish at $84.65 per barrel.

- Gold futures slipped 0.7% to settle at $1,793.40 an ounce.

- The CBOE Volatility Index (VIX) spiked 4.9% to 15.98.

- Bitcoin prices fell 1.2% to $61,951.69. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Hasbro (HAS) gained 3.2% after the toymaker reported higher-than-expected third-quarter adjusted earnings of $1.96 per share on inline revenues of $1.97 billion. The company's entertainment division got a lift from its "My Little Pony" and "Come From Away" productions, which helped cushion the blow from shipment delays caused by global supply chain disruptions. CFRA analyst Zachary Warring maintained a Buy rating on HAS. "The company saw 76% sales growth in entertainment as the division benefitted from resumed productions and deliveries and 32% sales growth in digital gaming as they see continued momentum in the space. We believe HAS will outperform as its entertainment and digital segments drive margins and sales higher," he wrote in a note.

- Google parent Alphabet (GOOGL) delivered a wide third-quarter beat on both the top and bottom lines. The company brought in $65.1 billion in revenues to top estimates for $63.3 billion, and earned $27.99 per share to easily exceed expectations for income of $23.48 per share. That’s a particularly strong quarter given that traffic acquisition costs of $11.5 billion were much higher than the $8.2 billion reported in the year-ago quarter. GOOGL shares, however, were down 2% in early after-hours trade.

Is the Market Poised for More Gains?

Seasonality suggests the stock market has plenty of upside left. The S&P 500 tends to mark its fourth-quarter lows in late October before rising into the new year, says Ryan Detrick, chief market strategist for LPL Financial. Furthermore, Q4 is historically the strongest quarter of the year.

And looking beyond seasonality, Detrick points to several signs of improving market internals and fundamentals, including the recent rebound in copper prices, the broader indexes making new highs and declining COVID-19 cases.

A confluence of such signals, notes Detrick, can "clear the way for a potentially bullish environment for equities through year-end." As such, the strategist believes "tactical investors should tilt portfolios in favor of stocks over bonds relative to their respective targets."

For those looking to ride this bullish wave into the new year, consider financials, which are hitting new highs after several months of stagnation. Another way to participate in seasonal tailwinds is with consumer discretionary stocks – which are outperforming the S&P 500 after lagging it for most of the summer – and could continue to do so through the key holiday shopping season. Have a look as we examine 13 of the best opportunities in the consumer discretionary sector.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.