Stock Market Today: AmEx Lifts Dow to New Heights

American Express's strong Q3 earnings shone as the Dow closed the week on a high note. Intel and Snap weren't so lucky.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

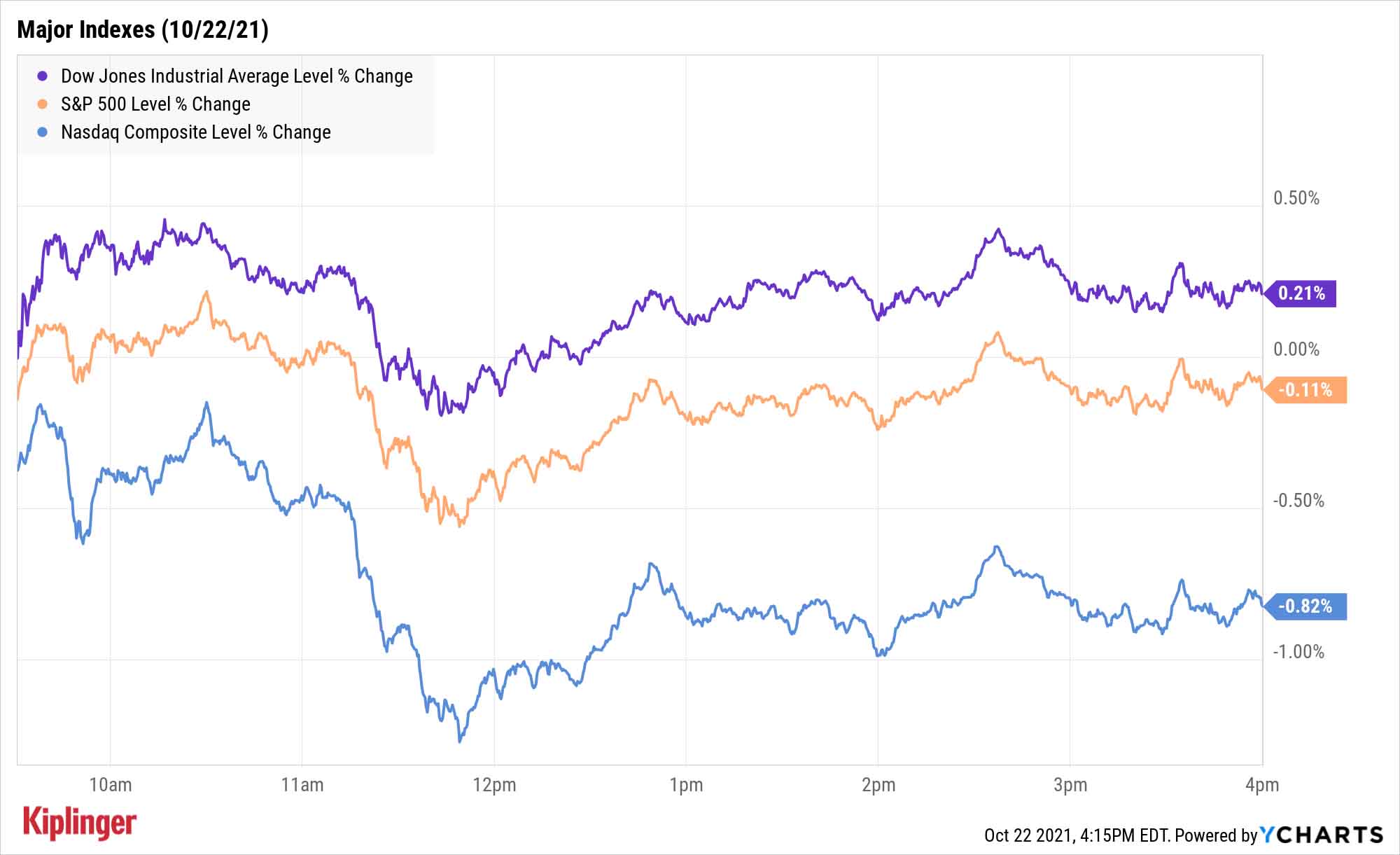

The earnings calendar giveth, and it also taketh away – which explained the divergent paths of the Dow Jones Industrial Average and Nasdaq Composite as the week came to a close.

A Friday light on economic data kept the focus on corporate profits, and on that front, American Express (AXP, +5.4%) certainly didn't disappoint. The company delivered third-quarter earnings of $2.27 per share on revenues of $10.9 billion, exceeding analysts' consensus expectations for profits of $1.80 per share on $10.5 billion in sales.

Susquehanna analyst James Friedman, who rates the stock at Neutral, nonetheless raised his 12-month price target to $190 per share from $165 "as Network Volumes are finally above 2019 levels and as we continue to see declines in uncertainty on the macro & medical outlook past 2021. With these trends, we have greater confidence and visibility into the recovery of the U.S. domestic market."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

AXP was by far the best performer among the 30 Dow components and helped the industrial average advance 0.2% to a record-high 35,677.

However, the Nasdaq (-0.8% to 15,090) was indirectly dragged down by Snapchat parent Snap (SNAP, -26.6%). SNAP stock itself actually trades on the New York Stock Exchange; but mega-cap Nasdaq components Facebook (FB, -5.1%) and Google parent Alphabet (GOOGL, -3.0%) declined in sympathy after Snap's disappointing third-quarter financial results.

As explained in today's free A Step Ahead e-newsletter, Snap's Q3 was hampered by ad issues caused by Apple's new iOS security measures requiring people to explicitly give permission for apps to track user activity across other apps and websites – an issue that could be felt across many other social media and internet companies.

Losses in GOOGL and FB also weighed on the S&P 500, which slipped 0.1% to 4,544.

Other news in the stock market today:

- The small-cap Russell 2000 slipped 0.2% to 2,291.

- U.S. crude oil futures climbed 1.5% to $83.76 per barrel.

- Gold futures settled a modest 0.2% to $1,786.00 per ounce with a little help from a softening U.S. dollar.

- The CBOE Volatility Index (VIX) rose by 3.3% to 15.51.

- Bitcoin prices continued to let out air, declining 3.0% to $60,921.45; the cryptocurrency had peaked just below $67,000 on Wednesday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Intel (INTC, -11.7%) suffered its worst drop in about a year after supply-chain issues caused the chipmaker to miss third-quarter revenue expectations. The company also projected thinner margins as it builds new semiconductor production facilities to keep up with demand, as well as invests in research and development. The report triggered a slew of price-target downgrades. One came from CFRA analyst Angelo Zino, who maintained a Hold rating on INTC but dropped his 12-month price target to $50 per share from $65 per share. "We are wary about gross margin compression ahead, rising capital intensity needs from the shift towards foundry services, share loss and likely peak PC demand," says Zino, who also points out that the company's chief financial officer, George Davis, is retiring in May.

- Beyond Meat (BYND, -11.8%) dropped to 52-week lows on its own earnings-related news. The company provided a disappointing update to its third-quarter guidance ahead of the plant-based-meat producer's Nov. 10 call. The company has lowered its revenue outlook to $106 million, from previous guidance of $120 million to $140 million – that's well under consensus views for $133.1 million. The company blamed a host of issues, from operational issues at a couple of its facilities to COVID. Beyond Meat added that it "experienced a decrease in retail orders that persisted longer than expected from a Canadian distributor coinciding with the reopening of restaurants [and] expected incremental orders that did not materialize from a change in a distributor servicing one of the Company's large customers."

Should Investors Seek Out Shelter?

A couple of the major indexes have scratched out new highs over the past week, but market pressures persist. Brad McMillan, chief investment officer for Commonwealth Financial Network, outlines several of the risks:

"Job growth dropped significantly again last month, and consumer confidence remains well below post-pandemic highs," he says. "Beyond the pandemic, the expiration of federal subsidy and protection programs is also weighing on sentiment. There are also signs that lower confidence is starting to translate into weaker spending growth, which will be a headwind going forward."

While McMillan still sees upside ahead, he believes these risks could bring about continued volatility for the foreseeable future. That could prompt some investors to go hunting for safety ... but how do you define what "safety" is?

If you simply prefer your portfolio to whip around less than the broader market, low-volatility funds typically offer more stable results (though the tradeoff can sometimes be lesser returns during bull runs). If you don't want to sacrifice growth, of course, you can look to high-potential stocks that have equally high measures of financial stability.

And if you're among the investors that equate dividends with safety, we have a few income picks for you to mull over. Just remember: If you truly want stability and security out of your dividend stocks, don't just look at the headline yield – dig deeper to ensure the company can keep paying its dividend, and hopefully raise those payouts over time.

These 13 dividend stocks fit that precise bill, meriting high rankings by the DIVCON dividend safety rating system – and we explore why each one looks so sturdy right now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.