Stock Market Today: Tech, Consumer Stocks Carry Nasdaq Higher

Disappointing China GDP and industrial production weighed on stocks early Monday, but the S&P 500 and Nasdaq finished higher on the back of Tesla, Facebook and others.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street kicked off a fresh week of trading with mixed results amid a couple of worrisome economic indicators, but also some optimism about upcoming earnings reports.

U.S. industrial production declined by 1.3% month-over-month in September – its largest such swoon since February. Also weighing on stocks early was China, which reported disappointing third-quarter GDP growth of 4.9% year-over-year, easily shy of estimates for 5.2%.

"That doesn't sound like a bad GDP print," Shawn Snyder, head of investment strategy at Citi US Consumer Wealth Management, tells Kiplinger, but he adds that it's more troubling "when you put it in context with China policymakers that say, 'We are going to hit 6%.'"

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

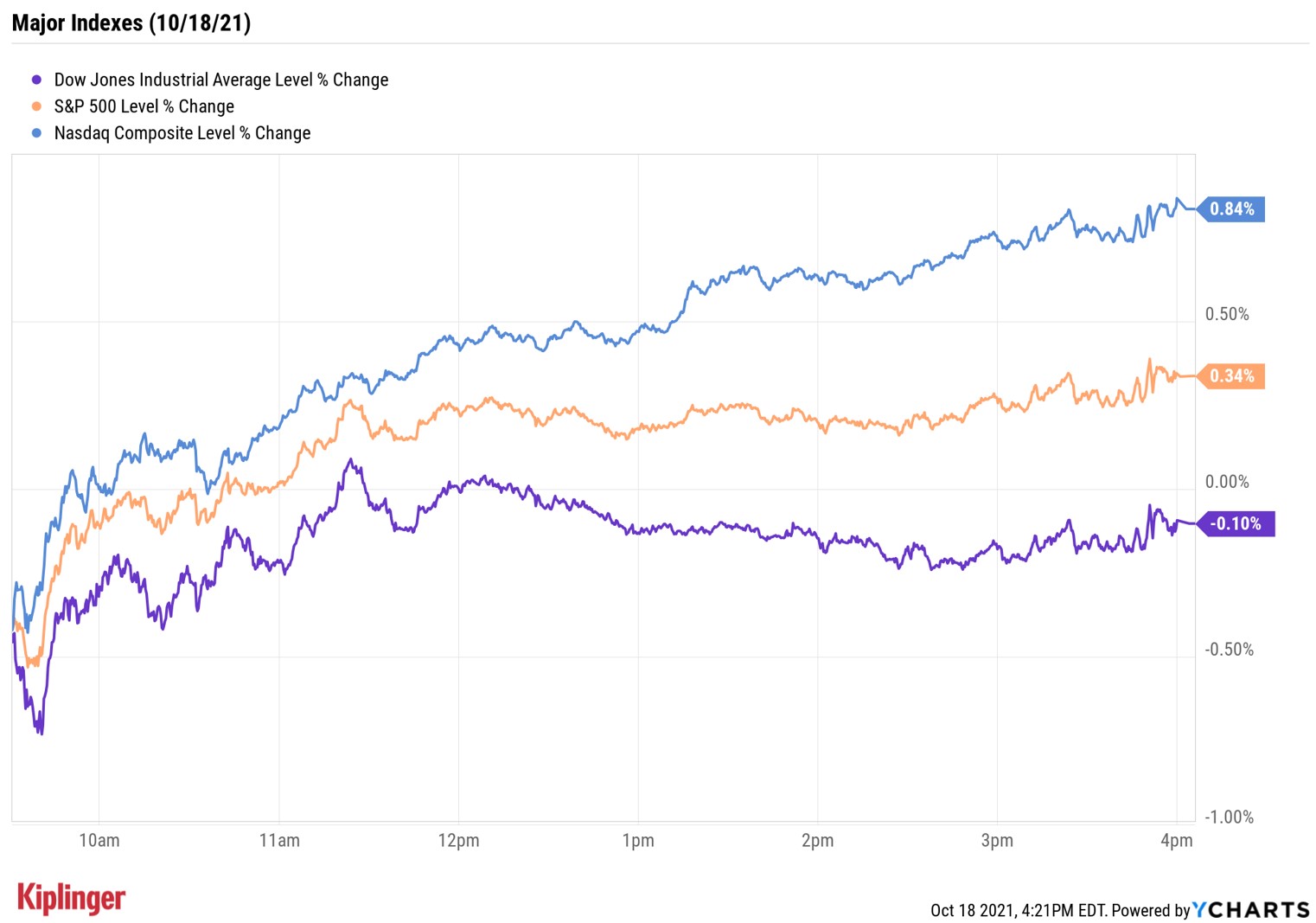

Those drivers ultimately helped keep the Dow Jones Industrial Average in negative territory, with the industrial average slipping 0.1% to 35,258.

The S&P 500 (+0.3% to 4,486) and the Nasdaq Composite (+0.8% to 15,021) fared better, however, on the back of gains in technology, communication services and consumer discretionary stocks. Tesla (TSLA, +3.2%) and Facebook (FB, +3.3%) were among notable names on the rise in anticipation of their Q3 reports, due out later this week.

Other news in the stock market today:

- The small-cap Russell 2000 inched 0.1% ahead to 2,267.

- Walt Disney (DIS, -3.0%) was the worst Dow stock today after Barclays analyst Kannan Venkateshwar downgraded the entertainment issue to Equalweight from Overweight (the equivalents of Hold and Buy, respectively). Venkateshwar believes Disney will need to double its current pace of subscriber growth in order to meet its goal of having 230 million to 260 million Disney+ subscriberes by fiscal 2024. For reference, DIS had 116 million global subscribers at the end of June. This is the first downgrade DIS stock has received so far this year, according to Reuters.

- Zillow Group (Z, -9.5%) was a notable decliner after a weekend Bloomberg report indicated the online real estate company is halting its purchases of U.S. homes to make its way through a backlog of properties it has already bought and intends to sell. CFRA analyst Kenneth Leon isn't overly concerned, keeping his Buy rating on Z stock intact. "In our opinion, Z remains steadfast in automating real estate workflows to large-scale operations," he writes. On the other hand, BofA Global Research analysts maintained their Underperform (Sell) rating on Zillow. The "latest development highlights inherent scalability and macro uncertainty risks with ibuying model," they write.

- U.S. crude futures gained 0.2% to settle at $82.44 per barrel.

- Gold futures slipped 0.1% to $1,765.70 an ounce.

- The CBOE Volatility Index (VIX) rose modestly, up 0.3% to 16.35.

- Bitcoin prices, at around $61,436.15 at this same time on Friday, has pulled past the $62,000 mark a couple of times since then amid excitement over the first Bitcoin futures ETF, but was marginally below Friday's prices as of Monday afternoon, at $61,423.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How Bad Are Wall Street's Supply-Chain Woes?

A term that will get thrown around a lot this earnings season: "supply chain."

If you've gone out to buy something just to find out that it's out of stock, you're hardly alone – frazzled supply chains are disrupting businesses not just here, but around the globe. And investors should hear more specifics about that as the Q3 earnings season unfolds.

"We have heard from a number of global companies in recent weeks that their profit margins are coming under more pressure from supply chain challenges," says Jeff Buchbinder, Equity Strategist for LPL Financial. "It will be very interesting to hear how long companies expect supply chain bottlenecks and shortages of labor and materials to last. These pressures on companies' costs may impair profit margins for the rest of 2021 – and likely into 2022."

But supply-chain pain can, in fact, be investors' gain ... at least in the short term.

If you're simply looking to avoid companies at risk, you might consider many of the social media and streaming companies in the communication services sector. You could also target industries that can make hay in the current environment. Chip stocks, for instance, have been a popular play amid red-hot demand but limited supply.

And then there's transportation. Port logjams are constraining vessel supply and sending up shipping prices – a clear boon for shipping stocks responsible for transporting goods across the world.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.