Stock Market Today: Economic Data, Earnings Fuel Stock Surge

The producer price index came in below expectations, while weekly jobless claims hit their lowest level since mid-March 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors were cheered with a plethora of pleasant surprises Thursday, sparking a widespread rally that saw every sector close well in the green.

Kicking things off was the latest producer price index – a measure of how much suppliers are charging businesses and other customers for their goods – which rose 0.5% last month. This was slower than the 0.7% rise in August and also below the 0.6% increase economists were expecting.

Prices at the producer level tend to seep down to consumers, says Jennifer Lee, senior economist at BMO. But while she's "grateful for some relief on the price front, we need a few more months of this to signal a turning point."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In other economic news, initial jobless claims last week fell to 293,000 from 329,000 the week prior, marking the lowest level of new applicants for unemployment benefits since March 14, 2020.

Investors also eyed a fresh batch of corporate earnings reports, with drugstore chain Walgreens Boots Alliance (WBA, +7.4%) and insurance giant UnitedHealth Group (UNH, +4.2%) both surging in the wake of this morning's top- and bottom-line beats.

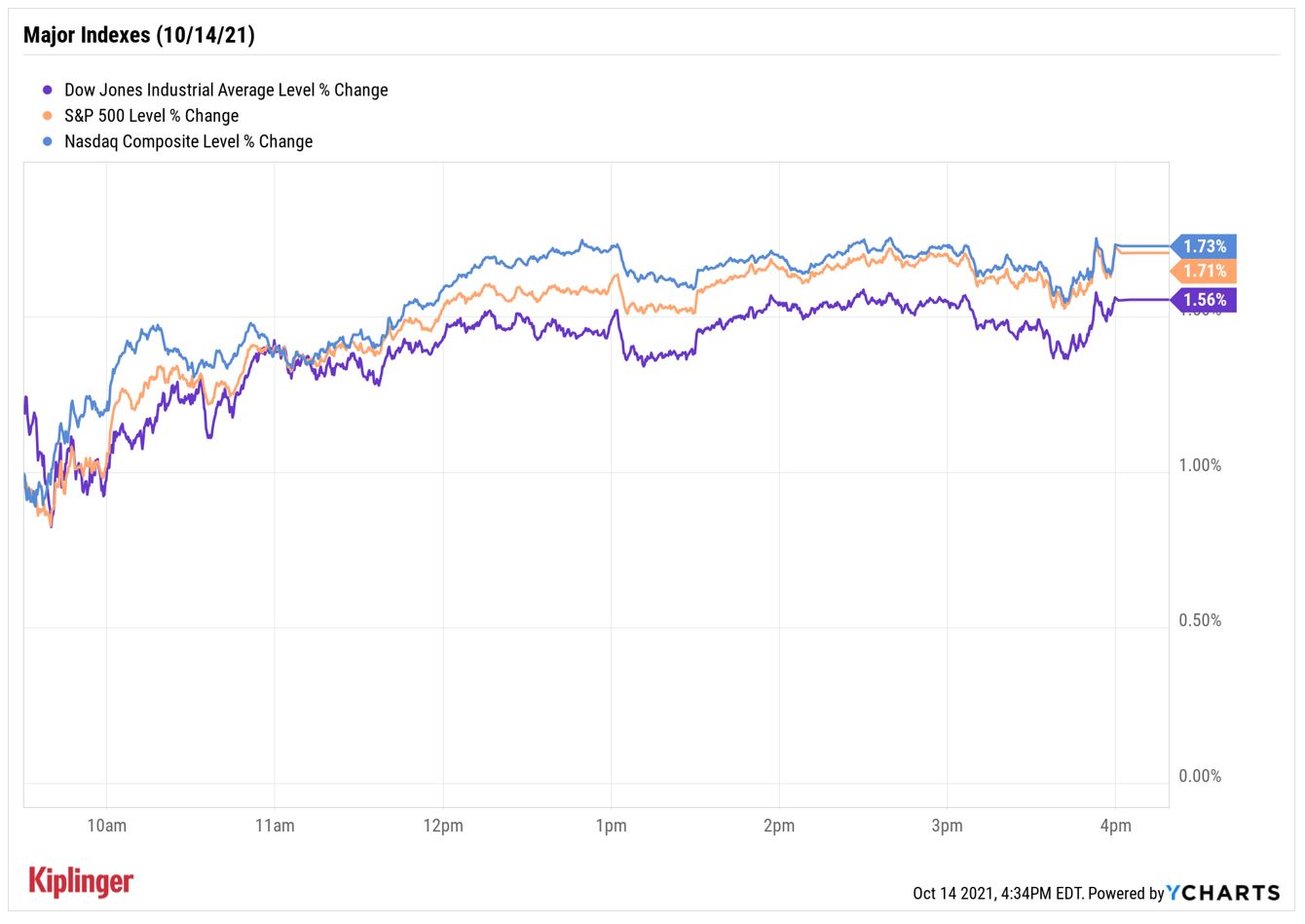

At the close, the Dow Jones Industrial Average was up 1.6% at 34,912, the S&P 500 Index was 1.7% higher at 4,438 and the Nasdaq Composite jumped 1.7% to 14,823.

Other news in the stock market today:

- The small-cap Russell 2000 popped 1.4% to 2,274.

- Bank of America (BAC, +4.5%) said earnings per share jumped 58% year-over-year in the third quarter to 85 cents, while revenues rose 12% to $22.87 billion – thanks in part to a $1.1 billion release of funds it had previously set aside for credit losses. Piper Sandler analyst Jeffery Harte maintained his Overweight (Buy) rating in the wake of the financial firm's results. "Revenue strength in a still difficult interest rate environment is a clear positive," he says.

- Wells Fargo (WFC) was another post-earnings mover, though its shares retreated 1.6% on the day. For the third quarter, WFC reported earnings per share of $1.22 on revenues of $18.83 billion, with both figures beating consensus estimates for earnings of 99 cents per share on $18.35 billion in sales. However, the bank did see a 5% drop in net interest income from the year prior. CFRA analyst Kenneth Leon kept his Buy rating on WFC. "We are confident in WFC delivering a 2021-2022 turnaround that drives higher capital returns," he wrote in a note.

- U.S. crude futures jumped 1.1% to settle at $81.31 per barrel – their highest level since October 2014 – after the International Energy Administration (IEA) lifted its outlook for global oil demand for this year and next.

- Gold futures rose 0.2% to $1,797.90 an ounce.

- The CBOE Volatility Index (VIX) plunged 9.6% to 16.86.

- Bitcoin prices gained 1% to $57,871.64. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Bitcoin ETF Buzz Builds

The exchange-traded fund industry is buzzing about a potential breakthrough for cryptocurrency ETFs.

There are more than 20 cryptocurrency funds under review at the Securities and Exchange Commission (SEC), including some that actually hold Bitcoin, and others that are tied to Bitcoin futures.

Dave Abner, global head of business development at crypto exchange Gemini, notes that the "The price of Bitcoin is rallying on rumors of the potential launch of a Bitcoin futures ETF. While this ETF may be successful at gathering assets over the next year, generally ETF launches do not have short term price impacts on the assets they contain."

But Wall Street is still quite excited about the potential for SEC approval, which would open the door to new forms of Bitcoin exposure that investors simply don't have. Most people who want to invest in Bitcoin and other cryptocurrencies through traditional brokerage accounts have limited options.

They can buy stocks that are connected to crypto in some way, or they can sort through a hodgepodge of ETFs and other funds that provide varying types of Bitcoin exposure. While many of these funds stick to equities involved in cryptocurrency technology, a few names have more direct exposure to the digital assets, albeit with a few more turns and twists, too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.