Stock Market Today: Energy Leads, Tech Lags, As Interest Rates Keep Rising

The rotation into cyclicals and value was in full gear Monday as the 10-year Treasury yield briefly eclipsed 1.5% for the first time in months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The new trading week kicked off Monday with various market sectors taking off in different directions.

Cyclical and value stocks continued their recent ascent. Exxon Mobil (XOM, +3.0%) and Halliburton (HAL, +5.4%) helped make energy (+3.6%) the strongest sector of the day, driven by a 2.0% increase in U.S. crude oil futures to a two-month high of $75.45 per barrel.

Declines in big-tech names such as Microsoft (MSFT, -1.7%) and Nvidia (NVDA, -1.9%) tried to pull markets in the other direction.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"To oversimplify things, it comes down to the continued move higher in interest rates and the concentration of mega-cap tech stocks in the S&P 500," Michael Reinking, senior market strategist for the New York Stock Exchange, said in an afternoon note. "The value factor has underperformed the growth factor by ~15% since the middle of May. Today it is outperforming growth by almost 2%. The continued move higher in rates is at the center of this rotational activity."

Indeed, the 10-year Treasury yield has jumped from about 1.3% last Wednesday to just above 1.5% earlier today, reaching its highest level since July.

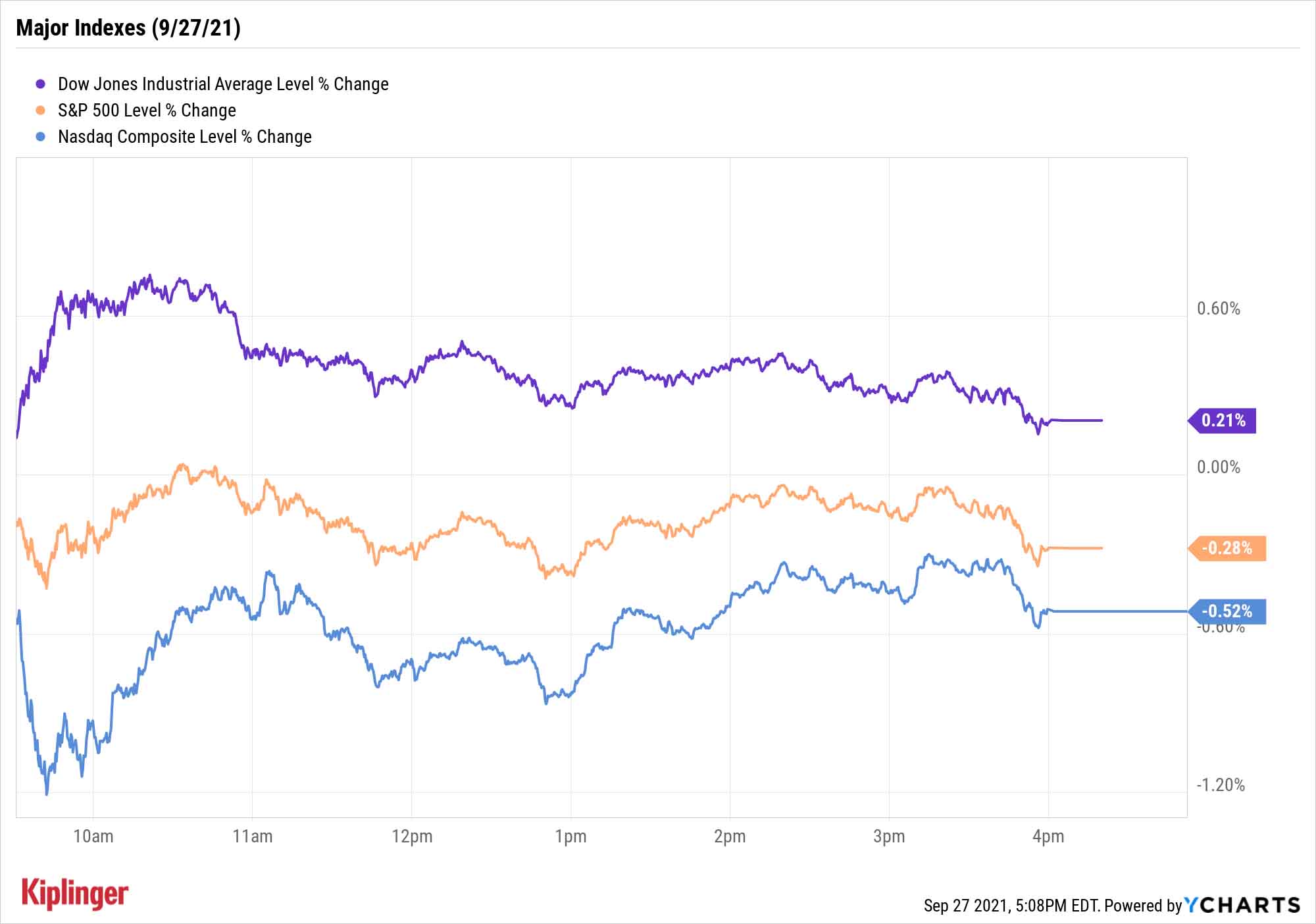

The Dow Jones Industrial Average closed with a modest 0.2% gain to 34,869. The S&P 500 slipped 0.3% to 4,443, while the tech-heavy Nasdaq Composite finished down 0.5% to 2,282.

And what does the rest of the week have in store?

"The infrastructure and spending bills will certainly be a focus for investors this week, both for the short-term impact on market dynamics but also the long-term outlook for the U.S. economy," says David Keller, chief market strategist for StockCharts.com.

"From a technical perspective, the S&P 500 continues to trade around the 50-day moving average which has served as price support for much of 2021. The S&P remains in a constructive price pattern as long as it remains above the August lows around 4,360."

There's also a light earnings calendar that includes reports from a few noteworthy companies, including Micron (MU) and Bed Bath & Beyond (BBBY).

Other news in the stock market today:

- The small-cap Russell 2000 stood out from the pack, leaping 1.5% to 2,281.

- The rising 10-year Treasury yield also created tailwinds for bank stocks today, as higher interest rates often boost margins and profits for financial firms. Goldman Sachs (GS, +2.3%), JPMorgan Chase (JPM, +2.4%) and Bank of America (BAC, +2.7%) were among the notable gainers.

- Altice USA (ATUS) slid 5.8% after Credit Suisse analysts downgraded the broadband provider to Neutral from Outperform (the equivalents of Hold and Buy, respectively). They acknowledge that ATUS is trading lower than "its likely asset value and that management's pivot from focusing on margins and stock buybacks to a more aggressive fiber overbuild and edge-out strategy could prove successful longer-term." However, they expect this "new investment strategy will take at least several quarters, if not longer, to begin bearing fruit." As such, they are moving to the sidelines.

- Gold futures eked out a marginal gain to settle at $1,752.00 an ounce.

- The CBOE Volatility Index (VIX) jumped 6.0% to 18.82.

- Bitcoin prices were up 1.5% over the weekend, to $43,040.80. "I don't think the market is factoring in how big the Evergrande default is," says Charlie Silver, CEO of Permission.io, a cryptocurrency-enabled provider of e-commerce permission advertising. "Evergrande is like a cockroach in your kitchen. There is never just one. The leverage in China is 3x what it is in the U.S., and it looks like there is going to be massive defaults rippling across the banking system globally. This will impact crypto significantly; the crypto market is in a wait-and-see mode." (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Is October Going to Be Any Easier?

The volatile month of September will be behind us soon, but the volatility itself might not be.

A research team from wealth manager Glenmeade outlines two of the near-term risks facing the markets: "Currently the government is at risk of shutdown on Sept. 30 and the debt ceiling needs to be raised by mid-October," Glenmeade says. "If the ceiling isn't raised, the U.S. could default, making it more expensive for the Treasury to borrow money and could cause a credit rating downgrade – events that both parties would want to avoid."

The potential for additional market "wobble" might very well put a premium on safety plays, whether you're talking about financially stable stocks or low-volatility funds.

But some investors prefer to check their shopping lists if they see volatility coming, and quick market drops can provide an opening to get already high-quality companies at slightly better prices.

Take the following five stocks to buy, for instance. Each of these companies boast solid balance sheets, cash generation and other healthful financial measures, but each has also been caught up in the market's latest tantrums.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.