Stock Market Today: Dow Loses Fifth Straight as Apple Hits a Wall

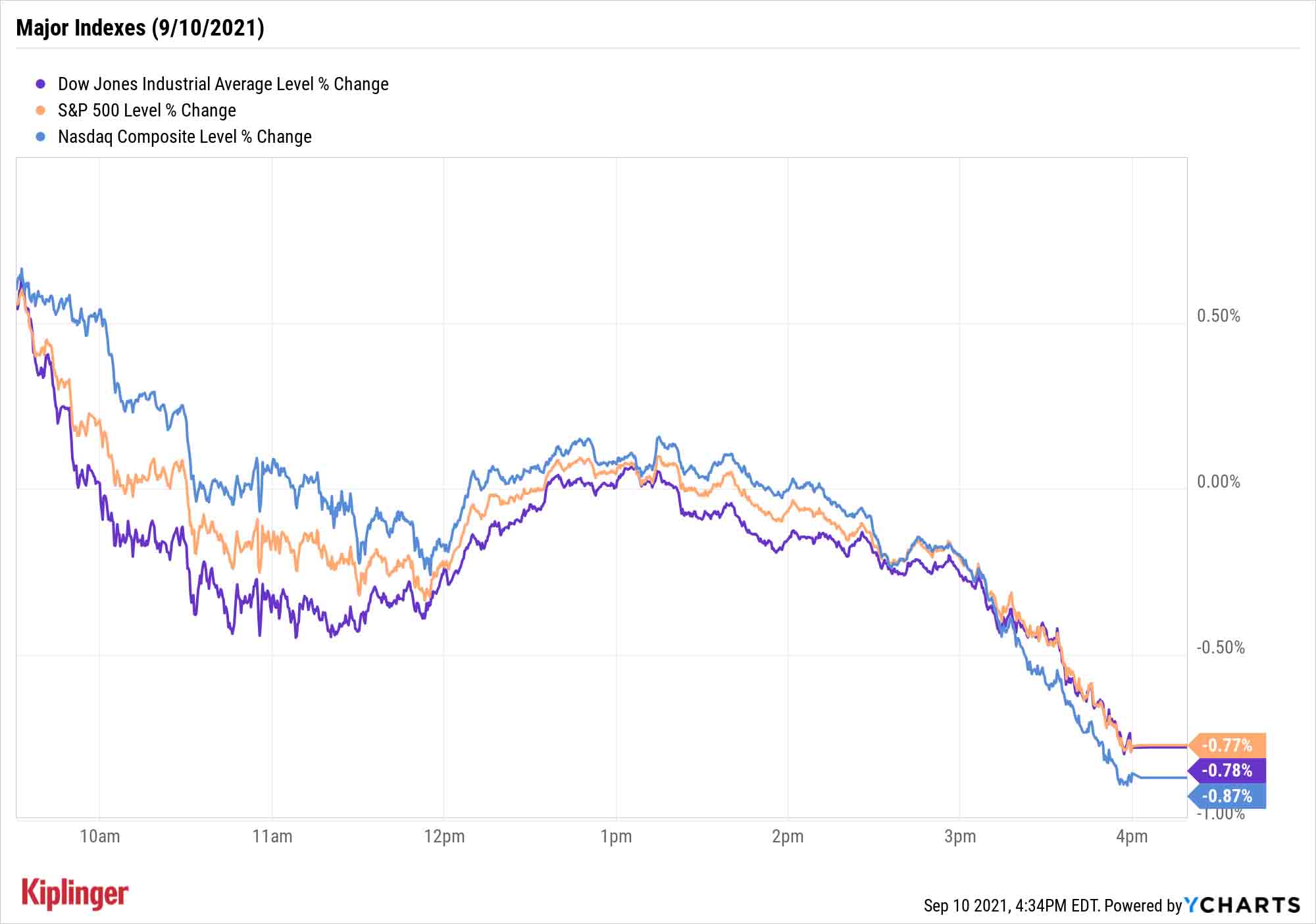

Another early rally fell apart by the close, capping a holiday-shortened week full of losses for the Dow and S&P 500.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks pulled a pessimistic 180 for the second consecutive session, with the major indexes opening Friday trade in the green only to swoon into the close.

The day began with inflation news: The Bureau of Labor Statistics reported that the U.S. producer price index jumped by a record 8.3% year-over-year in August; on a month-over-month basis, wholesale costs were up 0.7% – worse than expected, but perhaps indicating a crest in producer inflation.

"While the annual number rose sharply ... the monthly number dropped sharply. This means that looking back we see higher inflation, but looking around we see inflation starting to decline," says Brad McMillan, chief investment officer for Commonwealth Financial Network. "The real takeaway from this report is not that inflation is high – which we already knew – but that the trend is showing signs of turning."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Jennifer Lee, senior economist for BMO Capital Markets, notes that "core" PPI was up 0.6% – "still heated" – but up just 0.3% if you excluded trade services, which marks the smallest such increase in about nine months.

Nonetheless, Charlie Ripley, senior investment strategist for Allianz Investment Management, says Americans are likely to feel the pinch.

"While higher wholesale prices don't necessarily translate into higher consumer prices, it's hard to imagine today's 8.3% annual increase in PPI won't put pressure on companies to pass along further price increases on consumers," he says.

The clearest drag on Wall Street was the stock market's largest company: Apple (AAPL, -3.3%). Shares turned tail less than an hour before noon after a federal judge ruled that Apple must allow app developers to use payment options other than the App Store's. Apple scored a partial victory, however, as the judge did not rule that the company was a monopoly.

The Dow Jones Industrial Average, up 225 points (0.6%) at its morning peak, slid to its fifth consecutive decline – a 271-point, 0.8% drop to 34,607. The S&P 500 (-0.8% to 4,458) remained mired in a five-day slide of its own, while the Nasdaq Composite (-0.9% to 15,115) suffered its third straight loss.

Other news in the stock market today:

- The small-cap Russell 2000 fell 1.0% to 2,227.

- Kroger (KR, -7.5%) slumped on Friday despite a Street-beating quarterly earnings report. Kroger announced Q2 adjusted profits of 80 cents per share to top expectations by 16 cents, while revenues of $31.7 billion also beat estimates for $30.6 billion. Kroger also upgraded its full-year earnings guidance, to $3.25-$3.35 from $2.95-$3.05. However, the company reported a drop in gross margins, to 21.4% in Q2 vs. 22.6% in Q1. Other headwinds loom, too. "While today's results were encouraging, we think there is downside risk to guidance, especially given several labor union contract negotiations are set to take place this year and the Democrats are pushing for a $15 starting wage," writes CFRA analyst Arun Sundaram, who rates shares at Sell. "Digital profitability, sales deleverage, negative sales mix and lingering COVID-19 costs are also expected to be headwinds."

- U.S. crude oil futures improved by 2.3% to $69.72 per barrel.

- Gold futures settled at $1,792.10 – a 0.4% decline.

- The CBOE Volatility Index (VIX) jumped 11.1% to a roughly three-week high of 20.89.

- Bitcoin dropped 2% to $45,647.49 as the Securities and Exchange Commission punted on a decision about fund provider Van Eck's application for a Bitcoin exchange-traded fund. The SEC's decision day has been moved back to Nov. 14 from Sept. 15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

H20: A Mega-Trend in the Making

ESG (environmental, social and governance) investing covers a wide spectrum of issues. But a select few industries tend to hog the spotlight.

Electric vehicles, for instance, are a wildly popular corner of the market, thanks in large part to the consumer-facing nature of the business. Most traditional car companies offer EVs now, and Tesla (TSLA) has demonstrated the technology's potential by becoming one of the largest companies on earth.

In a similar vein, green energy stocks attract plenty of research and media attention thanks to the visible, worldwide shift toward solar, wind and other alternative sources of energy.

However, many investors might do well to pay attention to a decidedly unsexy (but equally critical) issue: water scarcity.

Around the globe, water shortages aren't just a future threat – they're a clear and present danger. The World Health Organization and UNICEF say that as recently as last year, "around 1 in 4 people lacked safely managed drinking water in their homes and nearly half the world's population lacked safely managed sanitation."

That makes a powerful argument for water stocks and funds, which range from sanitization to distribution to even dispensing water in your home. Read on as we explore a handful of water-themed mutual funds and ETFs that offer expose to the world’s emerging water crisis.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.