Stock Market Today: Comms, Defensive Stocks Rise After Weak Payrolls Report

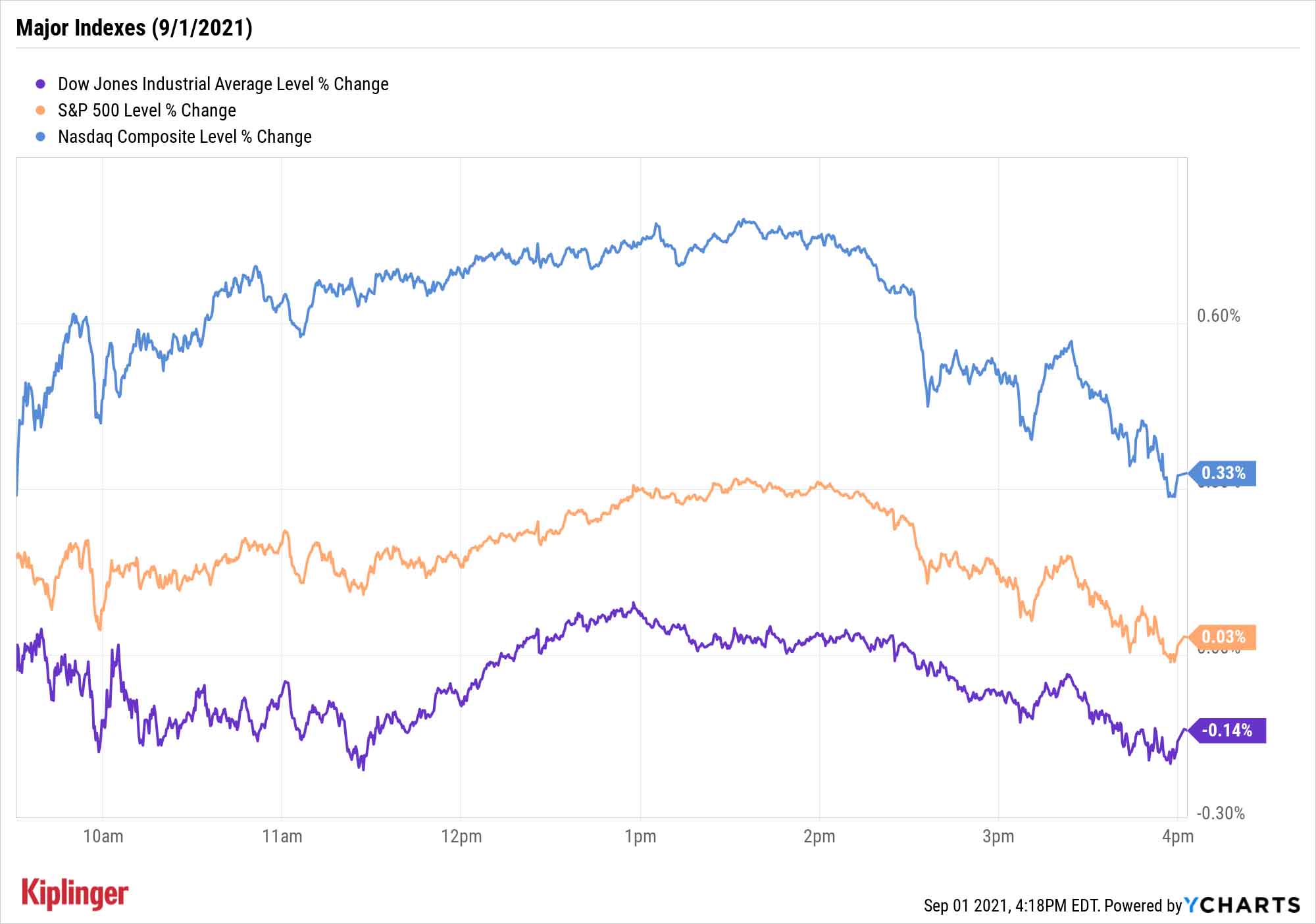

The Nasdaq hit new highs Wednesday, but the Dow declined, as ADP reported that August payroll growth came in well below forecasts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Nasdaq Composite managed to set new all-time highs on Wednesday, but that belied a much more mixed session for stocks as investors digested a few fresh economic reports.

Today's headliner was an extremely weak August employment reading – a precursor to Friday's government-sourced jobs report. ADP data showed private payrolls rose 374,000 last month – well short of estimates for 600,000.

"Given the Delta impact and weak economic data seen throughout August, it was not shocking to see a miss," says Michael Reinking, senior market strategist for the New York Stock Exchange. "The magnitude of the miss was quite large, but as we pointed out yesterday, the survey has not been a great indicator for the official BLS employment report over the last year and change."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The ISM manufacturing composite, however, did show strength, improving to 59.9 in August from 59.5 in July (anything above 50 indicates expansion).

"With production gaining momentum in August, we see encouraging signs that factories continue to make progress in realigning production with demand, despite ongoing challenges from supply bottlenecks," Barclays economist Jonathan Millar says.

Meanwhile, construction spending rose 0.3% month-over-month in July to top expectations.

Nonetheless, most of the market's reaction seemed focused on the lackluster jobs report. The defensive real estate (+1.7%) and utilities sectors (+1.4%) were Wednesday's best performers, and relative strength in communication services (+0.5%) pushed the Nasdaq 0.3% higher to a record 15,309, and also helped the S&P 500 achieve a marginal gain to 4,524.

Struggles in energy (-1.5%) and financials (-0.6%), however, dragged on the Dow Jones Industrial Average (-0.1% to 35,312).

Other news in the stock market today:

- The small-cap Russell 2000 managed another day of outperformance, gaining 0.6% to 2,287.

- Vera Bradley (VRA, -9.4%) stock took a big hit after the women's accessories maker reported second-quarter results that fell short of analysts' consensus estimates. VRA reported adjusted earnings per share (EPS) of 28 cents on $147.1 million in revenues – below the 33 cents per share and $153.6 million Wall Street was calling for. Nevertheless, Small Cap Consumer Research analyst Eric Beder reiterated his Buy rating on the stock. "We believe the company's management continues to do the right things in the near and longer term to create a more diversified and resilient business model that, as the world normalizes, will register strong consistent operating results and justify a higher multiple," he says.

- Ambarella (AMBA), on the other hand, surged 27.4% in the wake of its earnings report. In its second quarter, the fabless semiconductor company brought in adjusted earnings of 35 cents per share on $79.3 million in revenues. Analysts, meanwhile, were expecting EPS of 25 cents on $75.7 million in revenue. Stifel analysts chimed in after the results. "Overall, we believe AMBA is approaching a key inflection in its business, with the security camera inventory digestion now largely behind it, and computer vision (CV) hitting its stride ahead of a long secular growth runway," they say. "Coupled with a pristine balance sheet, we maintain our Buy on AMBA as a key, long-term beneficiary of CV/Edge Processing."

- U.S. crude oil futures eked out a 0.1% gain to settle at $68.59 per barrel. Earlier today, the Organization of the Petroleum Exporting Countries and their allies, collectively referred to as OPEC+, confirmed its plan to gradually increase oil production each month.

- Gold futures slipped 0.1% to $1,816 an ounce.

- The CBOE Volatility Index (VIX) declined 3.1% to 15.97.

- Bitcoin rebounded 2.0% to $48,229.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What Happened to the Year of the Value Stock?

Have we seen the end of value's day in the sun?

The more value-focused Dow was the leading major index through the end of May. But the script has since flipped, with the Nasdaq up 11.4%, the S&P 500 gaining 7.6% and the DJIA up just 2.3%.

"After several strong quarters for value stocks, the last few months have seen a sharp reversal in favor of growth," says Ben Inker, head of asset allocation at asset management firm GMO. "Understandably, this has led some investors to question whether value's run is over and whether value investing makes sense as anything more than a tactical play.

"The valuation disconnect between value and growth has reached extreme levels today. We've heard many reasons why 'it's different this time' and growth is destined and deserving to outperform. At these relative valuation levels, our long-term bet is the opposite."

In the shorter-term, many value choices are likely to overlap with the "recovery trade" as America tries to put COVID in the rearview mirror. But if you're just looking for value wherever it can be found, you have options just about everywhere on the market spectrum. For instance, while many investors think of small caps as mostly growth plays, smaller companies can indeed be attractive from a price standpoint.

But if you prefer the safety of larger firms, these 16 value stocks represent more traditional ways of approaching the investing style.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

How to Use 1031 Exchanges to Build Your Real Estate Empire

How to Use 1031 Exchanges to Build Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Where's the Best Place to Save for a House Down Payment?

Where's the Best Place to Save for a House Down Payment?Learn how timing matters when it comes to choosing the right account.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.