Stock Market Today: S&P 500, Nasdaq Nab New Highs as Apple Gains

The Dow ended in the red on weakness in American Express (AXP).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

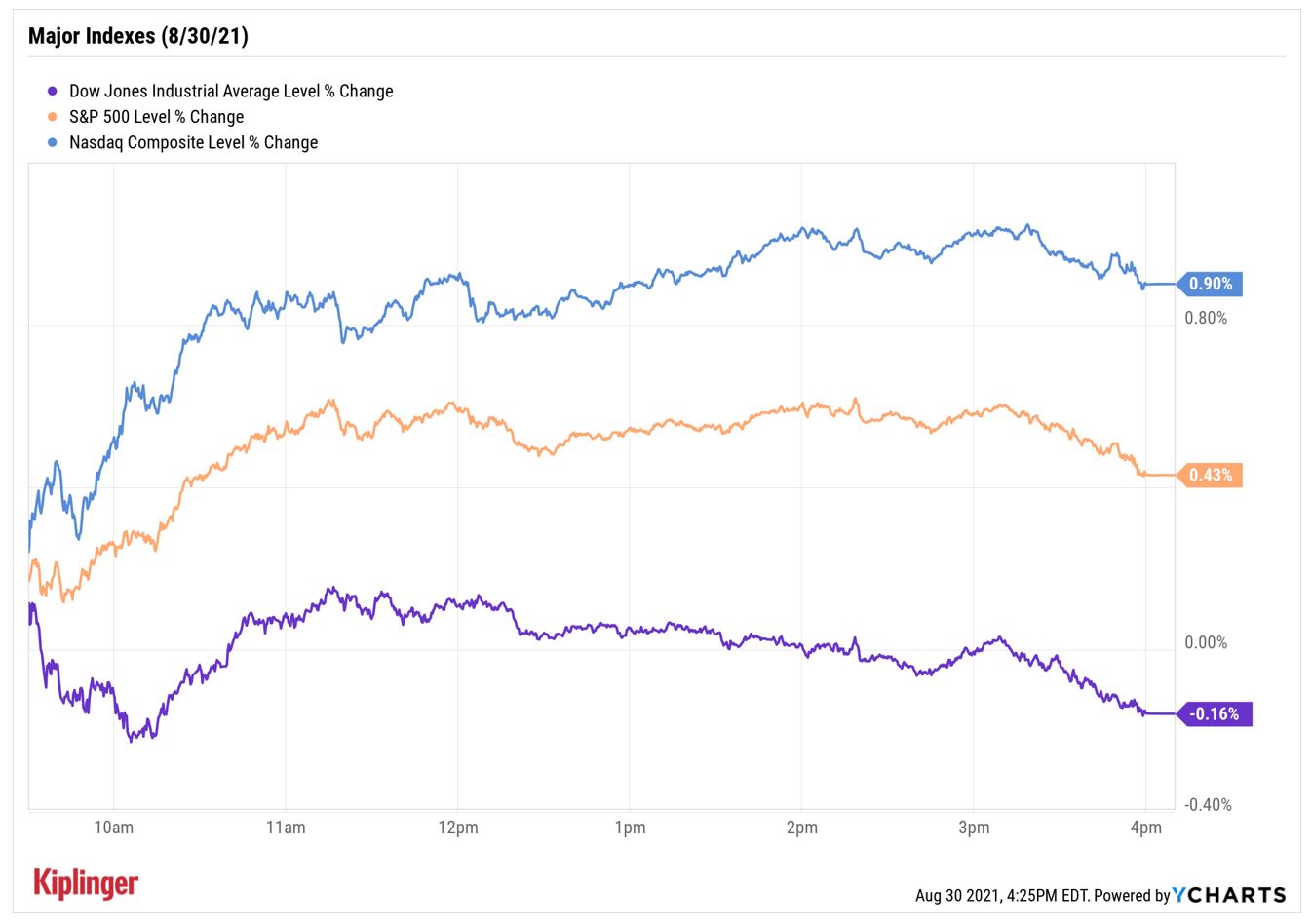

Stocks churned mostly higher today as investors continued to cheer Friday's dovish speech from Fed Chair Jerome Powell, where he indicated that tapering of the central bank's bond-buying program was likely imminent, but a rate hike was not.

The idea of low interest rates for the foreseeable future as well as a 3.4-basis point (a basis point is one-one hundredth of a percentage point) decline in the 10-year Treasury yield to 1.278% boosted the technology sector (+1.1%).

Among individual names, iPhone maker Apple (AAPL) was one of the biggest gainers, jumping 3.0% to top $2.5 trillion in market capitalization, while fintech PayPal (PYPL, +3.6%) rose on unconfirmed reports that it may be considering its own stock-trading platform.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This helped lift the Nasdaq Composite 0.9% to 15,265 – a new record high. The S&P 500 Index scored a fresh all-time peak of its own, rising 0.4% to 4,528. The Dow Jones Industrial Average, however, ended the day down 0.2% at 35,399 amid weakness in financial stock American Express (AXP, -2.6%).

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.5% to 2,265.

- Affirm (AFRM) surged 46.7% after the buy-now-pay-later provider inked a deal with e-commerce giant Amazon.com (AMZN, +2.2%). Under the terms of the deal, AMZN customers making purchases of $50 or more will have the option to choose monthly payments through AFRM's service. The program is currently being tested by a select group of Amazon.com users, with plans to expand it to a wider group over the coming months.

- A downgrade to Hold from Buy at Stifel weighed on Dave & Buster's Entertainment (PLAY, -4.7%) today. "We are taking a more cautious stance toward full-service restaurant stocks based on concerns that rising COVID cases are impacting customer visits and exacerbating challenges with employee staffing," they say. "We believe the incremental buyer of the stock at this point will need to underwrite the company's long-term unit growth potential, which we struggle to argue is a compelling thesis." Raymond James analysts, on the other hand, reiterated their Strong Buy rating on PLAY, calling the stock "materially undervalued."

- U.S. crude futures rose 0.7% to settle at $69.21 per barrel.

- Gold futures slipped 0.4% to finish at $1,812.20 an ounce.

- The CBOE Volatility Index (VIX) retreated 1.2% to 16.19.

- Bitcoin edged up 0.7% to $48,672.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Stay the Course With Stocks

The S&P 500 is set to close out the historically weak month of August with impressive gains, up 3% since its July 30 close.

So far this year, the index "has made 52 new all-time highs," Ryan Detrick, chief market strategist for LPL Financial, notes. "To put in context how rare this is, only 1964 and 1995 saw more than 50 new highs before August was over."

While this is all well and good, what should investors do going forward?

Continue to favor stocks over bonds, Detrick says. While a stock market correction could certainly be in the cards, especially since the S&P has not seen a typically healthy 5% pullback yet this year, "when looking at the recent pace of earnings, the policy environment and market history, we fail to see a compelling bear case against equities," he adds.

For those looking to add some tactical positions to their portfolio, consider this list of high-quality stocks the analysts love or these 21 picks with big potential through year's end.

You could also take a look at what the "smart money" is up to. Here, we've compiled a list of 25 stocks that are the most widely held among institutional investors with deep pockets and vast resources.

Karee Venema was long AAPL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.