Stock Market Today: Dow Droops on Jobs Miss, Interest-Rate Uncertainty

ADP's monthly employment report came in well below expectations Wednesday, injecting some doubt into the market ahead of Friday's July jobs report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

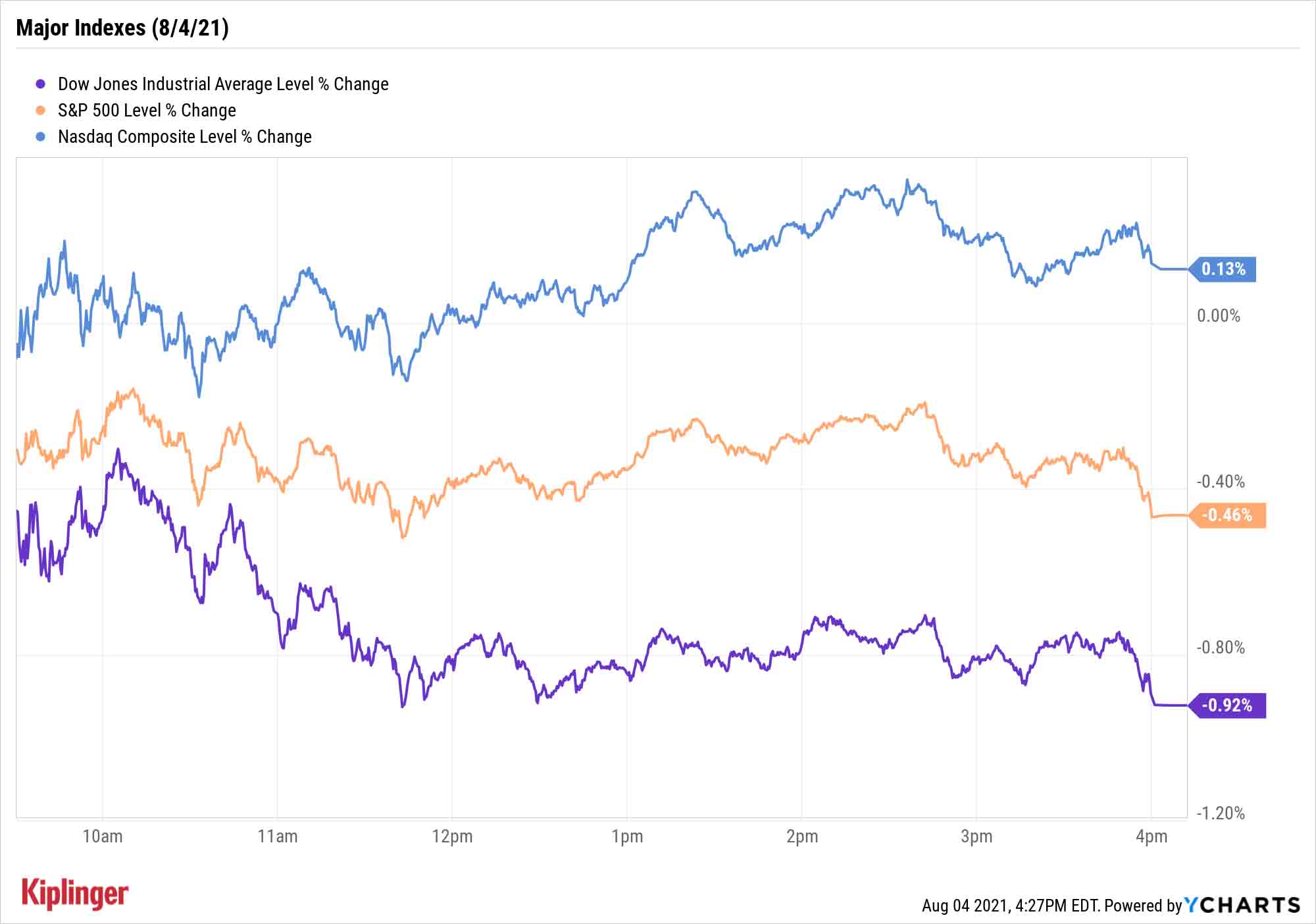

The market closed mixed Wednesday as investors received conflicting signals on the path for interest rates and absorbed a disappointing employment report.

Federal Reserve Vice Chairman Richard Clarida said Wednesday he believes the U.S. should be in a healthy enough position that the central bank could start raising interest rates by 2023.

But ADP's jobs report for July revealed job growth of just 330,000 positions, well below estimates for 653,000 and less than half the 680,000 new jobs created in June. The report added even more uncertainty heading into the upcoming non-farm payrolls report from the Bureau of Labor Statistics.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"During last week's Federal Open Market Committee meeting press conference, Chair Powell emphasized that the labor market "has a ways to go" before achieving the Fed's maximum employment goal," says Mark Heppenstall, chief investment officer at Penn Mutual Asset Management. "The general consensus for Friday's July employment report puts estimates at nearly 900,000 new jobs, but the forecasts range widely from 350,000 to 1.2 million, as pandemic-related factors continue to raise uncertainties about the supply of labor."

"That outlook [for 900,000 jobs] looks likely to be too optimistic," adds Brad McMillan, chief investment officer for Commonwealth Financial Network. "The major reason is the sudden resurgence of the pandemic, with the Delta variant taking case growth to five times the level at the end of June. The ADP employment report, which came out this morning, suggests that job growth may have slowed significantly in response to that medical news."

Relative strength in telecommunications stocks such as Facebook (FB, +2.2%), and tech stocks such as Advanced Micro Devices (AMD, +5.5%), helped keep the Nasdaq Composite (+0.1% to 14,780) aloft. However, the S&P 500 (-0.5% to 4,402) and Dow Jones Industrial Average (-0.9% to 34,792) finished in the red. Energy (-2.9%) and industrials (-1.4%) were Wednesday's biggest sector laggards.

Other news in the stock market today:

- The small-cap Russell 2000 was hit for a 1.2% loss to 2,196.

- General Motors (GM) shed 8.9% after the automaker reported lower-than-expected adjusted earnings per share (EPS) of $1.97, citing higher warranty recall costs. However, GM beat on the top line, bringing in $34.2 billion, and the company raised its full-year adjusted EPS guidance to $5.40 to $6.40 per share.

- Kraft Heinz (KHC, -5.1%) stock was another post-earnings loser. The food products specialist reported higher-than-anticipated adjusted earnings of 78 cents per share and revenue of $6.6 billion. However, organic net sales and sales volume were lower on a year-over-year basis.

- U.S. crude oil futures plunged 3.4% to end at $68.15 per barrel after data from the Energy Information Administration showed an unexpected rise in domestic crude inventories. It was black gold's third straight down day.

- Gold futures posted a marginal gain to end at $1,814.50 an ounce.

- The CBOE Volatility Index (VIX) edged 0.2% higher to 18.08.

- Bitcoin rebounded by 4.7% to $37,989.75. $39,758.78. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

When You Diversify, Don't Forget to Look at a Map

Wall Street experts have been sounding the same alarm all summer, believing volatility is right around the bend. We've been underscoring the importance of diversification as a way to brace for a bout of volatility, too.

In some cases, that means rethinking your sector exposure, adding defensive-minded stocks or finding room in your portfolio for a little income production. But don't forget about that other way of adding diversification to your portfolio: by broadening your geographic horizons.

European stocks, for example, often trade at more attractive valuations than their U.S. counterparts. And that happens to be just such the case right now – Europe simply looks like a bargain. Fortunately, you don't have to wander blindly into the eurozone wilderness. The European Dividend Aristocrats are chock full of well-heeled, dividend-growing multinational companies, many of which you might be familiar with.

If you're looking to diversify with a bigger emphasis on growth, you might want to focus on emerging markets (EMs) – but given the less-stable nature of these developing countries, it typically makes sense to "bundle" your purchases through funds such as these 10 emerging market ETFs.

Whether it's a difference in strategy or simply more targeted exposure to varying parts of the globe, these 10 funds provide a wide range of ways to invest in high-growth EMs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.