Stock Market Today: Coke, Chipotle Keep the Snap-Back Rally Rolling

Investors kept up the bullish momentum Wednesday, encouraged by a pause in bond buying and strong corporate earnings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock-market rebound from Monday's steep selloff continued Wednesday, with traders taking their cues from the earnings calendar and stability in the bond market.

An exodus to the safety of bonds continued to ease, with the 10-year Treasury yield recovering another 8 basis points to 1.293% after hitting a five-month low on Monday. (A basis point is one one-hundredth of a percentage point.)

Coca-Cola (KO, +1.3%) provided some enthusiasm after posting second-quarter revenues that surpassed 2019 levels and lifting its full-year earnings outlook. Chipotle (CMG, +11.5%) also surged after announcing a wide Q2 earnings beat, fueled by a 38.7% year-over-year surge in revenues.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, U.S. crude oil futures jumped 4.6% to $70.30 per barrel even as inventories increased by 2.1 million barrels – a surprise to analysts who expected a drop of 4.5 million barrels. Exxon Mobil (XOM, +3.2%) and Chevron (CVX, +3.4%) were among the energy sector's biggest beneficiaries of the oil-price move.

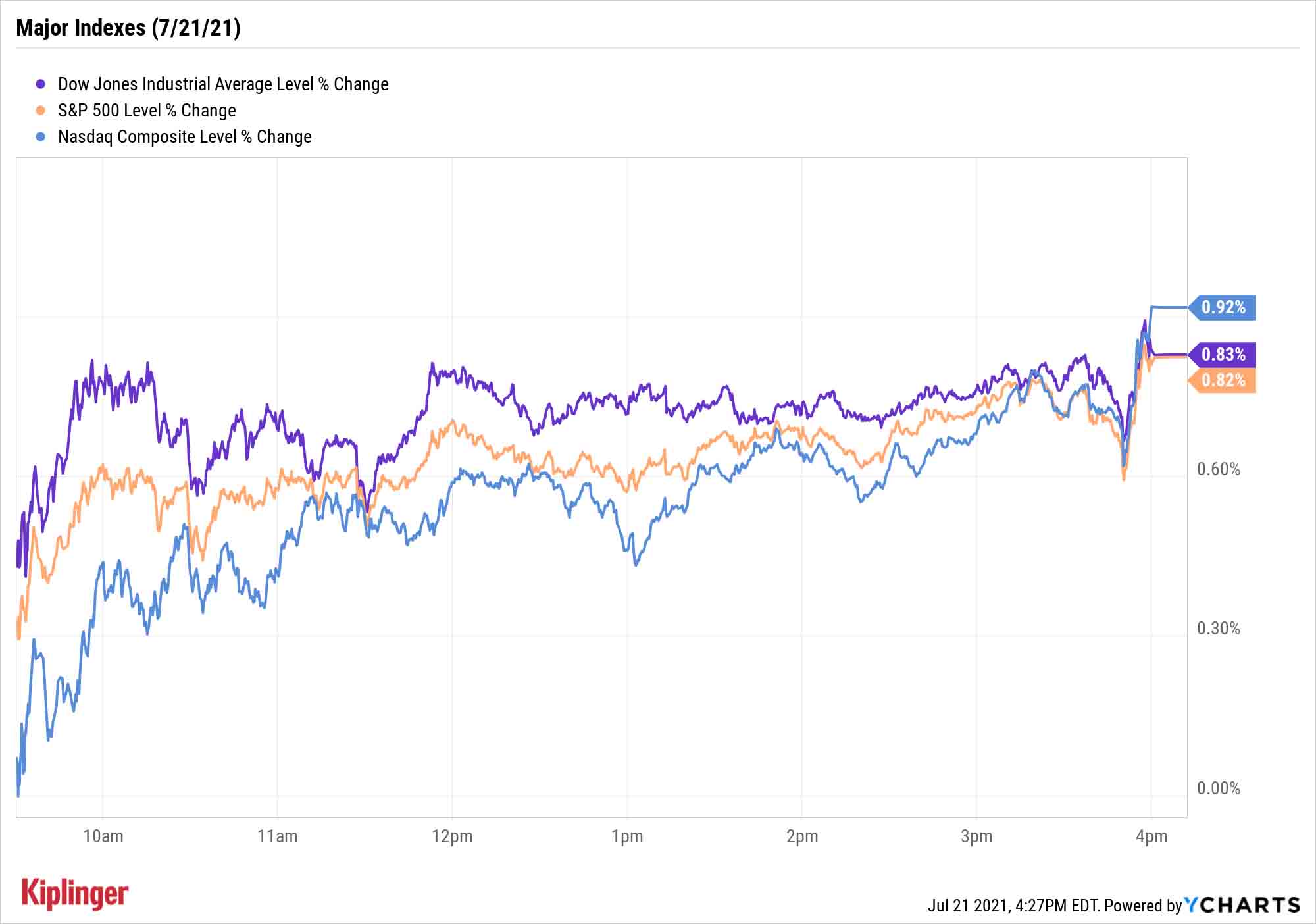

Today's finish looked much like yesterday's; the Dow Jones Industrial Average (+0.8% to 34,798), S&P 500 (+0.8% to 4,358) and Nasdaq (+0.9% to 14,631 put up similar advances, while the small-cap Russell 2000 (+1.8% to 2,234) outpaced its larger-cap brethren.

Other action in the stock market today:

- Netflix (NFLX) was in the spotlight today after Tuesday night's earnings report. IThe streaming service reported lower-than-expected second-quarter earnings of $2.97 per share, though revenue of $7.34 billion arrived just above the consensus estimate. Subscriber adds were the main talking point today, though. Netflix reported 1.54 million new paid subscribers over the three-month period; while this was more than analysts projected, it was the lowest quarterly amount on record. Plus, the company forecast a slimmer-than-anticipated 3.5 million net additions in the current quarter. NFLX stock closed the day down 3.3%.

- United Airlines Holdings (UAL) was another earnings mover. The airline posted an adjusted per-share loss of $3.91 in its second quarter – in line with expectations – while revenue of $5.47 billion came in above the consensus forecast. UAL rose 3.8% today.

- Gold futures slipped 0.4% to end at $1,803.40 an ounce.

- The CBOE Volatility Index (VIX) dipped 9.2% to 17.91.

- Bitcoin, which breached the $30,000 level yesterday, recovered with a 6.3% rally to $31,683.24. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Elusive Stock Market Correction

Stocks, for the moment, have managed to yet again dodge something that regularly occurs multiple times each year: a 5% drawdown.

"The truth is investors have been very spoiled by the recent stock market performance," says Ryan Detrick, chief market strategist for LPL Financial. "The average year sees three separate 5% or more pullbacks for the S&P 500 with not a single one happening yet in 2021."

That fact alone doesn't necessarily mean a 5% drop is right around the corner, he says, but several market factors make it more likely, including fewer stocks participating in the market's up days, weak seasonality, a lack of bears and the choppiness that is typical of a second-year bull market.

We've spent the past couple of days discussing defensive options for those who want to shield their portfolios from volatility, but we should remind investors that pullbacks are also an opportunity to buy good stocks at even better prices.

Fund investors looking for stocks powered by strong secular trends will want to explore these seven ETFs, which provide access to broad-based growth drivers, as well as specific themes.

If you prefer to invest in trends more granularly, though, there's no shortage of options.

Auto parts suppliers, for example, are in the spotlight because chip shortages have been a drag on car production. But a number of tailwinds could give the industry an additional lift well after manufacturing normalizes.

Then there's the financial technology space.

"Fintech," which for a long time simply meant payment processors like Visa (V) and Mastercard (MA), was already expanding rapidly in an increasingly digitized world. But then COVID-19 hit, greatly accelerating the sector's development and – by extension – its growth prospects. Here, we look at 10 of the top opportunities for the fintech mega-trend.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.