Netflix (NFLX) Earnings: Will Subscriber Adds Stall Again?

Our preview of the upcoming week's earnings reports includes Netflix (NFLX), Johnson & Johnson (JNJ) and American Express (AXP).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

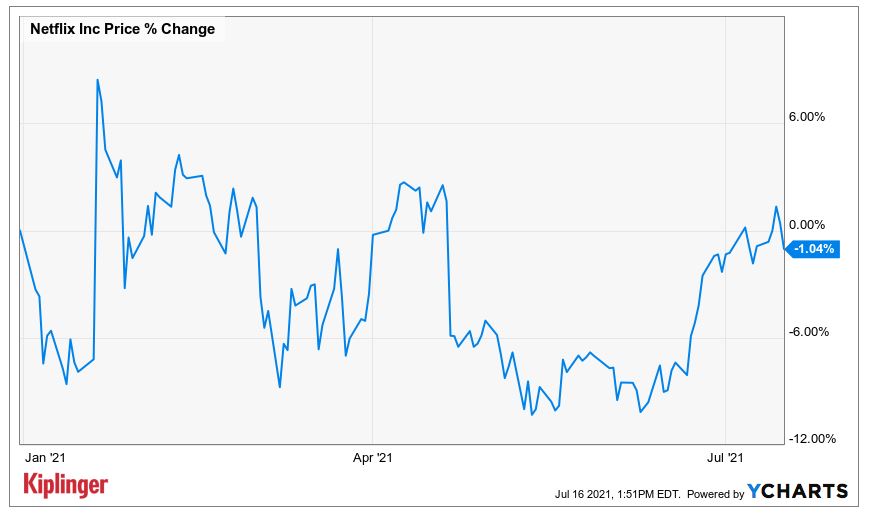

Will Netflix (NFLX, $532.22) post another quarter of disappointing global subscriber additions?

Netflix is scheduled to unveil its second-quarter results after the market closes next Tuesday, July 20. Thus, the streaming giant will be the first of the FAANG stocks to report quarterly earnings this season. Analysts, on average, are looking for revenues of $7.3 billion (+20.3% year-over-year) and earnings per share (EPS) of $3.15, nearly double what NFLX brought in one year ago.

Investors will also be watching global paid subscriber additions. In its first-quarter report, Netflix missed this metric by a wide margin – adding just shy of 4.0 net new subscribers over the three-month period, compared to expectations for 6.2 million – which sent the shares tumbling 7.4% in the subsequent session.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Wedbush analysts rate NFLX at Underperform (the equivalent of a Sell) with a 12-month price target of $342, representing a steep discount to its current per-share price. As far as subscriber adds go, the research firm sees "compelling" opportunities overseas, but believes it may be approaching "market saturation" in the U.S. and Canada.

"While there may be some room for Netflix to add some new high-ARPU (average revenue per unit) subscribers, competition is at its most fierce in the region, and with over half of all households already penetrated, the 'low hanging fruit' (above median income households) has already been harvested," the analysts say. Wedbush is projecting 1 million net additions for NFLX in the second quarter.

Not everyone is bearish on NFLX.

Baird analysts William Power and Charles Erlikh carry an Outperform (Buy) rating on the stock with a $650 price target, implying 21.1% upside over the next 12 months or so. "Both current and upcoming content should reinvigorate subscriber growth for NFLX," the analysts say.

Johnson & Johnson Looks to Turn Around 2021 Underperformance

Johnson & Johnson (JNJ, $168.68) has been in the news lately as the pharmaceutical giant's COVID-19 vaccine has been linked to roughly 100 cases of Guillain-Barré syndrome – a rare neurological disorder. The company also recalled five of its aerosol sunscreen products due to the detection of benzene, a carcinogenic chemical compound.

These headlines have the stock headed for a modest weekly loss; overall, it's up about 7% for the year to date to easily underperform the major indexes. JNJ shareholders are looking for the stock to add to those gains when the company reports second-quarter earnings ahead of the open this Wednesday, July 21.

The pros are upbeat heading into the report. On average, they're looking for a 26% year-over-year pop in revenues to $22.2 billion, with earnings expected to rise 36% to $2.27 per share.

CFRA analyst Sel Hardy (Buy) recently lifted her full-year 2021, 2022 and 2023 adjusted EPS forecasts for JNJ "to reflect the improved outlook for the company's top- and bottom-line performance. In line with the broader reopening in the U.S., JNJ's largest market, we anticipate an improved momentum particularly for the company's key Pharma and Medical Devices segments."

This bullish bias toward the Dow stock is seen among the majority of analysts covering the shares that are tracked by S&P Global Market Intelligence. Currently, nine maintain a Strong Buy opinion, four say Buy, five call JNJ a Hold and just one deems it a Sell.

Can American Express Add to Its Gains?

American Express (AXP, $170.35) caps off a busy week of corporate earnings reports when it reveals its second-quarter results ahead of the July 23 open.

The stock has put in a tremendous showing in 2021, up 41% for the year to date – and trading not far from its July 1 record high of $173.60.

Piper Sandler analyst Christopher Donat thinks there's more to come for the credit card concern and recently raised his price target on AXP to $190 from $170, representing expected upside of 11.4% over the next 12 months or so. He maintains an Overweight rating on the shares, which is the equivalent of a Buy.

"American Express reported another excellent month for credit quality [in June]," Donat says, with both net write-offs and delinquency rates falling to the lowest level since Piper Sandler first started tracking the data in 2012.

"Meanwhile, card loan growth continued, with AXP the only large credit card issuer to post year-over-year loan growth in June. We think AXP's loan growth likely reflects higher spending on Amex cards, which should have positive implications for 2Q21 discount revenue."

On average, analysts are expecting American Express revenues to arrive at $9.5 billion (+17% from the year-ago period) in its second quarter. As for earnings, they're forecast to spike 445% on a year-over-year basis to $1.58 per share.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

5 Actions to Set Up Your Business With Your Exit in Mind

5 Actions to Set Up Your Business With Your Exit in MindWhen you're starting a business, it may seem counterintuitive to begin with exit planning. But preparing will put you on a more secure footing in the long run.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.