Stock Market Today: S&P, Nasdaq Score New Highs After Fed Minutes

While the Fed has started positioning for the eventual tapering of asset purchases and raising of interest rates, there is no concrete timeline as of yet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

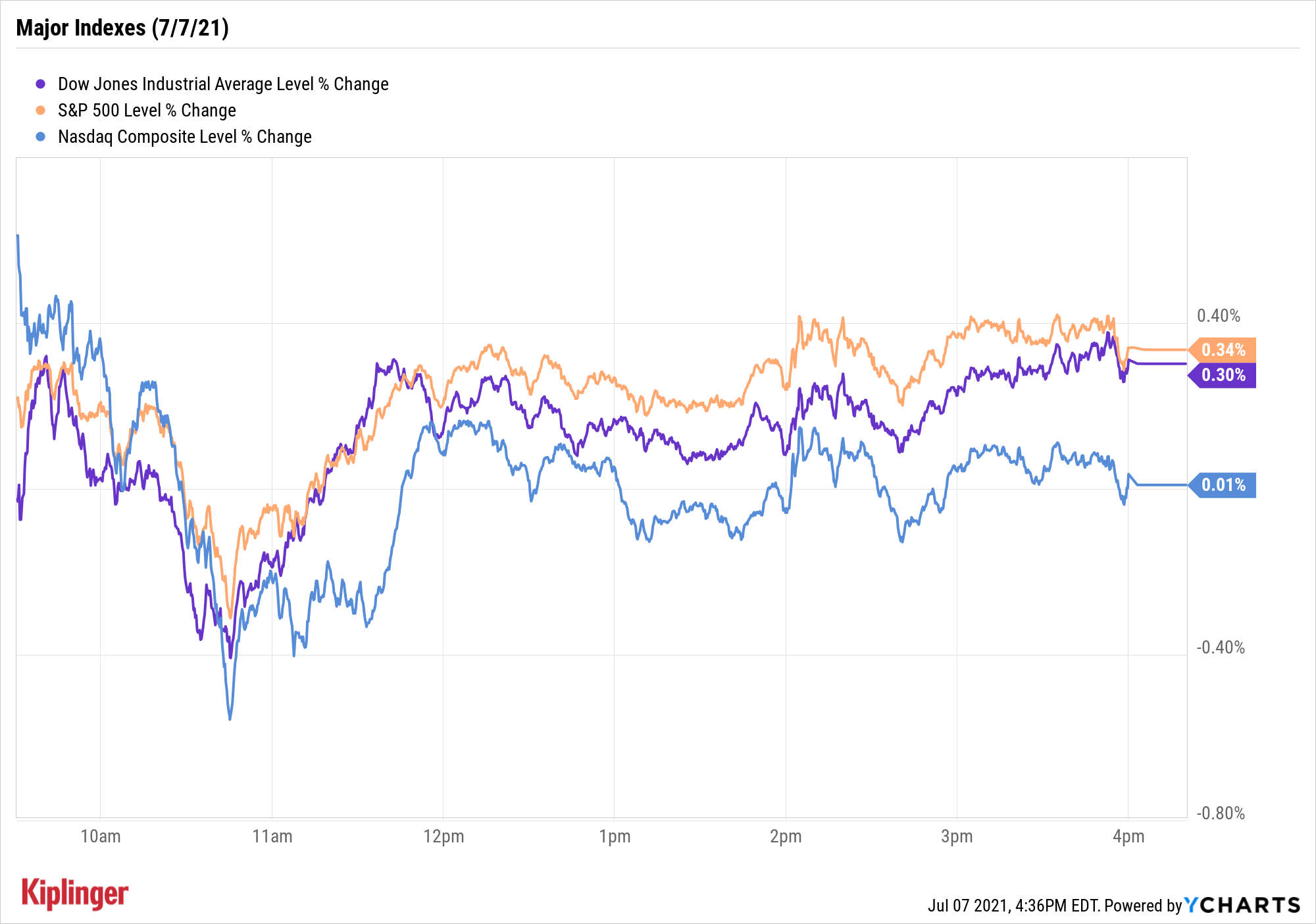

It was a choppy day of trading as investors waited on this afternoon's release of the minutes from the Fed's June meeting.

The minutes showed voting members of the Federal Open Market Committee (FOMC) generally agreed that it was time to position for the eventual easing of the central bank's supportive monetary policy, "in response to unexpected economic developments ... or the emergence of risks," such as rising inflation.

"Monetary policy recalibration is now on the table, as the FOMC becomes genuinely more data dependent and less calendar dependent," says Bob Miller, BlackRock's head of Americas Fundamental Fixed Income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The minutes today reflected a Committee that has started to shift its emphasis from realized economic outcomes to a more outlook-dependent reaction function. The upside/downside surprises for relevant economic indicators should now lead financial markets to adjust the distribution of outcomes with respect to tapering asset purchases and eventual lift-off from zero interest rates."

Without a concrete timeline for take-off in today's minutes, though, the major market indexes all pushed higher into the close. The S&P 500 Index gained 0.3% to 4,358 and the Nasdaq Composite rose 0.01% to 14,665 – fresh record highs for both – while the Dow Jones Industrial Average added 0.3% to 34,681.

Other action in the stock market today:

- The small-cap Russell 2000 fell 1% to 2,252.

- While the major indexes have been setting records left and right for months, Apple (AAPL) hasn't managed to hit a new high since January – until today. The mega-cap hasn’t made much in the way of headlines of late, but a steady drumbeat of positive analyst notes has lifted the stock some 14.8% over the past month. Its 1.8% gain Wednesday put it at $144.57, eclipsing its previous closing high of $143.16 set on Jan. 26.

- Newegg (NEGG), an internet electronics retailer that went public in May in a reverse merger, rocketed 148.4% after it announced a new build-to-order PC business. Customers who design their own computers on the Newegg PC Builder can now have them professionally assembled "significantly faster than other competitive BTO offerings," Newegg says. NEGG shares are now up 548% in the past month, and 1,528% for the year to date.

- U.S. crude oil futures dropped 1.6% to settle at $72.20 per barrel.

- Gold futures added 0.4% to finish at $1,802.10 an ounce.

- The CBOE Volatility Index (VIX) fell 1.5% to 16.20.

- Bitcoin prices rose 1.9% to $34,608.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

Tracking That 10-Year Treasury Yield

Another notable move today was in the 10-year Treasury yield, which fell 5 basis points (one basis point is equal to one-one hundredth of a percentage point) to 1.32%.

This is the T-note's lowest yield since February, and puts it close to oversold territory, says Dan Wantrobski, technical strategist at Janney Montgomery Scott.

"Current trends in yields are important to track in this environment," he says. That's because in addition to giving clues about how investors are feeling on a macro basis, "yields have been very influential on stock market internals – where we recently saw reflationary themes lead the broad indices higher as rates rallied (value, small-caps, financials, cyclicals), and low-growth/low-rate themes take on leadership as yields declined (large-caps; tech; discretionary). Going forward, we believe trends in the [10-year Treasury yield] will continue to affect U.S. sector leadership one way or another."

For those who want to play the hot hand of declining interest rates, consider some of these themes that Wantrobski laid out: you can get tech exposure via these sizzling semiconductor stocks, or large-cap exposure via these blue chips that are a favorite among the hedge fund crowd.

But for those that want to position for a bounce in rates, here's a list of small-cap stocks analysts are bullish on. Or, consider these seven master limited partnerships (MLPs) that are benefiting from a rebounding energy market. These MLPs allow you to leverage increased demand for oil, gas and energy products, but with an added bonus: significantly higher yield on average than more traditional energy stocks.

Karee Venema was long AAPL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.