Stock Market Today: Stocks Snooze While Investors Await Inflation Update

The major market indexes slipped ahead of the tomorrow's consumer price data.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

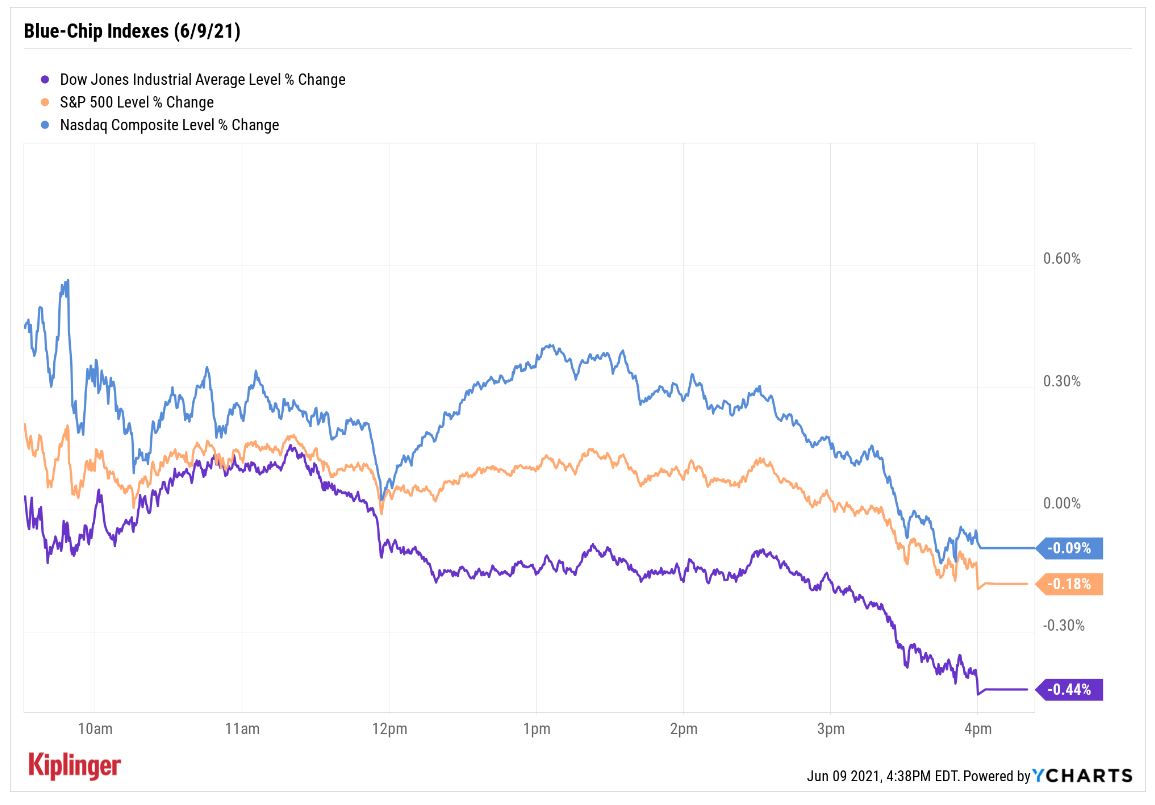

Wednesday's stock market action was. . . hesitant.

Most shares treaded water throughout the day amid a dearth of both earnings updates and splashy macroeconomic drivers – and perhaps some jitters ahead of Thursday's May consumer price index report, which will provide us the latest update on Wall Street's most prominent bugaboo: inflation.

"Our concern is that the current combination of monetary and fiscal policy could lead to an overshoot," says Eddy Vataru, chief investment officer of total return at asset manager Osterweis Capital Management.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Chair (Jerome) Powell has said the Fed will continue with its QE program until inflation is consistently above 2%, but from our perspective it seems probable it will creep higher than their target."

The Dow Jones Industrial Average declined 0.4% to 34,447 in a day that saw the major indexes end the session with modest losses, but the small-cap Russell 2000 (-0.7% to 2,327) also retreated after a run that had it on the verge of fresh highs.

More notable moves? Several big pharma stocks, including Bristol Myers Squibb (BMY, +2.7%) and Pfizer (PFE, +2.5%), enjoyed robust gains. Also, United Parcel Service (UPS, -4.2%) and FedEx (FDX, -3.2%) sank after the latter delivered profit-margin expectations for 2023 that were well below expectations.

Other action in the stock market today:

- The Nasdaq Composite eased back 0.1% to 13,911.

- The S&P 500 Index fell 0.2% to 4,219.

- Campbell Soup (CPB, -6.5%) was a notable decliner today after the packaged manufacturer reported earnings. In its fiscal third quarter, CPB reported adjusted earnings and revenue below consensus estimates, and lowered its full-year earnings-per-share guidance on a "rising inflationary environment" and temporary increases in supply chain costs

- U.S. crude oil futures slipped 0.1% to settle at $69.96 per barrel.

- Gold futures posted a fractional gain to end at $1,895.50 an ounce.

- The CBOE Volatility Index (VIX) jumped 4.8% to 17.89.

- Bitcoin bounced back following its recent retreat, with the digital currency adding 10.0% to $36,264.49. "Support seems clearly established at 30k for Bitcoin, but it may be tested a couple of more times," says Charlie Silver, CEO of Permission.io. "If it holds, I believe we will see new highs by the end of the year." (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Time to Tiptoe Back Into Risk?

While inflation is a cloud that could rain hard on the market's parade, broadly speaking, you could say the sky is starting to clear up.

Brad McMillan, chief investment officer for registered investment advisor Commonwealth Financial Network, says risks such as rising interest rates and the pandemic bear further monitoring, but "it appears that the worst impact from the pandemic on markets and the economy is likely behind us. Given the improvements for many of the factors that we track in this piece and the continued economic recovery during the month, we have upgraded the overall market risk level to a yellow light [from red]."

In other words, there isn't no risk – McMillan warns that more volatility could be in the cards -- but investors can at least feel a little more empowered to take on a bit more risk in the search for outperformance.

For some, that might mean simply delving into traditional growth stocks such as these top tech picks for the rest of 2021. Some prefer the short-term payoff of biotechs with big news on the horizon, while others might want to go diving into beaten-up solar firms and electric vehicle stocks that could have longer runways as green technology adoption grows.

Then there's a favorite of thrill seekers: low-priced stocks – typically those trading below $10. While this strategy is fraught with risk, you can do so with a little more security and strategy by paying attention to low-priced shares that still are on Wall Street's radar. Read on as we examine 10 such cheap stocks that the analyst community collectively appreciates.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

Stocks Struggle Ahead of November Jobs Report: Stock Market Today

Stocks Struggle Ahead of November Jobs Report: Stock Market TodayOracle and Broadcom continued to fall, while market participants looked ahead to Tuesday's jobs report.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.